UPDATE:

It may be worse than at first we thought. The savage drop could have been (this says it was) deliberately engineered by Goldman Sachs as a shot across the bows, warning legislators not to mess with them!

_______________________________________

Nathan Martin makes the point that Thursday's 1,000-point drop on the Dow Jones Index unveiled the truth: the current high valuation of the market is because of money thrown into it by banks and hedge funds, not ordinary private investors. The drop happened when the insiders stopped trading.

The question is, how much longer can the illusion be maintained? Why are they doing it? Is it to tempt investors back into the market so that they can suffer all the financial losses when the banks pull out?

This is an age when cynicism comes easily.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Saturday, May 08, 2010

Thursday, May 06, 2010

Right, it's UKIP then

When even a major political party is encouraging us to vote tactically, you know the system is cracking. Good.

It's not about Britain's economic difficulties: disaster is pretty much assured whoever gets in. But we've been poor before; so what? Liberty is harder to recover than wealth.

First we have to get the power back from Europe, then we have to get it back from our venal and treacherous domestic politicians.

There is no system that will make people good and happy; that revolution is in the heart. The bureaucratic reification of good intentions becomes the slave of its own power and protocols.

We need some freedom to act. I shall do my tiny, practically insignificant bit to clear a little space so that those who have good will can practise it.

A vote for UKIP, this "contemptible little army", may encourage those elsewhere with a better chance - perhaps in the South West - to keep pushing back, to resist the Black Hole.

UPDATE

Some discussion of the deficiencies of Proportional Representation on Hatfeld Girl's site. I've submitted the following comment:

PR no, Alternative Vote (what I used to know as the Single Transferable Vote) yes. The latter is basically the same as First Past The Post but with AV the post stands at 50% of votes cast.

I don't see how this would necessarily lead to hung Parliaments, coalitions and weirdo fringe MPs, indeed I think it would help avoid them. You'd get more of a fight for the centre ground, but you'd get an MP that was more likely to have reflected some level of your choice so you wouldn't feel disenfranchised. And I think you'd get more examination of policies to determine 2nd and 3rd choices.

Turnout this time in the national elections was reportedly 65%, less than at any time in the 75 years from 1922-1997. And that's after market panic, credit crunch, the near destruction of the banking system, general hoo-ha, fedupness with Brown (how much of the vote depends on emotional spasm?) and Sam Cam's bump.

The present system is effectively useless and corrupt, which is why it will continue. I expect David Cameron to offer a Royal Commission and then do nothing, since the current arrangement suits Tweedledum and Tweedledee.

It's not about Britain's economic difficulties: disaster is pretty much assured whoever gets in. But we've been poor before; so what? Liberty is harder to recover than wealth.

First we have to get the power back from Europe, then we have to get it back from our venal and treacherous domestic politicians.

There is no system that will make people good and happy; that revolution is in the heart. The bureaucratic reification of good intentions becomes the slave of its own power and protocols.

We need some freedom to act. I shall do my tiny, practically insignificant bit to clear a little space so that those who have good will can practise it.

A vote for UKIP, this "contemptible little army", may encourage those elsewhere with a better chance - perhaps in the South West - to keep pushing back, to resist the Black Hole.

UPDATE

Some discussion of the deficiencies of Proportional Representation on Hatfeld Girl's site. I've submitted the following comment:

PR no, Alternative Vote (what I used to know as the Single Transferable Vote) yes. The latter is basically the same as First Past The Post but with AV the post stands at 50% of votes cast.

I don't see how this would necessarily lead to hung Parliaments, coalitions and weirdo fringe MPs, indeed I think it would help avoid them. You'd get more of a fight for the centre ground, but you'd get an MP that was more likely to have reflected some level of your choice so you wouldn't feel disenfranchised. And I think you'd get more examination of policies to determine 2nd and 3rd choices.

Turnout this time in the national elections was reportedly 65%, less than at any time in the 75 years from 1922-1997. And that's after market panic, credit crunch, the near destruction of the banking system, general hoo-ha, fedupness with Brown (how much of the vote depends on emotional spasm?) and Sam Cam's bump.

The present system is effectively useless and corrupt, which is why it will continue. I expect David Cameron to offer a Royal Commission and then do nothing, since the current arrangement suits Tweedledum and Tweedledee.

Tuesday, May 04, 2010

It's not the ship, it's the tide that matters

The great problem for investors in today's environment is that there is no return on short-term, safe assets yet the higher risk levels on longer-term, higher return assets are too uncomfortable for most people...

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The centerpiece of our own strategy [...] is understanding liquidity flows. They are the single most important force driving investment markets both up and down. Contracting liquidity caused the crash in 2008-2009 and dramatically expanding liquidity since March 2009 has triggered one of the greatest bull markets in U.S. history. The next bear market will also be driven, at some point, by a contraction in liquidity flows. However, as long as the great reflation is doing its work, that day can be postponed. [...] The music is playing again. People are back out on the dance floor. But, if the great reflation is as artificial as we believe, then this is still musical chairs. When the music stops, there won't be a chair for everyone, just like the last time.

