*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Monday, January 21, 2008

Danger of systemic breakdown

We've just had a crash

He's begging for inflation now, rather than a useless stimulant later when the mule has died.

The $1 trillion loss figure reappears

Sunday, January 20, 2008

Economics in the dark

In advanced economies, it's important for companies, banks and individuals to receive such information, too.

But nearly 40 years later, the USA needs to re-learn the lesson. The Federal Reserve ceased reporting M3 money supply data in 2006; accurate assessment of inflation is complicated by "hedonic adjustment" and periodic (and tendentious?) alteration of the types of item included in price surveys; the Bureau of Labor Statistics seasonally adjusts unemployment figures so that an increase can sometimes appear to be a decrease; nobody (not even the lenders) yet knows the full figures on bad loans and "Tier 3 assets"; it is not even clear how we should assess a nation's wealth (GDP per capita seems a misleading measure).

How can you navigate without up-to-date information? Even in the nineteenth century, Mississippi river pilots had to keep track of the river's changes, or risk getting stranded on new sandbars. And as John Mauldin reports, party political manoeuvering is stymying two appointments to the Federal Reserve's Board, at a time when the Fed most needs to concentrate on resolving the unfolding complex financial crisis.

Even given the right data, decision-making has become tougher. Increasing global interconnection and wealth transfer between nations means that normal cycles may be broken by epochal linear developments, so the past is now a very unsafe guide to the future.

We need clarity, direction and vision.

Panzner votes DE (flation)

In his excellent book (reviewed here last May), he suggests that inflation will come afterwards (actually, not just IN- but HYPER-).

Saturday, January 19, 2008

A small town in Germany

Then a newsflash cut in: the President of the USA had been shot on a visit to Dallas and had been rushed to hospital. My father went upstairs. The programme resumed.

My father came down. I still remember him buckling his belt over his uniform, as ever uncomfortable and determined to do his best, a stocky man with a straight back, now full of tension. He watched with us as another newsflash came: the President was dead.

I think the camp sent a driver with a Jeep; in any case, Dad was gone. We watched some more TV, interrupted by occasional updates and speculation. Then it was time for bed. Flannel pyjamas, cotton sheets, the heavy blankets that trapped your feet. I went to sleep.

Lights woke me, illuminating the curtains. Heavy engines, headlights passing, heading in the direction of Düsseldorf. One after another after another. Now, I know they were tank transporters, racing to position the heavy armour in readiness for the Red invasion.

And now there are no more Communists, or so it seems. We buy fuel from the Russians, hardware and toys from the Chinese. The people my father, a gentle and sensitive man, was prepared to die fighting, are our friends and trading partners. As reported by The Independent, Chinese interests even supported our Conservative leader and former Prime Minister, Edward Heath (Sir Edward protested the following week, saying the claims were "misleading and inaccurate" - but did not go so far as to say that they were untrue). Surely, we're all friends now. After all, Dad had helped the Germans start to rebuild their country; he'd worked with German civilians, learned to speak the language fluently, married a German refugee. Wars happen, and so does peace. The people of the world are vexed by their leaders, yet love for one another endures and triumphs.

But Communism is not a nation, and does not love people. Everything, even its own most ardent supporters, can be burned on the altar of abstract principle. Informed that a general nuclear war would kill a third of humankind, Mao said good, then there would be no more classes.

As gypsies and beggars used to sing:

So proud and lofty is some sort of sin

Which many take delight and pleasure in

Whose conversation God doth much dislike

And yet He shakes His sword before He strike

(The Watersons performed it on "Frost and Fire", which our English teacher played to us in the late Sixties. I associate it with cold, freshness, the musty fragrance of the Monmouthshire woods, animism, hope.)

By degrees, this brings me to the current state of affairs. Our leaders wish us to believe that the history of our fathers is at an end, and now only efficient administration remains to be achieved. The revels of democracy are ended; they were fun, but their time is past.

