Following up my Parthian shot about Waldsiedlung in the previous post, I looked up Erich Honecker and discovered that one of his slogans in the 80s was "Vorwärts immer, rückwärts nimmer" ("Always forwards, never backwards").

Following up my Parthian shot about Waldsiedlung in the previous post, I looked up Erich Honecker and discovered that one of his slogans in the 80s was "Vorwärts immer, rückwärts nimmer" ("Always forwards, never backwards").*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, July 19, 2009

Lost in fantasy

Following up my Parthian shot about Waldsiedlung in the previous post, I looked up Erich Honecker and discovered that one of his slogans in the 80s was "Vorwärts immer, rückwärts nimmer" ("Always forwards, never backwards").

Following up my Parthian shot about Waldsiedlung in the previous post, I looked up Erich Honecker and discovered that one of his slogans in the 80s was "Vorwärts immer, rückwärts nimmer" ("Always forwards, never backwards").Locking the doors

The same article describes a Chinese proposal to start issuing bonds denominated in renminbi, so that if the dollar does drop against the Chinese currency, all that will happen is that the dollar cost of the capital debt will increase.

It occurs to me that such extra security for lenders may help interest rates to remain lower than they otherwise would be. So the threat to borrowers is not that interest rates will increase, but that debt outstanding will continue to feel heavy, since inflation won't lighten the burden. In fact, the burden of foreign debt could get worse, if the dollar weakens in this new foreign-currency-mortgage era.

Another factor, which may be a deliberate strategy with an eye to the above, is China's own expansion of credit. If monetary inflation goes global - including in the East - then there's less hope that Western businesses could use relative currency devaluation to increase the demand for their goods and services. Manufacturers here will still be unable to compete and debt will grow. Our creditors will own us - we'll "owe our soul to the company store".

It's time to grasp the nettle - bust the banks who got us into this, have a tremendous clearout of debt from the system, reset wages and prices at lower (more internationally competitive) levels, get the people back to work and shrink the dead weight of government and its dependants.

That, or see what's left of our wealth leak away, and then suffer all the above as well - at even lower levels of per capita assets and income.

Doubtless the politically-favoured option is the latter - "Let it all happen on someone else's watch, after we've made ourselves into the New European Aristocracy and gone to our country estates." This would be a mistake. The palace of Versailles didn't protect Louis XVI, nor Waldsiedlung the East German communist elite.

Belling the cat

Karl Denninger calls again for the fat cats to "eat their own cooking", i.e. accept responsibility for the ruinous debt that will otherwise put a brake on the American economy for a decade. Good luck with that. Now, who's going to make them do it?

Karl Denninger calls again for the fat cats to "eat their own cooking", i.e. accept responsibility for the ruinous debt that will otherwise put a brake on the American economy for a decade. Good luck with that. Now, who's going to make them do it?Saturday, July 18, 2009

Signs and portents

Studying the US Dollar Index, Willie uses a measure that Karl Denninger has previously cited, namely, a comparison of two trends: the 20-week moving average with the 50-week moving average. When the first crosses the second, the second will eventually follow - in this case, downwards.

In my previous post, I referred to signs and portents. This is because when big things are happening, the fog of lies thickens, so we have to look for betraying details and use our intuitions. Art is often the canary in the mine - you hear the coming conflict in the discords of Stravinsky's 1910 "the Rite of Spring". The disturbed children that I teach have recently been exploring zombies. Some also play computer games at home, that involve stabbing opponents in the eyes or genitals. One child's graffiti tag is JABZ.

In my previous post, I referred to signs and portents. This is because when big things are happening, the fog of lies thickens, so we have to look for betraying details and use our intuitions. Art is often the canary in the mine - you hear the coming conflict in the discords of Stravinsky's 1910 "the Rite of Spring". The disturbed children that I teach have recently been exploring zombies. Some also play computer games at home, that involve stabbing opponents in the eyes or genitals. One child's graffiti tag is JABZ.Doodling, they draw pistols, rifles, knives, swords; but still read Postman Pat and Spongebob Squarepants. Gossiping, they talk of their mother's vibrator, their father's merkin, but (at age 11) don't quite understand and are looking forward to learning the facts about sex next week, which our curriculum now requires me to deliver. They come in shadow-eyed from gaming, but also from (in one case) accompanying their father late at night as he hunts down and savagely beats people who tied up and soaked with petrol an uncle suspected of stealing a motorbike. Where are the police? you may ask; the father is an ex-policeman. The Monarch's writ does not run where our underclass have to live; to have normal social inhibitions would be dangerous in such an environment.

Some may accuse me of moral panic; but I didn't grow up with the currently prevailing sense of moral ambiguity, despair and social collapse. Are we breeding a nation of future child guerrilla-band soldiers? And how tragic, how culpable, that the entertainment industry is playing its part in this; and that the Government hopes to shore up its vote by perpetuating the financial dependence of its claimants.

But it won't happen to us, will it? "Wat geht dat mik an?" as the mediaeval Germans would say: "What's it got to do with me?" Years ago, my Prussian grandmother described Der Flucht, the flight from the Red Army in 1945. They would come to a farm and be very grudgingly permitted to sleep in the haybarn; two days later, the owners would be on the road themselves.

