*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Saturday, November 20, 2010

Inflation vs deflation revisited

Some may think that I'm scaremongering, talking about such a scale of inflation; and we must hope that it doesn't come to pass. After all, history cannot be repeated exactly because the later time has the memory of the earlier, a point made elegantly by Jorge Luis Borges' short story "Pierre Menard, Author of the Quixote". But we may simply get to the same destination more slowly - after all, the dollar and pound have lost something like 98% of their value since the beginning of the 20th century.

So I responded to the comments as follows:

You're right, we're in a deflation at the moment, but the undermining of the currency is already showing up as inflation in energy and food prices. Recently (http://www.youtube.com/watch?v=J2-BZEyOnhE) Mike Shedlock and Dr Marc Faber appeared together on an interview and they agreed that inflation was the end stage, the only real difference of opinion between them was over timing.

Deflation would greatly benefit holders of cash (and gold, which seems to be a great each way bet if you buy in at the right price), but pretty much cripple and bust everyone else, so you're right again. Which is why our governments are so very motivated to find a way to restimulate inflation.

This time, the most indebted countries seem to be competing to see who inflates most (so they end up debauching their currencies in parallel), and the creditors who depend on exporting to them are trying to follow suit. The global economy has never been so interconnected before so we're in new teritory.

Faber reckons we are heading for a global bust; in which case I suppose global trade will break down, the focus will be on national and individual self-sufficiency and those who have spare assets will hold commodities of one sort or another until a new, sound currency arises.

Scaremongering? My mother's family lived through the Weimar inflation, but got through OK because they were farmers; until the busted German middle class turned to a new leader. The farm is now in Russian-held territory and we haven't seen it since 1945.

I have hope for the USA because it has natural resources (including land) that could satisfy the reasonable needs of the population; and because you have a Constitution that could be your storm cellar, if you don't let your corrupted elite persuade you to fill it in and build over it.

Thursday, November 18, 2010

The State of the Union, in credit terms

________________________________________

CMA DataVision's third-quarter report gives the latest assessments of sovereign debt default risk, as measured by the price of credit default insurance. This edition also includes ratings for selected individual States of the USA. I have combined the latter with the former in a ranking below, so that you can see the ratings of States in some sort of context. Please click on the picture to enlarge.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Sovereign debt default risk

___________________________________________

On October 7, CMA DataVision released their third-quarter report on the credit ratings of sovereign countries. CMA's ratings are worked out by looking at what the credit market charges for insuring against default. This market-based marking is different from the assessments of Standard and Poor's, Moody's, Fitch etc, who are paid by the organisations they rate and whose reputation has been brought into question after the events of 2008.

On page 4, CMA says that four of the 10 most risky nations are in the EU (Greece, Ireland, Portugal, Romania). It's worth remembering that a fifth on that list, Ukraine, is eager to join the EU. (For those who want to know about all the "PIGS", Spain is 21st most risky.) How is the currency and banking of the European Union meant to contain these problems?

The UK is rated 59th most risky (or 13th safest), with an implied credit rating of aa+ (as opposed to the official AAA rating that has helped to keep down the cost of our credit).

Four Nordic countries lead the list of securest debt: Norway, Finland, Sweden and Denmark. Only four other countries share their "implied AAA" rating: Germany, Switzerland, the Netherlands and Australia.

The United States has been downgraded this quarter, from "aaa" to "aa+" - the same as for the United Kingdom.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Gold is merely the thermometer of inflation?

________________________________

The vitally important inflation / deflation debate continues. In my last post, I relayed one view, which is that the very rich and powerful will not permit runaway inflation, because it erodes the value of money and the rich have most of the money.

As a corrective, I give below the latest video from the National Inflation Association (NIA), a US group that has warned about credit growth and inflation for a long time. Their motivation appears to be patriotic - a return to sound money as part of what makes individual prosperity and freedom possible.

The NIA argues that the rise in the price of gold is not because of mass speculation, for although a lot of gold has been bought recently, a lot has also been sold. What may be happening now is a transfer of privately-held gold from relatively poor people who need to raise money, to investors who are looking ahead to a time when cash will rapidly depreciate. Think of all those gold-buying outlets (or inlets) you now see on your High Street. As someone said a while ago, the mania will be when those shops start selling you gold instead of buying it from you.

As many have now said, trading nations around the world are devaluing their currencies to keep pace with one another, for fear that their exports will be hit if they don't. So the soaring value of precious metals can be seen as a better indication of inflation than currency exchange rates.

You may think that if currencies are depreciating, then surely prices of goods and services in general must also increase rapidly, and we don't see this yet. But we are in a recession and the threat of unemployment is keeping down wage demands; the self-employed are willing to lower their rates, perhaps especially if paid in cash; and traders in items such as cars and computers are offering discounts to clear stock and keep paying their overheads.