No: as Christopher Fry said, "affairs are soul size", still. Although I do believe that sudden and total conversion is possible, as in James Shirley's now implausible-seeming play "Hyde Park" (who would have believed the Earl of Rochester's conversion? - and there are those who still doubt it, not knowing how the sinner hates sin), I doubt that all who worked with the old Soviet and Chinese Communist regimes have abandoned their principles and plans. Like the remark about the significance of the French Revolution (variously attributed to Chou En-Lai and Mao Tse-Tung), it's "too early to say".

Even if our leaders should be gullible or merely suborned, Jeffrey Nyquist reminds us again that there are still people who think differently from us, and we must be prepared. It is not all right to be weak, whether militarily or in our economies. Good fences (and good borders) make good neighbours.

Punish the perp

Unfortunately, we in the UK have chickened out - for party political reasons to do with its power base in the north of England, the Labour government is currently holding the baby in the case of insolvent lender Northern Rock, even though the tax payer is on the hook for nearly $120 billion as a result. (Hey, that's nearly as much as the proposed new tax break to reflate America - and our population is one-fifth the size of yours!)

Hope you have better luck - or better leaders - over there. Buy a Lottery ticket and hope?

Friday, January 18, 2008

Dow 9,000 update

Nearly there, and the new announcement of a $145 billion reflation may push gold that extra yard.

Stocks may follow bond yields down

Wednesday, January 16, 2008

Here we go

Monday, he reasserted his belief in DE-flation; but as I've been saying for some time, maybe the real issue is the divide between haves and have-nots, and he deals with that, too. No point being rich if you daren't go out.

Yesterday, he sounded the bells for a possible crash today. Maybe this is when Robert McHugh's prediction is fulfilled.

Tuesday, January 15, 2008

Time to buy into Northern Rock?

The share price has slumped from over £12 last February to 69 pence, assisted by the gleefully gloomy 20/20 hindsight of the news media. We had voxpops today from small "windfall share" demutualisation shareholders ruefully reckoning their notional losses and admitting they can't find the (now-near worthless - ha!) certificates.

One of Sir John Templeton's maxims is "The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell."

Let me offer two of mine: "Never buy what the fund managers try to sell you at financial adviser seminars", and "Remember the journalists who had their pensions in Equitable Life with-profits, because EL didn't (ugh!) pay commissions".

If I had the spare, I might speculate on NR. Hedge funds may be able to afford losing money, but they certainly don't go out of their way to do it. I wonder what will happen?

Monday, January 14, 2008

Oil to crack the dollar?

Now that the gold dinar has been introduced in Malaysia, Lewis wonders whether the dirham should link to gold, too, so oil exporters can avoid being robbed by a falling dollar.

Brownouts and lines at the gas station again, perhaps.

USA / UK Sovereign Wealth Funds?

Foreign governments with trade surpluses (based on artificially low currency exchange rates and stupid overspending by the West) are building up trillions in reserves and eyeing our companies and real estate. If our own leaders aren't willing to rebalance the world economy, the least they can do is get a piece of the action.

Why not?

Sunday, January 13, 2008

Dow 9,000 update

The Dow is now 12,606.30 and gold $894.90, so the Dow is now worth 14.09 gold ounces. It has fallen by 5.78 ounces out of the predicted 6.36, so the prediction is 90.9% fulfilled so far.

McHugh will be fully correct if, for example, the Dow remains unchanged and gold rises to $933/oz; or if gold stalls, the Dow will need to fall to 12,090.

To Gordon Brown: please remit £4bn ASAP

"U.K. Sold 395 tonnes of gold at an average price of $274.9 per ounce. The first sale at $254 caught (or caused?) the low point in a 20-year slide in the price of gold.

The losers are us, Brown's gold sales raised around $3.49 billion.."

-- Telegraph.co.uk , January 2, 2006

That was written when the price was $627 and at today’s gold price of $895 the position would be worth $11.4 billion. And - remember the reason for selling was to improve central bank returns - what did they buy with the funds?

I make that a loss of $8 billion to date, or £4bn sterling.

We hear a lot about accountability. If only politicians could be made personally financially accountable.