We are in this together; but I cannot see how the present political arrangement can tackle the challenges. There are too many ways for our leadership to be distracted, to be suborned and to escape consequences personally.

Crash, cash, gold stash

I don't know how it is for you in the US, but here the jewellers have recently been fielding TV ads offering to buy your gold. What a favour they are doing for you.

PS

Barry Ritholtz shares in a strange, ecstatic group experience.

Friday, July 17, 2009

Prepare

Thursday, July 16, 2009

The East is [in the] Red

For now, a cloud no bigger than your fist on the horizon; but sometime... This is how we ourselves started, back in the 80s.

Wednesday, July 15, 2009

Masters of the Universe vs. the Lord's Elect

On an unrelated note, I've suddenly recalled the episode in Evelyn Waugh's "Decline and Fall" where Paul Pennyfeather meets a madman in prison:

"Well, one day I was just sweeping out the shop before shutting up when the angel of the Lord came in. I didn't know who it was at first. "Just in time," I said. "What can I do for you?" Then I noticed that all about him there was a red flame and a circle of flame over his head, same as I've been telling you. Then he told me how the Lord had numbered His elect and the day of tribulation was at hand. "Kill and spare not," he says."

Fortunately, the nutter's victim is a Modern Churchman, not a vitally important, wealth-creating banker.

Many market "shorts" are due to expire on Friday, I understand. Perhaps the market - a free and unmanipulated market, you may be sure - will change its mood next week.

PS

The S&P 500 closed above 900 points yesterday. "Mish" has said that it could easily fall below 500 points, or stall for years. He is against "buy and hold." So who profits if the poor layman is persuaded to stay in the market?

Regardless of what strategy one uses, it is a horrible idea to hold stocks throughout recessions.

Why Is Bad Advice So Common?

Clearly, stay the course is bad advice. So why is it so common? A personal anecdote might help explain things: In January of this year, an investment advisor from Wachovia Securities called me up and stated "Mish, I am sitting on millions because I see nothing I like". I told the person I did not like much either and that Sitka Pacific was heavily in cash and or hedged. His response was "Well, I do not get paid anything if my clients are sitting in cash".

I called up a rep at Merrill Lynch and he said the same thing, that reps for Merrill Lynch do not get paid if their clients are sitting in cash.

Massive Conflict of Interest

Notice the massive conflict of interest possibilities. Reps for various broker dealers have a vested interest in keeping clients 100% invested 100% of the time, even if they know it is wrong. And so it is every recession, bad advice permeates the airwaves and internet "Stay The Course".

We own you

This one points out that to balance the US budget with borrowing, new bonds must be sold totalling 3 times the amount issued last year. Bearing in mind that there's less money around, and that people are getting nervous about America's credit rating, inflation and the value of the dollar on the international market, it seems very unlikely that this new debt auction would succeed; and if it did, it would have to be on the basis of higher interest rates, to factor-in the various increased risks.

Alternatively, it's time for the repo man - with a twist. Nassim Taleb and Mark Spitznagel suggest that banks could take part of homeowners' equity in exchange for lower interest rates. But if houses continue to decline in price? I bet the banks have thought of that, so if such a scheme were introduced, they'd want a bigger share than most homeowners would be willing to give them. My guess is that when houseowners realize that the market isn't going to turn soon, there'll be more voluntary bankruptcies and doorkeys in the post. That, plus rising and lengthening unemployment could set off the domino chain.

But returning to the Sprott analysis, note that late last year, 28% of US debt was foreign-owned. Look out for some form of debt-for-equity here - if not the sale of equities, then in the form of favours and concessions. He who pays the piper calls the tune.

Sunday, July 12, 2009

It's just the way things are?

I've asked several times before, whether any country could have played it differently and avoided getting involved in The Crash. Then I read this article (htp: Jesse) about ex-BIS economist William White, and near the end there's an indication that maybe it's not simply about baddies and goodies:

This is the sort of thing that worries him. "That's when you have to ask yourself: Who exactly is controlling the whole thing anymore?"

They

Can't we do better than call vainly for somebody to restore justice to the world? Because that's the one thing that won't happen.

So, any ideas?

For example, what to do about the New World Order coinage unveiled by Medvedev the other day?

If you have a son or daughter, would you advise him/her to join GS and their ilk? Or McKinsey? Or emigrate?

Saturday, July 11, 2009

KBO

They're sobbing themselves to sleep,

The shrieks and wails

In the Yorkshire dales

Have even depressed the sheep.

In rather vulgar lettering

A very disgruntled group

Have posted bills

On the Cotswold Hills

To prove that we're in the soup.

While begging Kipling's pardon

There's one thing we know for sure

If England is a garden

We ought to have more manure.

Hurray-hurray-hurray!

Suffering and dismay.

Noel Coward.

Thursday, July 09, 2009

Wednesday, July 08, 2009

An astrologer writes

Next market peak due in... 2018 - if society's still around by then

On the other hand, history doesn't repeat, it rhymes. In 1966 China was... a disaster area. The world economy is much more interconnected now, and the tide is Eastwards, and big business is global. The company you invest in, if US or UK-based, may still be making good profits on its overseas earnings, even if domestic workers are all on the dole.