However, the NIA and others say there will come a time when the system begins to crack. Governments are buying their own debt, or lending money to banks to do it for them, to maintain the appearance of normality and control; this can't go on forever. The prediction is that we will get either default or hyperinflation. So the gold bugs say buy gold, silver, maybe oil and agricultural commodities etc - anything tangible that can't be multiplied at will.

I don't think (feel) that the turning point is imminent, because of recession and the attempts by some governments (such as the UK) to retrench. But I fear that these last-ditch attempts are untimately doomed to partial or complete failure. In that case, the gold bugs will probably be vindicated.

The other thing I'd say, as I've said before, is that if the system really does come under severe strain, the price of gold may not be the most important of your concerns. If you accept the inflationists' thesis, you will be quietly making preparations to cope with emergencies of different kinds.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Should retirees look to the stockmarket for income?

______________________________________

Adapted from my advice to a client this weekend:

Price inflation is not uniform or universal. Food and fuel have risen in cost recently, but State Pension benefits are linked to a cost of living index and should therefore approximately keep pace with increases in the price of basic needs.

In other areas (e.g. cars, cruises) prices have remained stable or even fallen. During what I suspect will turn out to be a long, Japan-style recession, it may be that the price of luxury goods and services will not inflate greatly, except perhaps for the luxuries of the very wealthiest.

Other than cash, what other ways could you invest?

First, one could look at deposits that link to inflation indices. Unfortunately, NS&I recently withdrew their index-linked savings certificates, the first time they have done so in 35 years. National Counties Building Society has an RPI-linked cash ISA (available until 30 September) but this is for a fixed amount (£5,100), runs for a fixed 5 year term and does not permit earlier withdrawals, so it may not fit in with your requirements.

If the government issues new index-linked gilts, these provide income and capital growth in line with RPI. The initial income may be low, however. For further details, please see the website of the Debt Management Office or a stockbroker. Generally, I would not now strongly recommend government bonds on the second-hand market, because the demand for them has become so high in these troubled times that the yield (ratio of income to traded price) is very low. If public finances unravel and interest rates rise, the effect on the capital value of bonds would be very depressing. As it is, the UK is struggling to maintain its official AAA rating and the implied credit rating on the credit default insurance market is actually rather lower already.**

Residential property appears still to be overpriced in historical terms. I think the only reason prices haven’t fallen much further is that interest rates are very low, which allows homeowners to maintain their mortgage payments on large loans. As the budget cuts begin to take effect, I think we will also see a depression in commercial real estate.

The stock market is also in a bubble, I believe. The ratio of price to earnings is still very high and the earnings may not truly reflect the forward position*. Companies are reportedly maintaining some degree of profitability by running down stocks, closing sites and laying off staff, but there is only so far they can go down this road. Many leading companies derive a significant part of their earnings overseas, but world trade is so interconnected these days that a slowdown in Western consumption will also impact on Eastern production.

The general picture appears to be deflationary, and although governments would like to stimulate further inflation in the way they have done over the past 30 years, there are respected economic and investment commentators who say we are now saturated with debt and unless we see outright defaults by sovereign nations (which could still happen), we will have to go through a long and painful process of retrenchment and paying-off debt.

Others look beyond deflation and think that it will ultimately force governments to find some way to increase the monetary base and devalue their currency. It may be significant that both Russia and China have made substantial purchases of gold in the last few months, and China has announced its intention of increasing her holding from c. 1,000 tonnes to six or ten times that amount in the next decade. But here we are in the realms of financial speculation, and the inflation speculators are already buying into agricultural commodities, precious metals, oil etc.

However, extreme or unconventional government strategies to deal with deflation don’t seem imminent and so I think that over the next couple of years, cash savings are likely to be a good way to build up funds for your envisaged discretionary expenditure***. Should there appear to be a major policy change, then we may have to look at investments that could protect against high inflation.

* Albert Edwards at SocGen expects a major reversal, the FT reports today.

** Though CMA DataVision have raised the UK from aa to aa+ in their Q2 report.

*** "There are no longer any “defensive” securities on the planet. The old asset allocation models and the diversification models don’t and won’t work any more and they haven’t for over a decade. I can’t believe that prominent asset managers are still using this approach." - Steven Bauer

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Monday, November 15, 2010

The State of the Union, in credit terms

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Sovereign debt default risk

On page 4, CMA says that four of the 10 most risky nations are in the EU (Greece, Ireland, Portugal, Romania). It's worth remembering that a fifth on that list, Ukraine, is eager to join the EU. (For those who want to know about all the "PIGS", Spain is 21st most risky.) How is the currency and banking of the European Union meant to contain these problems?