Or if they could be paid to go away. In recent times, it would have saved the country a fortune if each senior politician had been given £10 million to do nothing at all.

Saturday, January 12, 2008

Debt and slavery

Doug Noland sees the debt crisis spreading to the corporate sector; David Jensen writes a letter to the Governor of the Bank of Canada, including very telling graphs of mounting debt and the bubble in the financial markets; Michael Panzner discusses a piece from the Financial Times on the threat of a downgrade of America's historic AAA credit rating, and refers to the weakening of the USA's military pre-eminence; Sol Palha worries about the acquisition of Western assets by sovereign wealth funds ("Slowly but surely America and Europe are going to be owned by foreigners. The irony is that Congress is trying to keep immigrants out of this country but right in front of their eyes foreigners are slowly gobbling up huge chunks of this country.").

All this leads me to Jeffrey Nyquist's grim, but compelling latest piece. He despairs of the irrelevance of mainstream political discussion, especially as the polling process rattles on, and paints a far greater picture. I think you should read it all, but here are a few extracts:

What is happening in the news today, what is happening in the markets and in the banking system, has profound strategic implications... There are no invulnerable countries... If a government does not see ahead, make defensive preparations, establish a dialogue with citizens, lead the way to awareness and responsibility, then the nation stumbles into the next world war unarmed and psychologically unprepared.

Even worse, today's politics has become a politics of "divide and conquer" in which one constituency is played off against another: poor against rich, non-white against white, the secular against the religious. Before a positive outcome is possible, we must have unity and we must have reality.

It's more comfortable to ignore the crying of Cassandra, but maybe Nyquist is like Churchill in the pre-WWII political wilderness, trying to prepare us for the next conflict. We in Britain only just made it, and how we have paid for that struggle ever since.

But it was a price worth paying. History would have been very different, and very horrible I am sure, if Churchill had listened to some in his Cabinet in 1940 who advised him to make a deal with the Nazis. He said, “If this long island story of ours is to end at last, let it end only when each one of us lies choking in his own blood upon the ground.” It's a line that even now has tears pricking my eyes. The appeasers were silenced by the sound of deeply-moved men banging their fists on the Cabinet table in agreement and applause.

My worry is that I don't see men of that calibre now. As Lord Acton said in a letter to a bishop, "Power corrupts, and absolute power corrupts absolutely". Commenting on the House of Commons after the Great War, Stanley Baldwin remarked on the presence of "A lot of hard-faced men who look as if they had done very well out of the war". Today, the faces are softer, the hair expensively dressed, the manner relaxed and affable, but behind it all one senses cold-hearted, selfish betrayal. To be charitable, it may be that our leaders and ex-leaders don't fully realize the negative consequences of all their deals, compromises and consultancies.

As our reckless debt is progessively converted into ownership, we may find out how much we took our freedom for granted. It's a lot harder to get back.

The Bible has something to say on this, too (and no, I'm not a preacher, this is to show that the issues endure throughout history): Leviticus, Chapter 25 deals with debt, buying and redeeming slaves, and how the chosen people should be treated differently from the heathens - for the latter, enslavement is perpetual.

Friday, January 11, 2008

Gold, the dollar and the Dow

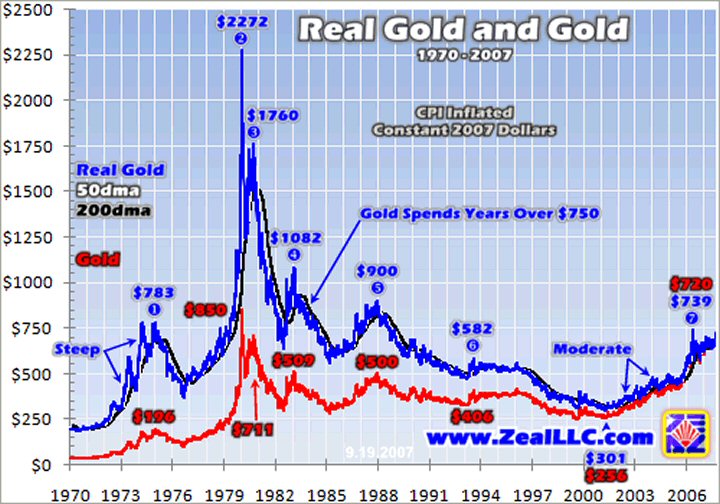

Here's a relatively recent graph of the price of gold, adjusted for inflation (admittedly, inflation can be defined in many ways):

On this chart, it looks as though gold's median price would be around $600/oz, so currently it's above trend and presumably the elevated value factors-in some economic concern.