A recovery for the investors may happen sooner, and the market bottom may not be so deep in nominal terms (currency-adjusted is something else: look at what has happened to the dollar and pound; and what may yet happen). I think there's a big disconnect between the markets and Joe Average, since the extra wealth from 1980 on has mostly accrued to the top layer of society.

The concentration of money into fewer hands means that investment issues must inevitably give way to considerations of maintaining (repairing) the social and political fabric of our democracies.

Sunday, July 05, 2009

Where did the funny money go?

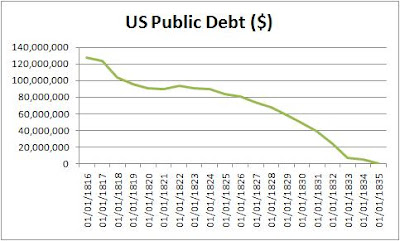

Now I come across a graph that makes it plain:

I suppose much the same happened here in the UK. So that's why we got all those posh-cooking and property-in -Provence TV programmes. We were encouraged to dream about the top echelon, not try to join them. As Eva Peron said, "I am taking the jewels from the oligarchs for you"; but somehow we never got to wear them ourselves. Not unless we went into hock for them.

I suppose much the same happened here in the UK. So that's why we got all those posh-cooking and property-in -Provence TV programmes. We were encouraged to dream about the top echelon, not try to join them. As Eva Peron said, "I am taking the jewels from the oligarchs for you"; but somehow we never got to wear them ourselves. Not unless we went into hock for them.

This Wiki entry on the Gini coefficient remarks "Overall, there is a clear negative correlation between Gini coefficient and GDP per capita; although the U.S.A, Hong Kong and Singapore are all rich and have high Gini coefficients." Perhaps there is going to be a reversion to the standard international model: a poorer USA with a high Gini coefficient. Or (same source) a reversion to the social stratification of 1929:

"Gini indices for the United States at various times, according to the US Census Bureau:

1929: 45.0 (estimated)

1947: 37.6 (estimated)

1967: 39.7 (first year reported)

1968: 38.6 (lowest index reported)

1970: 39.4

1980: 40.3

1990: 42.8

2000: 46.2

2007: 46.3"

This blog projects a Gini convergence between the USA and Mexico - perhaps it makes sense, on the reversion-to-mean basis:

Friday, July 03, 2009

The sun also rises

It's well worth reading the whole letter from Jesse's friend in Japan - not just about energy, but preventive healthcare etc. They walk to McDonald's - not waddle. They're organising themselves; so can we.

It's well worth reading the whole letter from Jesse's friend in Japan - not just about energy, but preventive healthcare etc. They walk to McDonald's - not waddle. They're organising themselves; so can we. Thursday, July 02, 2009

Faber: correction, then inflation

Dow 400?

For the record, EWFF also shows a "grand supercycle," beginning in January 2000 and ending at 400. Yes, that was FOUR HUNDRED.

And I thought I was being Eeyorish at 2,000.

Approaching the three-day week?

Wednesday, July 01, 2009

Market support

Denninger:

Denninger:... a handful of banks, most specifically Goldman Sachs, constitute the majority of NYSE trading volume... This "back and forth trade" between a handful of institutions is nothing more than the old "pump and dump" game that has been played in the OTC market forever - and almost always screws the individual investor.

This is no different than you and I selling a house back and forth between us repeatedly, each time at a higher price. We both appear to be geniuses as we're both making a "profit", right?

Well, no. One of us is destined to take a horrifying loss if we do not find a sucker to make the final transaction with.

I wondered what was keeping it all up. And sooner or later...

P.S. Rob Kirby strongly suspects that similar manipulation is going on in oil and gold - one kept up, the other down. (For an update on the latter, click on the goldcam.)

Tuesday, June 30, 2009

Sunday, June 28, 2009

Another letter to The Spectator

Irwin Stelzer (“No more consensus: this time there is a choice”) holds up Ronald Reagan as a model of a Conservative working for the ordinary voter. He could hardly have chosen a worse exemplar.

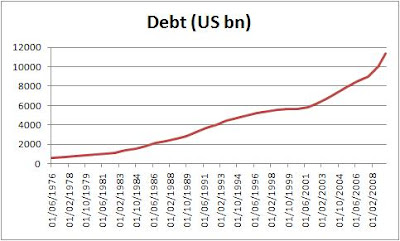

From 1947 to 1981 (the year in which Jimmy Carter left, and the Great Communicator took office), US public debt outstanding had fluctuated between $2 – 2.5 trillion (inflation-adjusted to 2009 dollars). Carter ended his Presidency with the debt no worse than it had been when he began. Under Reagan, the debt doubled in real terms (average 9.7% p.a. increase). Bush senior continued this trend (7.3% p.a.); the next two terms under Clinton showed a significant slowing (1.8% p.a.); but Bush junior picked up the pace again (6.3% p.a.) America now has $11.4 trillion public debt around its neck, approximately 5 times the equivalent in 1980, when Reagan asked voters, “Are you better off than you were four years ago?”