The UK is rated 59th most risky (or 13th safest), with an implied credit rating of aa+ (as opposed to the official AAA rating that has helped to keep down the cost of our credit).

Four Nordic countries lead the list of securest debt: Norway, Finland, Sweden and Denmark. Only four other countries share their "implied AAA" rating: Germany, Switzerland, the Netherlands and Australia.

The United States has been downgraded this quarter, from "aaa" to "aa+" - the same as for the United Kingdom.

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Sunday, November 14, 2010

Shares as a safeguard against inflation

_________________________________________________

It is well-known that German money became worthless in 1923, thanks to hyperinflation. The value of cash savings was wiped out; fixed rents also became worthless, which benefitted the ordinary person; but practically all one's income was spent on food, instead (see Table 6 at the bottom of this page).

What is less well known is how investors who didn't have to sell their shares actually gained, after a market pullback.

UPDATE: As Michael Panzer points out, what I called a "pullback" should more properly be termed a horrendous crash! Unless you have the titanium nerve to hold on through such an event, there is a grave danger that you could buy in now and sell in a panic later and lose most of your wealth.

CLARIFICATION / CORRECTION:(I should have made it clearer that the graph above is not mine - it comes from the site I linked to in the text, i.e. Now and Futures. Apologies for any misunderstanding, which I didn't intend.)

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Could shares protect against inflation?

What is less well known is how investors who didn't have to sell their shares actually gained, after a market pullback.

UPDATE: As Michael Panzer points out, what I called a "pullback" should more properly be termed a horrendous crash! Unless you have the titanium nerve to hold on through such an event, there is a grave danger that you could buy in now and sell in a panic later and lose most of your wealth.

UPDATE: As Michael Panzer points out, what I called a "pullback" should more properly be termed a horrendous crash! Unless you have the titanium nerve to hold on through such an event, there is a grave danger that you could buy in now and sell in a panic later and lose most of your wealth.

CLARIFICATION / CORRECTION:(I should have made it clearer that the graph above is not mine - it comes from the site I linked to in the text, i.e. Now and Futures. Apologies for any misunderstanding, which I didn't intend.)

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

"A liar and a cheat"

Black Dog, in the Mail on Sunday:

A new twist in the resignation from London’s Garrick Club of Guardian editor Alan Rusbridger after he unsuccessfully proposed ex-Labour City Minister Lord Myners as a member.

Now Dog hears of a contretemps over an unpaid dinner bill. When chased by the club some months later, Rusbridger sent a photocopy of the cheque he paid with.

The Garrick could still find no record of receiving the original cheque, so he sent a second one bearing a serial number consecutive to the first. Times are hard at The Guardian.

TWO

Mr Rusbridger himself (editor of The Guardian newspaper) about the collapse of Jeffrey Archer's libel case against that newspaper, in an article titled "A liar and a cheat" (highlights mine):

"The Guardian has never doubted the truth of its original story. We would have produced damning evidence of Mr Hamilton and Mr Greer's lack of integrity if the case had proceeded. No doubt that is why they dropped the action."

This ultimately led to a trial of Lord Archer for perjury. He was found guilty and sentenced to four years in jail.

THREE

Wikipedia, on the philosopher and media personage C.E.M. Joad:

In April 1948, Joad was convicted of travelling on a Waterloo-Exeter train without a valid ticket. Although he was a frequent fare dodger, he failed to give a satisfactory excuse. This made front-page headlines in the national newspapers, and the fine of £2 (£54 as of 2010) destroyed all hopes of a peerage and resulted in his dismissal from the BBC. The humiliation of this had a severe effect on his health, and he soon became bed-confined at his home in Hampstead.

Joad died a few years later, a broken man.

_________________________________________

Why were Mr Rusbridger's two cheques to the Garrick Club sequentially numbered? Is it really the case that he wrote no cheques at all on that account for the intervening months? This could easily be proved by revealing the dates of cheques written immediately before the first cheque to the Garrick.

One would think that the implications of Black Dog's article are potentially quite damaging for the editor of a national newspaper that, whatever its political inclinations, has built a reputation for truthfulness and integrity, qualities it seems to have found lacking in Mr Hamilton and Mr Greer.

I wonder what Mr Rusbridger may be prepared to do to combat the seeming innuendo of Black Dog's article?

Saturday, November 13, 2010

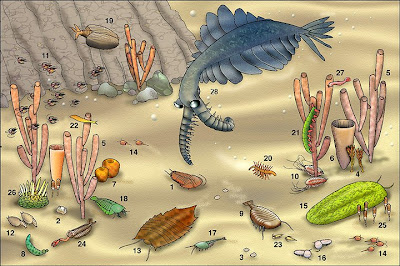

In praise of "First Life"

How wonderful, to learn of creatures with rock bodies and crystal eyes, roaming shallow seas in endless variety, an infinite case of intricate, animated jewels.