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

The current investment conundrum, in a nutshell

The great problem for investors in today's environment is that there is no return on short-term, safe assets yet the higher risk levels on longer-term, higher return assets are too uncomfortable for most people...

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

The centerpiece of our own strategy [...] is understanding liquidity flows. They are the single most important force driving investment markets both up and down. Contracting liquidity caused the crash in 2008-2009 and dramatically expanding liquidity since March 2009 has triggered one of the greatest bull markets in U.S. history. The next bear market will also be driven, at some point, by a contraction in liquidity flows. However, as long as the great reflation is doing its work, that day can be postponed. [...] The music is playing again. People are back out on the dance floor. But, if the great reflation is as artificial as we believe, then this is still musical chairs. When the music stops, there won't be a chair for everyone, just like the last time.

John Mauldin

The only winning strategy "for the long haul" is to be fully committed to the market when it is rising and economic fundamentals support that direction, and to be entirely out at all other times.

Karl Denninger

Monday, May 03, 2010

Could Norway be a safe haven?

A few weeks ago, I looked at national credit ratings and Norway was the clear leader. So I wondered how strong the Norwegian Kroner might be if other currencies began to unravel.

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:

DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:DISCLAIMER: Nothing here should be taken as personal advice, financial or otherwise. No liability is accepted for third-party content, whether incorporated in or linked to this blog.

Should we go for Norwegian cash, bonds and shares?

A few weeks ago, I looked at national credit ratings and Norway was the clear leader. So I wondered how strong the Norwegian Kroner might be if other currencies began to unravel.

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:

Could the past give us a clue? No doubt those of you who have access to more sophisticated financial software and databases can do better - this is just a starting point for discussion.

Here's the 10-year history (O&A data, interbank rate, annually on 3rd May each year, rebased to 100% against the Kroner in 2000).

And in graphic form:

And in graphic form:Sunday, May 02, 2010

A house is a home, not an investment

A Nationwide Building Society press release (29 April) says the average house is now worth £167,802. Prices rose by 10.5% in the past year. Perhaps we should be in a hurry to buy again.

All the previous three sentences are misleading.

First, “average” is hard to define. According to nethouseprices.com, in 2010 a semi-detached house in Sheldon, Birmingham sold for £10,000 while another in Harborne changed hands for £470,000. During the same period in London, semis sold for between £130,000 and £10 million (93 other semis went for over £1 million).

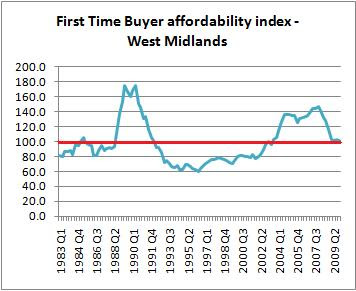

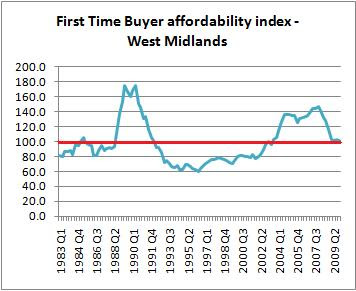

Second, as the Nationwide report admits, house prices are still 10% below the peak reached in October 2007. The good news is that they are more affordable now: using the Nationwide’s online database, here is a graph of first-time buyer mortgage costs as a proportion of average take-home pay in the West Midlands (the most typical region in the country):

Third, we face a long period of economic difficulty, with the threat of high unemployment. A falling pound could result in higher food and energy costs, and if the UK’s credit rating drops interest rates could rise. Each of these factors could easily depress property prices.

You have to live somewhere, but don’t think of it as a money-maker.

All the previous three sentences are misleading.

First, “average” is hard to define. According to nethouseprices.com, in 2010 a semi-detached house in Sheldon, Birmingham sold for £10,000 while another in Harborne changed hands for £470,000. During the same period in London, semis sold for between £130,000 and £10 million (93 other semis went for over £1 million).

Second, as the Nationwide report admits, house prices are still 10% below the peak reached in October 2007. The good news is that they are more affordable now: using the Nationwide’s online database, here is a graph of first-time buyer mortgage costs as a proportion of average take-home pay in the West Midlands (the most typical region in the country):

The bad news is, the graph is affected by record low interest rates; the actual amount borrowed is much higher than it used to be. As late as 1998, new mortgages averaged £60,000; now, according to thisismoney.co.uk (25 February), the average new loan is £140,000 – 5 ½ times the median wage, far above the long-term trend (3 ½ times earnings).

Third, we face a long period of economic difficulty, with the threat of high unemployment. A falling pound could result in higher food and energy costs, and if the UK’s credit rating drops interest rates could rise. Each of these factors could easily depress property prices.

You have to live somewhere, but don’t think of it as a money-maker.

Subscribe to:

Posts (Atom)