Well, how much better-off is Joe Average now? In the latest issue of Harvard Business Review, Gary Pisano and Willy Shih conclude that “average real weekly wages have essentially remained flat since 1980.” Instead, the “trickle-down effect” has turned out to be a torrent for the upper stratum only: in a 2006 speech reviewing hourly wage rate increases from 1973 – 2005, the economist Janet Yellen, of the Federal Reserve Bank of San Francisco, said “... the growth was heavily concentrated at the very tip of the top, that is, the top 1 percent”. The rest played catch-up by taking on extra personal debt: an investment analyst quoted in The Economist (22 January 2009) says “... the share of household and consumer debt alone went up from 100% of GDP in 1980 to 173% today, equivalent to around $6 trillion of extra borrowing.” Naturally, this process was much to the advantage of bankers, brokers and others in the top 1%.

In short, America has been pretty nearly busted by and for its elite. So much for the party of smaller government; so much for supporting the core Conservative, hard-working average wage-earner; not so much clear blue water, as a tide of red ink. One can only hope that the next British Conservative government, if there is one, will seek not to emulate Reagan and the Bushes.

Yours,

Saturday, June 27, 2009

Down

The left-hand scale is in $billions.

To quote Status Quo, "down down, deeper and down".

Thursday, June 25, 2009

Cash vs the stock market: an inconvenient truth

Tuesday, June 23, 2009

Inflation, not deflation

Our own view is that a serious stagflation with further devaluation of the US dollar as it is replaced as the world's reserve currency is very likely, after a period of slackening demand and high unemployment. A military conflict is also a probable outcome as countries often go to war when they fail at peace.

Tips?

From my own readings in this area, the people who tended to survive the Weimar stagflation the best were those who:

1. Owned independent supplies of essentials including food and shelter and were reasonably self-sufficient.

2. Had savings in foreign currencies that were backed by gold such as the US dollar and the Swiss Franc

3. Possessed precious metals

4. Belonged to a trade union and/or had essential skills or government position which guaranteed a wage

5. Were invested in foreign equity markets, and even in the domestic German stock market for a time

Sunday, June 21, 2009

US public debt since 1945 - inflation-adjusted

Presiding over indebtedness... or as helpless as King Canute?

A samizdat on Europe

Why can we not design and post up a form - a petitition for a referendum, for printing-off and taking round for signing by work colleagues, friends and neighbours? With a request that everyone follows suit - downloads, prints, distributes and posts into a central address?

Or even an unofficial, but fairly-worded referendum itself?

Or are we indeed "entering a post-democratic age?"

Saturday, June 20, 2009

US Public debt vs. gold

For the first 70 years, the gold-priced public debt was always less than twice its 1791 level, and often below the starting point.

Now to see the progress of the public debt since 1860:

... and second, since 1945:

... and second, since 1945:These pictures seem to indicate the influence of:

(a) two world wars

(b) the closure of the "gold window" in 1971

(c) monetary expansion since the 1980s

(d) the Grand Bust of 2000, NOT 2007, and the consequent flight to commodities

- and on this way of measuring the catastrophe, we're 50% worse off than at the end of WWII - plus we're not rebuilding the economy, we're doing the reverse.

Glory days

US Public Debt - annual rate of change

US Public Debt - the long view

Any more inconvenient truths?

Do you believe that there is a right time for the truth to be revealed?

Can you give examples of any truths that should be revealed, or myths dispelled, now?

Friday, June 19, 2009

Chinese SWF: a subtle assault on the US dollar?

Gold bugs say that the price of gold and other commodities has been held down by parties interested in maintaining the credibility of the US dollar. Willie thinks that the entry of a large Chinese sovereign wealth fund may foil such market manipulation in future, especially since the Chinese can back their hedge fund loans with their US Treasury holdings. An attempt to break a Chinese-held commodity position, if successful, could lead to a selloff of Treasuries and so crater the bond market, leading to raised interest rates and/or a drop on the dollar.

Between a rock and a hard place. This is what it is to be a debtor.

Commercial real estate to crash?

There's various ways you could interpret this - e.g. it could be a way to deflect criticism of Tesco's powerful position in the retail commercial property market, which some say has been used to prevent competitors setting up near their own outlets. But there are cheaper ways to deal with critics.

I think this billion-pound bet may be a straw in the wind - or perhaps an uprooted tree in the mighty gale - portending a significant fall in commercial property values.

A fish rots from the head down

Are there some people who just get away with it, for ever?

Tuesday, June 16, 2009

Survival

Big changes are on the way. Jesse reports on how the world is weaning itself off the dollar; the Contrarian Investor notes how China is cornering the market in rare minerals vital to modern technology.

There is a power struggle - a host of power struggles - going on. The good news is that life goes on, too. The bad news is that not everybody makes it.

Don't be the doughboy this time.

Sunday, June 14, 2009

What the blackbird said

We do the same. We complain of encroachments on our liberty, the debauching of our currency and national wealth, the weakening of the bonds that tie society together, and so on. And we do it many times, passing judgment with our "wise saws and modern instances", like Shakespeare's magistrate.

We're not alone. In a well-worth-reading article today, former Tory minister Neil Hamilton tells it like it is now with our rulers: democracy is dead (not that it was ever much alive). It's especially disturbing that senior politicians will say this now, not just the cranks among the public.

