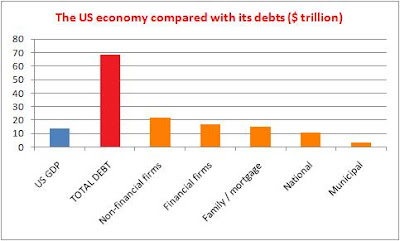

US GDP is estimated at $14.3 trillon, and the

Chinese article referenced in my post yesterday calculated total debts to be $68.5 trillion. The

average interest rate on Federal debt in October was 4.009%.

So if that interest rate applied to

all debts in the US, it would equate to 19.2% of GDP. In other words, $19.20 out of every 100 dollars earned simply pays interest. But private borrowing costs more, so the real burden is even greater.

Worse still is the fact that debts have been rapidly increasing for years. A study by the

Foundation for Fiscal Reform calculates that debt-to-GDP rose from 249% in 1983 to 392% earlier this year, an average increase of nearly 6% (of GDP) per year; actually, accelerating faster than that in the last few years.

So merely to go no further into debt, plus paying interest

without ever repaying capital, would cost at least 25% of GDP. And if there were (please!) a plan to abolish all debt by the beginning of the next century (92 years away), that would add another 5% or so, bringing the total national debt servicing to 30% of GDP.

Having got to this breakneck speed, there is no difference between stopping and crashing.

I suspect there simply must be debt destruction - either slowly, in the form of currency devaluation, or quickly, in debt writeoffs and defaults.

How long do bear markets last?

How long do bear markets last?