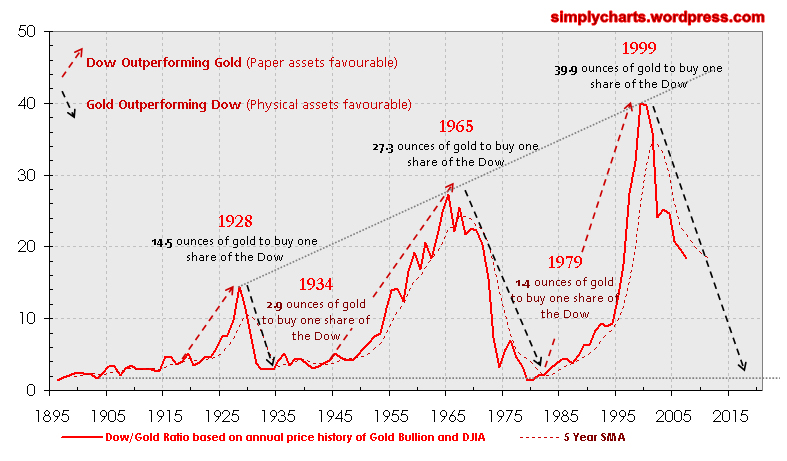

Now, here's a chart correlating the Dow and gold: It seems harder to spot an average here, since each peak is much higher than the one before. But taking the Dow as it is now (12,606.30) and the current price of gold ($894.90), the present ratio of 14.08 ounces would be in the middle range of the variation since the mid-1920s.

It seems harder to spot an average here, since each peak is much higher than the one before. But taking the Dow as it is now (12,606.30) and the current price of gold ($894.90), the present ratio of 14.08 ounces would be in the middle range of the variation since the mid-1920s.

So a purchase of gold now looks like a speculation, rather than a bargain.

Waves and tides

Thursday, January 10, 2008

Stuffed

Wednesday, January 09, 2008

Something's gotta give

It's more serious than that, of course: James Turk quotes the Comptroller General, David M Walker's estimate that total liabilities, including commitments to future social security benefits, are around $53 trillion. The government's annual revenues are only around 5% of this figure, so the credit card looks like it's pretty much fully-loaded.

However it happens, it seems something must give way under the strain. Frank Barbera reckons the Dow has plenty further to fall (and possible interim correction or not, he thinks gold looks good). Prieur du Plessis concurs, quoting Nouriel Roubini's comment that "... a lousy stock market in 2007 will look good compared to an awful stock market in 2008."

Bob Bronson thinks the downturn will be long as well as hard. He in turn quotes the chairman of the National Bureau of Economic Research: this one “could be deeper and longer than the recessions of the past.”

Boris Sobolev also looks to gold, but prefers the smaller companies because of all the money that's piled into the majors.

In case we in the UK should be tempted by schadenfreude, Ashraf Laidi predicts that sterling will accompany the US dollar's fall against other currencies. From what I read in connection with the USA, a weakening currency may provide a temporary boost to exports, but also inflate the cost of imports; so I don't suppose that our following the dollar will do us much long-term good, either.

Of course, it's possible to dismiss all this as group-think wall-of-worry stuff, but maybe that would be double-bluffing ourselves. Sometimes, things are exactly what they seem. Banks have consistently turned a profit for centuries, on the inexorability of debt.