But why are we singing? Simone de Beauvoir said, "Every good book is a cry for help"; who do we hope will make speed to save us? And why does he have a sword and sceptre in his hands? Because to ask for help is to surrender power.

So let us combine against the oppressor. But who will lead us? And how will they mutate as they convert our assent into fresh authority? Is a libertarian party ultimately doomed by its oxymoronic essence?

George Orwell said, 'All historical changes finally boil down to the replacement of one ruling class by another. All talk about democracy, liberty, equality, fraternity, all revolutionary movements, all visions of Utopia, or "the classless society", or "the Kingdom of Heaven on earth", are humbug (not necessarily conscious humbug) covering the ambitions of some new class which is elbowing its way to power ...'

Like charity, liberty, wealth and happiness begin at home. Let us waste no more of our dreaming time on the puppets that wish to master us; in a Berkleian way, they are created and maintained only by our perception. Neither vote nor revolt; ignore. Trying to change society is like sending flowers to a soap opera wedding.

The revolution is personal. How much of your time and money could you save, reorganise, invest to make you and yours happier? "Il faut cultiver notre jardin."

And in our garden, the birds will sing.

Giant US slush fund?

This is not quite as ludicrously James Bond-ish as it seems. Bear in mind that some time ago, Brad Setser studied Treasury bond purchases by China and the UK and concluded that the latter country was acting as an additional conduit for the former's loans.

Good news for the Italians - their law says they'll take 40% of the contraband.

Saturday, June 13, 2009

The housing market: qualifying my comments

The London-based retiree looking for a bungalow in the South or South-West; the cereal packet family-of-four headed by a breadwinner; the pair of teachers deciding whether one can afford to go part-time; the buy-to-renter who sold out in time; the one who didn't; the rich guy dashing off a cheque for a Park Lane house to add to his international collection; the divorcee who bought out her ex-husband's share of the family home because she just can't let go; the car worker who's just lost his job; the Last Of England emigrant; the oldie looking for a sheltered housing apartment.

Houses sold by estate agent, by private treaty, by auction; houses sold, repossessed, swapped, abandoned, divided, combined, left as legacies, sold for care costs, seized by the law, occupied by squatters; flats, terraced houses, semis, detached dwellings. Brick and mortar, cruck, stone, straw bale, genuine and mock Tudor, eco.

Houses in central London, the London boroughs, the Home Counties, the provinces, Wales, Scotland and South-West; houses in thriving, decaying and recovering cities; in towns, villages, hamlets, lonely moors, islands; even a house on a pair of rocks on Newquay's beach.

How can one generalise meaningfully?

Why I think house prices must continue to fall

- Interest rates go up, to make it worthwhile for lenders to continue financing us. This will cut into take-home pay and make it more difficult to service large mortgages. House prices will drop, and so, eventually, will rents.

- The government will continue pumping cash into the system, one way or another. Our currency will depreciate further. Imports will become more expensive - and we import essentials like food and fuel. Since we have let our industries wither, we cannot quickly turn to providing for our own needs. So prices will soar and remain high for a long time. This will cut into take-home pay and make it more difficult to service large mortgages. House prices will drop, and so, eventually, will rents.

"Eventually" is happening now, as it happens. We were looking for a place to rent, found one on the Internet at £595/month, looked round it last week and the agent handed us a details sheet with the asking rent: £450.

Friday, June 12, 2009

Return of the spiv

Want to escape?

Or if you regard murder and suicide rates as indicators of general unhappiness, note the countries with low rates. (Also note how statistics is plagued with problems of accurate information, though.)

Thursday, June 11, 2009

Euro and EU doomed?

Beg to differ on one point:

If the Brown government fails, Britain will be left rudderless in the midst of the worst fiscal storm in decades. In a worst-case scenario where bad events lead to worse decisions, opines Stephens, the domino chain could even lead to a British exit from the EU.

"Worst-case"? Au contraire, the sooner the better, and for the reasons he has given in his exploration of Europe's problems.

What slows us? Not just the dollar; demographics, too

Off with his security pass!

Does liberty mean no more than this?

Life is a duck race

A few weeks ago, we watched a duck race in the Wye Valley. The ducks were emptied out of a big bag off the bridge at the same time, but at the finish a mile lower down, the winner was 20 minutes ahead of the second. Others had formed little groups and convoys, with stragglers and outliers.

A few weeks ago, we watched a duck race in the Wye Valley. The ducks were emptied out of a big bag off the bridge at the same time, but at the finish a mile lower down, the winner was 20 minutes ahead of the second. Others had formed little groups and convoys, with stragglers and outliers.Seems like a metaphor to me. The winner certainly didn't paddle any harder or smarter than the others. How much of a part does luck play in our lives?

Wednesday, June 10, 2009

Investment cataclysm?

Historically, the p/e ratio of the S&P 500 has averaged less than 20 - whether you measure from 1881, 1900, 1945 or 1970.

If the earnings don't improve dramatically and soon, the implication is a super-crash. But even if earnings triple from last week's level, that would merely put us back to where we were in December 1999, when the S&P's p/e ratio stood at its highest-ever (up to then) level: 44.2. And as you know, the market went on to halve in value by 2003.