How wonderful, to learn of creatures with rock bodies and crystal eyes, roaming shallow seas in endless variety, an infinite case of intricate, animated jewels.

Thursday, November 11, 2010

Prospering during the collapse

So where are all the wise guys from the Mayans, Toltecs, Aztecs, Inca?

Perhaps their descendants are quartered on some as yet undiscovered Caribbean island, living off the interest on their interest and drunk on Inca Pisco every night. Maybe Dan Brown is working on another thriller about the secret inheritance of the ancients.

Tuesday, November 09, 2010

Bewildered

Sunday, November 07, 2010

The class system

Something is completely ripe and succulent in the state of Denmark

Mind you, at 20th we're way above Italy, which ranks below Rwanda.

Having a go, because they won't

As usual, he does coy, paradoxical and faux modest so well; but not well enough to disguise the fact that the Fourth Estate has become as conceited - and part of the in-crowd - as the rest of our masters. I will allow them the first, if they will relinquish the second.

A recurring fantasy pesters me, about the episode (sadly the clip omits the marching, menacing entrance of AC; audio fly on the wall here) in which the now pointedly poppy-less Jon Snow deals with a gatecrashing Alastair Campbell rather differently:

JS (before AC even reaches the desk): Please leave the studio, you have not been invited onto this programme.

AC: I phoned to say I was coming.

JS: And you had your reply. Please leave immediately.

AC: No I won't, there's something that needs to be said right now!

JS: Please leave now, or Security will escort you off the premises.

AC: I'd like to see them try! Now be sensible, Jon -

JS: - We'll take a break. Security!

Instead, we got "And now we are joined by Alastair Campbell - a rare moment - thank you for coming in" etc - and the chummy handshake at the end. Channel 4 News patted itself on the back for a journalistic coup, but out here in the bleachers it just looked as though Campbell felt entitled to treat a news studio like an airport executive lounge.

Reporters Without Borders' "Press Freedom Index" says we've gone backwards since 2003 - and even two points down on 2009. Our national ranking is now 19th, below most of the Nordic and Baltic countries. Is there a link between cold weather and integrity?

Monday, November 01, 2010

It's an ill wind...

Jesse's sidebar links to a website that shows national indebtedness, e.g.:

But this needs interpreting in the light of money owed both ways (the net international investment position, or NIIP), e.g.:

Recent ONS statistics show that as our pound and stocks devalued, our NIIP improved (if that's an improvement):

... so what counts as good news, and how badly-off are we?

Caravan news

I've often said to others - especially my wife - never mind New Age travellers, let's become old age travellers. That is, no tats, no drugs, no atomkraft nie danke stickers. Just go where you like by caravan, pretending you're on holiday from your drab dwelling in e.g. Birmingham. That way the police will just see you as silly old crumblies and leave you alone. Bless you, love, we're on our way to Bournemouth for a fortnight, that sort of thing. My Mum used to say people always think you're dafter than they are, just play up to it.

In other words, don't challenge the system, just sidestep it unobtrusively. We're all too interconnected to bring down the system without horrible things happening to us, the ones we love and the ones we depend on. Find your niche. As the Chinese saying goes, better to light a small candle than complain about the dark.

It's not consistent, I think, to complain about Communist strategies for mass social subversion on the one hand and then on the other to advocate something very similar oneself, e.g. withdrawing all your cash from the bank on a given date, a move Ian PJ appears to support, though I well understand the temptation.

The point is not to smash the system - we've seen the joy that brought to Russia, China, Cambodia etc - but to encourage it to mutate to our preferences. CAMRA turned the tide on proper beer, people like Hugh Fearnley-Whittingstall got Tesco et al to get more serious about humane and organic food - all without torching the pubs and supermarkets.

The first to operate on the new model will doubtless get a free or cheap ride - see the caravanners who've invaded upmarket Venice Beach, a place where they could never afford to buy houses even before they had theirs repossessed - and then the system will adjust.

There's no need for a hey-guys-let's-all approach: do what you've decided, don't put up with what you don't have to, be prepared to pay the price for your decision. If enough others do the same, society will change appropriately; if not, you've suited yourself. I quit teaching in 1989 because I wasn't prepared to put up with the crap and bullying, and it cost me financially - but who knows what carrying on would have cost me? My life has been incredibly richer experientially as a result of realising that it wasn't all decided for me. We forget how free we are already.

No self-destructive emotional spasms, please, we're British.