Oil splat

In simplest terms, we are concerned that the very lifeblood of the world industrial economy—net oil export capacity—is draining away in front of our very eyes, and we believe that it is imperative that major oil importing countries like the United States launch an emergency Electrification of Transportation program--electric light rail and streetcars--combined with a crash wind power program.

That is just the tip of the iceberg, surely: residential and office heating/lighting, mechanised farming, supermarket shopping, centralised medical facilities - so much will have to be reviewed and planned.

Tuesday, January 08, 2008

Twang money, encore

In the short term, we have this contest between credit contraction and currency expansion. I'm getting the feeling it'll be the first followed by the second, which is what Michael Panzner predicts in "Financial Armageddon".

Grab your pension now, inflation-proof it?

Monday, January 07, 2008

Killer greens

... both oil and cereals are global commodity markets. If it's profitable to make food into fuel in the US, even without a subsidy, then it's profitable elsewhere also - possibly more so given lower labor costs. So the basic growth dynamics are the same. The infection just hasn't got as strong a grip on the whole globe yet, but it's growing at similar rates.

... I expect oil prices to increase in the medium term, though certainly they could go down in the short-term if the credit crunch affects the global economy enough.

... When we have a bidding war between the gas tanks of the roughly one billion middle class people on the planet, and the dinner tables of the poor, where does that reach equilibrium?

... We noted earlier that according to the UN about 800 million people are unable to meet minimal dietary energy requirements. That is 12% of the world population. [...] we can estimate that a doubling in food prices over 2000 levels might bring 30% or so of the global population below the level of minimal dietary energy requirements, and a quadrupling of food prices over 2000 levels might bring 60% or so of the global population into that situation.

Zero sum for the lower echelons

... it seems likely that the most skilled Westerners will continue to give their countries a comparative advantage against emerging markets. However, there is no guarantee that these research-intensive sectors are likely to support the entire Western population, far from it. They are highly cyclical, benefiting hugely from an active stock market and venture capital market. Further there is no evidence that innovation itself, as distinct from the fruits of recent past innovations, is significantly expanding as a percentage of output -- indeed, research expenditure has if anything declined.

... Since the majority of location-dependent jobs in Western countries are low-skill it therefore follows that if governments wish to protect local living standards, they need to discourage low-skill immigration. Except in Japan, they have not been doing so; both in the EU and the United States low-skill immigration, frequently illegal immigration, has got completely out of control and is immiserating the working classes.

... the economic histories of a high proportion of the Western population under 30, except the very highly skilled, will involve repeated bouts of unemployment, with job changes involving not a move to higher living standards but an angry acceptance of lower ones. By 2030, it is possible that the median real income in the United States and Western Europe may be no more than 50-60% of its level today.

This will expose the democratic divide between those who vote and influence the system in their favour, and the rest. The class division could sharpen as "I'm all right Jack" is replaced by "One can't complain, Piers".

Sackerson awards a Prose Prize for Hutchinson's use of the term "immiserating".

P.S.

... and presumably this will have an obvious effect on residential property prices. Who's for selling up and buying a caravan?

Gold boom, gold bust

I've reported expert comment before, about the vulnerability of gold to market manipulation and speculation. I think I'll keep on sitting out this dance.

Inflation or deflation: an expert writes

Also heartening to see my suggestion re insider jiggery-pokery echoed here:

As an aside, I still don't know what to make of the triangle / diamond in Goldman's chart (see Figure 4) other than they plan to squeeze stocks higher under the cover of low volumes over Christmas holidays in justifying their bonuses.

Sunday, January 06, 2008

A winning combination

The Daily Mail alleges a new craze called "celebrity maths", where you combine two famous faces to make a third. Who might be the third here?

The Daily Mail alleges a new craze called "celebrity maths", where you combine two famous faces to make a third. Who might be the third here?And what other political combinations would you like to see?

Gold and liberty

I watched a programme last night about how we very nearly had the Third World War in 1983. This was a time when Russia was especially paranoid about the West's military intentions - spies were even ordered to report how many lights were on in late evening at the Ministry of Defence in London, apparently not knowing that the offices were lit so the cleaners could do their work.