So the S&P earnings have to become three times better than they are now, just to match the pre-Millennium crash conditions.

The dominant feeling I have now is a diffuse sense of denial.

A winning move for New Labour?

Tuesday, June 09, 2009

Call out the instigator

I suggest you read this op-ed piece in the NYT (htp: Jesse). Revolution is in the air - here, too. That's why we need radical reform, instead.

He who pays the piper calls the tune

China is requiring new PCs to come with factory-installed Internet filters (don't tell our government)...

... and may be buying American military secrets from the US Government (I believe I suggested this as a possible development quite some time ago, but I'm still looking for the reference.)

Recession - not even halfway there

So anyone who has real money wants out: "The Chinese, Saudis and others with actual money that we are attempting to borrow to kick that can once again have figured out our scam and they are headed for the exits."

Coming soon: austerity, a devalued currency and high interest rates. And in the UK, it'll be worse.

A good time to save money, while you're still able to; and to bet against the crippled Anglo-American horses. No point piling up savings in our rotten fiat cash.

The Mogambo Guru continues to chirrup his commodities song.

Monday, June 08, 2009

Return of the Mighty Marmite Machine

I've often suspected that those who employ the ad hominem strategy do so because they are on dodgy ground. I'm not a fan of logical proof by abuse, but it has its adherents.

Nevertheless, surely handsome, trendy Cox has heard of the possibility of a "Vacuum metastability event", explained thusly in Wikipedia:

"If our universe is in a very long-lived false vacuum, it is possible that the universe will tunnel into a lower energy state. If this happens, all structures will be destroyed instantaneously, without any forewarning."

How could this happen? A further link in the infallible Wiki universe considers the possibility of cosmic annihilation by particle accelerator:

One scenario is that, rather than quantum tunnelling, a particle accelerator, which produces very high energies in a very small area, could create sufficiently high energy density as to penetrate the barrier and stimulate the decay of the false vacuum to the lower energy vacuum. Hut and Rees,[3] however, have determined that because we have observed cosmic ray collisions at much higher energies than those produced in terrestrial particle accelerators, that these experiments will not, at least for the foreseeable future, pose a threat to our vacuum.

"...at least for the foreseeable future": a phrase to treasure, when set beside the earlier phrase, "...without any forewarning."

Not that I'd mind. After all, we'd know nothing about it. And it'd end the debate about global cooling / global warming / climate change - no guilt, either. And it'd make the Bible a nice bookend for both ends of the history of the universe, starting with "Let there be light" and ending "the day of the Lord will come as a thief in the night."

Throw that switch, Twatfinder General.

Sunday, June 07, 2009

Selling off the family... gold?

It's not going to be over by Christmas

...the proximate cause was a vast income disparity which placed much of the prosperous era's profits in the hands of a small wealthy class, who then mal-invested the profits...

- in the "non-real" economy:

The financial Plutocracy, observing that actually producing goods is not very profitable unless you can fix prices [...] sinks its capital into the FIRE economy (finance, insurance and real estate), eschewing real-world investments as comparatively unprofitable.

Though rarely noted, this is a longstanding trait of capitalism stretching back to 1400-era Venice. When trade became less profitable than mainland farmimg, the Venetian Elite stopped funding trading and bought farms on the mainland. As a side effect, Venice ceased to be a military and trading power. But the Elite remained immensely wealthy.

Watch that Gini coefficient rise.

Friday, June 05, 2009

Education: wha' happen'?

So I thought I'd revisit the notion of corporal punishment, too. Here in the UK, we had a tiny but influential pressure group called STOPP (Society of Teachers Opposed to Physical Punishment). Its spokesman was a Tom Scott*, who used to teach in London. What do I find in the Guardian online?:

One of the leading figures in the campaign to abolish corporal punishment was Tom Scott, then a teacher in Tower Hamlets, east London, who helped set up Stopp, the Society of Teachers Opposed to Physical Punishment. Scott is believed to have quit teaching since, and retrained as a theatre director.

I've watched it all happen. The replacement of CSEs and O levels by GCSEs; the move towards, then away from continuous assessment; phonics as obligatory, then phonics as career suicide, then phonics as essential again; book-burning by heads of English in secondary schools (literally) to ensure that coursebooks could never again be used, followed by the fay ce que voudras English curriculum; then the "we'll sort the teachers out" National Curriculum; then the exploitation of the need for new textbooks by commercial publishers; then the teaching of sciences coalescing into a general science, the withering of maths, combined with introduction of PC characters in the SATS assessments to mix-in multicultural social issues...

Tosspots.

___________________________________________________

*I don't know whether he's the same Tom Scott who ran the Eye Theatre and/or later joined the BBC's whizzy digital department...

Wednesday, June 03, 2009

Tuesday, June 02, 2009

Fight

Would it even be possible to hold the American revolution today? The Boston Tea Party? Imagine if George III had been able to sit in his palace across the ocean, look at the security-camera footage, press a button, and freeze the bank accounts of everyone there. Oh, well, we won’t be needing another revolt, will we? But the consequence of funding the metastasization of government through the confiscation of the fruits of the citizen’s labor is the remorseless shriveling of liberty.

Read more from the excellent and usually sharply funny Mark Steyn.

Sunday, May 31, 2009

History Revisited?

In his segment on Isaac Newton, he notes that Newton couldn't get the attention of the rich and influential in his middle years. The reason was that there was little interest in science and technology, since so many were making fortunes in the South Sea Bubble scam.

It struck me at that moment that the disinvestment in science and technology in the US and UK for the past 30 years may be due to a similar set of cicumstances, since so much money was being conjured out of thin air, first in the dotcom bubble, and then in artificial housing prices.

Thursday, May 21, 2009

Welcome, the Gurkhas

Tuesday, May 19, 2009

Sunday, May 17, 2009

The biggest bubble: human population

This is cart before horse. If we don't want the world to become composed solely of (a) people (b) things we need for food and drink c) weapons and (d) radioactive and otherwise polluted and barren desert, we need to:

1. limit human population growth...

2. ... without creating demographic gender imbalance

3. ... or demographic age imbalance

I read "Blueprint for Survival" in a Penguin edition in the 70s. One point it discussed, which had not occurred to me, was that the deceleration - population stabilisation/reduction - has to be slow and planned, otherwise we will develop serious imbalances that will destroy the economy and trigger a crash - a real, lethal one, not just the loss of some savings.

Time - time long overdue - for a plan to tackle this super-bubble. Wind farms and CO2 targets are near-irrelevancies.

Friday, May 15, 2009

The memory hole

Tony Blair dodged possible fire over his housing deals after hundreds of expenses claims were 'accidentally' shredded.

Documents itemising some of the then Prime Minister's receipts for 2001-02 were destroyed by Commons officials 'by mistake'.

Raising his voice above the shredders' roar, a source close to a former Prime Minister bawled that he was a pretty straight kind of a guy. Your correspondent made his excuses and left, pursued by an alcoholic pugilist making dark references to discoveries in woods.

Thursday, May 14, 2009

Still stuck on the 'B' Ark

In the past few years, we have seen significant increases in enrollment. I attribute that to:

a) the fact that there are fewer good jobs out there

and

b) while the typical 18-year-old is lazy and ignorant, they are not stupid. Consequently, they are flocking to the analytical fields (where the jobs are), including mathematics and science education.

However, our student services people are convinced that it is because of the advertisements, 'student appreciation days', and the like, not the teaching that we do.

Accordingly, they recently brought in management experts to help us in recruitment and retention efforts.

And where did these experts come from, to help out academia? The Disney corporation!

I must really work for a Mickey Mouse operation.

Dow 4,000 yet again

“the price-to-earnings ratio for the Dow Jones Industrial Index is now a hefty 43.1! It should be, historically, less than 20!”

Do the math, as they say. In fact, I'll do it for you now: take the Dow at close the night before Mogambo ranted (8,469.11) and multiply by 20/43.1. Result: 3,929.98.

I gues the question is, is the current low level of company earnings a temporary matter caused by recent dislocations, or is it set to continue as the economic climate darkens?

Plus, as we all know, the market can stay irrational longer than you can stay solvent. But I still think that, adjusted for what now seems inevitable high inflation, we're going to see Dow 4,000 sometime, as I graphed back in December:

Wednesday, May 13, 2009

Why inflation is going to hit us

Scott Burns at MSN Money (htp: Michael Panzner) calculates that unfunded government programs for social security and Medicare ($46 trillion) represent a debt equivalent to around 90% of all consumers' net worth ($51.5 trillion). If Americans' net assets decline by a further 10%, then effectively the American citizen is bust.

Scott Burns at MSN Money (htp: Michael Panzner) calculates that unfunded government programs for social security and Medicare ($46 trillion) represent a debt equivalent to around 90% of all consumers' net worth ($51.5 trillion). If Americans' net assets decline by a further 10%, then effectively the American citizen is bust.Tuesday, May 12, 2009

Monday, May 11, 2009

Sunday, May 10, 2009

A velvet revolution, or a concrete one?

We think that we are more sophisticated than our grandfathers. But we are less sophisticated, by far. Our descent into darkness is best demonstrated by listing old artists beside new artists; by listing old statesmen beside new statesmen; by comparing the lives of our grandparents to our own. The sociologist notices that more children are born outside of marriage, that epidemic cheating has taken our schools by the throat, that we have incompetence in business and government, that we find banality and ignorance on all sides. What conclusion can he draw? The powers and advantages of modern life haven’t made us worthy. They merely serve to amplify and accelerate our unworthiness.

I am amazed by those who think the U.S. economy is going to recover, that global peace is attainable, that American liberties are going to survive American barbarism. Look at our culture today: men are no longer men, and women are no longer women; capitalists no longer uphold free market principles; constitutional government no longer adheres to the Constitution; enemies are treated as friends. Nobody reads the signs. Nobody sees what is coming. Look at the birthrate among Europeans. Look at the abandonment of European culture. Look at the Muslim birthrate. Europe will be Islamic in fifty years. Long before that, the Russians and Chinese will achieve nuclear dominance of the globe. What do you think the investment climate will be in 2059?