Then in September, a Soviet spy satellite, fooled by sunlight reflecting off high-level cloud, reported not one, but five missile launches from America. The Russian monitor on duty ignored the klaxon and flashing screen, backed his judgment and told his superiors it was a false alarm, for which he was ultimately discharged from the Army. Wikipedia says his name is Stanislav Petrov. He's certainly worth more than the $1,000 the Association of World Citizens could afford to award him. We may owe him our lives.

Looking for updates on the gold dinar, I came across this blog by a Pakistani, in which he looks to the Islamic dinar as a way of breaking the enslavement of the world by a fiat-currency banking cartel. Irrespective of whether he's justified in his analysis of the situation, or reasonable in his hopes for such a currency, we should note the victim-perception. I seem to recall a maxim (from Sun Tzu?) that you should fear a weak enemy.

Which brings us back to the economic vulnerability of the UK and USA. Weakness can invite aggression, but also makes the weak fear an attack even when it isn't coming. Worryingly for a potential aggressor, weakness may be feigned:

22. If your opponent is of choleric temper, seek to irritate him. Pretend to be weak, that he may grow arrogant. ("Laying Plans")

I don't think you can truly be free until you are strong and independent. We need to get our houses in order, so we can deal with others from a secure base - which is safer for all involved.

Iraq may have the last laugh

... prior to the war with Iraq the Dinar was $3.00+ per US Dollar.

...Today the country is almost debt free; Iraq is one of the leaders in oil, natural gas and holds a huge amount of gold in its country.

... The Company believes in the near future there will be a revalue of the Iraq Currency, it is the Company's opinion after doing its due diligence and public statements from Iraq's government officials, that the revalue could come in at between .82 and 1.00 per US Dollar.

Twang

"Examine the disappearing equity. It came from no where and is going back to no where."

That's what happens when credit becomes a form of currency, as the bullion moralists keep reminding us.

Why are banks allowed to create so much "fiduciary money"? Who does own the Fed?

Saturday, January 05, 2008

Bitter medicine

... the present crisis is already more serious than any that has occurred before in modern times.

... Our projections, taken literally, imply three successive quarters of negative real GDP growth in 2008. Spending in excess of income returns to negative territory, reaching -1.6 percent of GDP in the last quarter of 2012—a value that is very close to its “prebubble” historical average.

... while the rate of growth in GDP may recover to something like its long-term average, all our simulations show that the level of GDP in the next two years or more remains well below that of

productive capacity.

... We conclude that at some stage there will have to be a relaxation of fiscal policy large enough to add perhaps 2 percent of GDP to the budget deficit.Moreover, should the slowdown in the economy over the next two to three years come to seem intolerable, we would support a relaxation having the same scale, and perhaps duration, as that which occurred around 2001.

Our projections suggest the exciting, if still rather remote, possibility that, once the forthcoming financial turmoil has been worked through, the United States could be set on a path of balanced growth combined with full employment.

Raving sane?

The conspiracy theory here is that the Fed and other central banks are a cartel that not only inflates the money supply, but has created trillions in derivatives, partly to manipulate the investment markets. "Deepcaster" accuses this cartel of engineering drops in the gold price, just when you'd think gold should be emerging as a natural currency.

He brings in the Amero theory, too - ultimate replacement of the destroyed dollar by a new North American currency, presumably so the crooked poker game can continue with fresh cards.

Can anyone please shed light on all this? For example, who EXACTLY are the owners of the Fed?

If nobody knows or is willing to tell, perhaps one of us should claim ownership - "finders, keepers".

Unemployment B-L-S---

Karl Denninger reports that the US unemployment rate has hit 5%. He thinks - and it's certainly plausible - that we're already in a recession. Especially if Rob Kirby is right, and the Bureau of Labor Statistics (BLS) is lying about the scale of job losses in the financial industry.

Friday, January 04, 2008

Marquess of Queensberry rules?

Now, Jeffrey Nyquist treats us to another Sino-Soviet frightener, and Nadeem Walayat sees even more potential enemies, who may not refrain from below-the-belt blows. The enemies of the Open Society abide. Are our Western politicians prepared? Will they defend us?

Gold and the Dow

Taking the present values - Dow 13,056.72, gold $864.80 - the formula works out at 15.098, which suggests that the Dow is still well above trend.

Some would see this as indicating a coming gold spike; but another way to rebalance is for the Dow to fall. As credit deflation takes hold, I suggest that in 2008, both gold and the Dow will drop below their current levels, but the Dow more than gold.

UPDATE

Gary Dorsch is looking at the same ratio ("By the end of 2008, the DJI to Gold ratio might tumble towards 10 oz’s of gold"), but thinks the rebalance could happen the other way, through destructive inflation.

If so (and he doubts that it's possible), Karl Denninger thinks you'd still be better off betting on the Dow, using call options:

So tell me again - if you believe in "hyperinflation" - why do you want to buy the clear LOSER of an asset that metals represent, when you can buy index CALLs and, if your thesis is correct, you will make an absolute stinking FORTUNE!

(Of course if you're wrong and the DOW is under 16,000 by the end of the year, that $20,000 is totally flushed. That's the price of poker - but again - just how sure are you that "The Fed" is going to "hyperinflate"? And by the way, no, I don't think they are - in fact, I don't think they CAN.)

SECOND UPDATE

Gary Tanashian sets a target of $920 for gold, but anticipates a drop-back anytime; but longer term, Julian Phillips can't imagine governments NOT hyperinflating, to avoid the horrors of deflation.

The astrologers continue to mutter and gesture over their charts.

Dead Cat Splat

His view: housing is woeful, emerging markets look as though they may be topping-out, the Ted Spread is signalling insolvency fears, the 10-year bond rate augurs slowing growth; so cash is king.

Little boxes, revisited

I think it's in "Jane Eyre": a teacher who wishes to instil piety into a little boy, asks him whether he'd rather have a biscuit or a blessing. When he answers, a blessing, he gets two biscuits.

When recession empties the the biscuit barrel, maybe we'll get authentic leadership.

UPDATE

My beloved recalled it better, and so I've found the quote on the Net:

...I have a little boy, younger than you, who knows six Psalms by heart; and when you ask him which he would rather have, a ginger-bread nut to eat, or a verse of a Psalm to learn, he says: "Oh, the verse of a Psalm! Angels sing Psalms," says he. "I wish to be an angel here below." He then gets two nuts in recompense for his infant piety.’

We need recession, to avert total disaster

It seems that we must wish our own countries a spell of hard times, in order to stimulate the changes that will defend us from permanent ruin.

Thursday, January 03, 2008

Ta-ta industrial wages, hello Mcjobs

Mirror, mirror

Few are brave enough to come out and declare the start of a bear market; but the watchword is "proceed with caution".

Wednesday, January 02, 2008

Consequences

Bad news: we depend on the banks

When things turn vengeful, let's take a careful look at the banks, and those who give them their orders. Not for the first time, they've lifted us up, and are making ready to drop us from a great height.

As the song from Mary Poppins has it:

If you invest your tuppence

Wisely in the bank

Safe and sound

Soon that tuppence,

Safely invested in the bank,

Will compound

And you'll achieve that sense of conquest

As your affluence expands

In the hands of the directors

Who invest as propriety demands

[...]

You can purchase first and second trust deeds

Think of the foreclosures!Bonds! Chattels! Dividends! Shares!

Bankruptcies! Debtor sales!

... for the whole lyric see here.

The scene ends, happily enough, with a run on the bank as young Michael loudly demands the return of his twopence.

Monday, December 31, 2007

Small is beautiful

I think this links in with our domestic EU in-or-out debate, on which the allegedly Conservative British MP David Cameron has recently been making flirty noises. I say "flirty" because although the headline talks boldly of tearing up the un-referendum-ed Constitution, the leader of the Opposition says "We think the treaty is wrong because it passes too much power from Westminster to Brussels." How much is enough?