Again and again, we are reminded that the issues are much bigger than mere money. I think that we could be on the verge of a social and political revolution, especially if whoever next takes on our nations' problems fails as signally as the present administration. To be clear, I don't welcome revolution, and don't expect its aftermath to be better than the state of affairs that preceded it. There must be effective reform, soon.

Us banks vs UK banks

By contrast, as you see here, the US has 8,500 banks, most of them in good condition. The problems are concentrated in their handful of giants. Over there, it would be possible to bust them and have others ready to take on their books of loans (discounted) and deposits.

Here, I think we'd have to create a new bank, if only to provide some competition for Barclays and HSBC.

A lighter moment

http://www.youtube.com/watch?v=70wuAWxOEZA

... but the Revolution begins at home

And all that believed were together, and had all things common;

And sold their possessions and goods, and parted them to all men, as every man had need.

And they, continuing daily with one accord in the temple, and breaking bread from house to house, did eat their meat with gladness and singleness of heart,

Praising God, and having favour with all the people. And the Lord added to the church daily such as should be saved.

It's a big ask, as they say; and the more we have, the bigger an ask it is. Jesus' advice to the rich young man (Matthew 19, v. 21) is after the latter has confirmed that he already performs all the normal religious duties:

If thou wilt be perfect, go and sell that thou hast, and give to the poor, and thou shalt have treasure in heaven: and come and follow me.

It was too much for that trustafarian, and it's too much for modern us. So we try to explain it away, Philadelphia lawyer-style. Clever people will explain that if you give away all, you'll merely be a charity case yourself. Or they'll tell you that the advice was case-specific: the young man needed freeing from his attachment to material things (and, presumably, we don't).

Yet the history of the early Church clearly shows that these sophisticated glosses are plain wrong. They were far, far closer to the revolutionary events (and witnesses) of the New Testament, and we must assume that they understood the message better. "Such as should be saved" must join the project, and obey the project's rules.

Reportedly, 82% of Americans are Christians (even the Simpson family). Many sincerely try to follow the early example - think of the people who took in refugees from Katrina-devastated New Orleans, and how some of these good hosts were robbed and even killed as a result.

But writing comments on US blogs suggesting sharing resources (even in the bureacratic form of the NHS) will get sharp ripostes accusing you of socialism or worse.

It's still a big ask, isn't it? And still too big for me, at the moment.

The Revolution is beginning

It is now not only the Government that has ceased to deserve our trust. So many members of the House of Commons have disgraced themselves so completely that their right to make laws for the rest of us has evaporated.

Read the rest of this extraordinary attack on our corrupted Parliament and broken democracy, in the Mail on Sunday here. The blogger-whingeing has now gone mainstream.

Saturday, May 09, 2009

The gold bugs are chittering - but don't get over-excited

Jeff Clark at Casey Research (htp: The Mogambo Guru) plays with the numbers to estimate gold's potential.

One stat is created from a comparison of all the world's cash with all the world's gold: "Total central banks reserves (including gold holdings) = $4.8 trillion, divided by 929.6 million ounces total gold reserves held by all official institutions that issue currency = $5,246 gold price." Or about £3,500 per ounce.

HOWEVER: the World Gold Council estimates that all the gold ever mined to the end of 2006 is about 158,000 tonnes, or 5,079.7 million ounces. If we round down to 5 billion ounces (to allow for some permanent loss, but offset to some extent by new mining - esp. in China - since 2006) we get a gold price of $960 per ounce - not far off where we are today. Allow a bit of cash held outside banks, and gold would be worth - what? $1,000? $1,200?

Yes, there may be a spike like in 1980 - and there may not be. But speculation/panic aside, it would seem that, globally, the current gold-to-money ratio is not quite so wrong as might seem at first sight. So the story is not really about gold, but about the weakness of the dollar in a heavily unbalanced US economy. Priced in a different, stronger currency, gold may not zoom to the moon.

Wednesday, May 06, 2009

Gold, and theft by inflation

A killer graph here from Charles Hugh Smith. Interestingly, the steady real decline of average incomes begins at almost exactly the same time as Nixon shut the "gold window".

A killer graph here from Charles Hugh Smith. Interestingly, the steady real decline of average incomes begins at almost exactly the same time as Nixon shut the "gold window".Smith's take is that "the speculative mania in housing was fundamentally a tragic last-gasp effort to make up lost ground via speculation in housing". And if housing reverts to mean, it has a long, long way to go yet.

Friday, May 01, 2009

Is it worth a shot?

By contrast, our modern elite have often never generated anything. I believe that is why they find it so easy to destroy things that they don't understand (which is a long list).

Petty officials in Brussels attack the British banger and English chocolate, not by relevant measures such as taste or safety, but using purely arbitrary scales.

In Britain, the well-educated New Labour, demonstrating their reverse snobbery, diminish the Peerage, and complete the destruction of a once-great educational system.

In the US, we have the legions of draft-dodgers who steer high-ticket military contracts to their friends, while our exhausted troops salvage from junk yards. The managers, accountants and lawyers have brought our economy to its elbows by equating the movement of wealth with its generation. Our fragile education system is battered by consultants and administrators who confuse good grades with competent teaching and actual learning.

Perhaps some of this could be improved by adapting some of the Japanese model, where management trainees first must try every job on the shop floor?