Perhaps some will say mine is a typical reaction from a little Englander, but originally that term meant an opponent of imperialism. Well, I'm used to ignorant brickbats. It was Philip Toynbee who - his son told me - called me a Colonel Blimp while I was still at school, I think because I had dared to ask him about the significance of colour in Lorca's poetry. What I gathered from this experience was: never ask a posh leftie for an explanation, he'll only look down his egalitarian nose at you. (I haven't met his daughter Polly, though.) Intriguingly, though the term "little Englander" is said to date from the 1899-1901 Second Boer War, there is an 1833 German dictionary-cum-phrasebook (published in Grunsberg) called "Der kleine Englander ober Sammlung". I do hope the title wasn't intended to have a pejorative tinge, but you can never be sure with the Germans - they do have a wry sense of humour.

The relevance of all this, aside from the asides? I think the themes of diversity, dispersion and disconnection will grow in importance over the coming years, in politics and economics. As with some mutually dependent Amazonian flowers and insects, efficiency and specialisation will have to be balanced against flexibility and long-term survival.

Sunday, December 30, 2007

Recession QED

He says the media is not reporting the truth. I tend to agree: I now throw away the Sunday football and financial supplements at the same time. If you want to know what's really happening, he says, watch what is going on at the banks, the Federal Reserve and Goldman Sachs, all of whom are battening the hatches, while CNBS (also castigated by Jim Willie) plays a cheerful tune to the proles.

I've written before how in 1999, as a financial adviser, I sat through a presentation from a leading UK investment house about tech stocks, which were supposedly about to start a second and bigger boom. I suspected then, and even more so now, that they were looking for the fabled "bigger fool" to offload their more favoured clients' holdings. Denninger intimates the same:

Are these shows, newspapers, and others reporters on the financial markets, entertainers, or worse, puppets of those who know and who need someone – anyone – to unload their shares to before the markets take a huge plunge, lest they get stuck with them?

Then he gives his predictions - which are grim, but not apocalyptic. It's the fools who will get roasted, not everybody. (By the way, Denninger is another Kondratieff cycle follower.)

What to hold, in his opinion? Cash, definitely; anything else, check the soundness of the deposit-taker. If you want to gamble on hyperinflation, he thinks call options on the stockmarket index are likely to yield more than gains on gold, even if the gold bugs are right.

This is where I thought we were in 1999. Thanks to criminally reckless credit expansion in the interim, we're still there, only the results may be worse than I feared then.

Oh, and he thinks the dollar will recover to some extent, because the rest of the world is going to get it just as bad, and probably worse. (Interesting that the pound is now back under $2.)

Saturday, December 29, 2007

The answer to Olduvai?

There is an international project (ITER) in the south of France to develop this, and if it works...

UPDATE

Thanks to GMG for a link to this discussion of fusion power, which tends to the conclusion that a successful and economically viable fusion system is a very long way off, if feasible at all, and we'd do better to concentrate on fission, i.e. the present type of nuclear power station.

Spot the trends

Generally, the poorer the country, the higher the income inequality as measured by the Gini Index (except for Azerbaijan, according to this from the ESRC).

The Factbook estimates 30% combined unemployment and underemployment in many non-industrialized countries; developed countries typically 4%-12% unemployment.

There are enormous fortunes to be made (by some) arbitraging the economic differences between countries.

In the USA and the UK, we are relentlessly spending more than we are earning.

What are our governments' plans for us to remain rich? And given the correlation between income and equality, do our business, media and political elites have much incentive to make and seek support for such plans?

Contradicting the contrarians

UPDATE

But Tim Wood expects the market to hit a low - "The straw that finally breaks the camel’s back may be closer than you think."

Friday, December 28, 2007

Desperate hope

However, many have already pointed out that (a) lending criteria are tightening and (b) not all of the interest rate cut is being passed on to the borrower. So lenders are trying to reduce their exposure and are also being paid more for the risk they have already assumed. And we see from this Christmas shopping season that (c) the consumer is becoming more reluctant to spend.

That's not to say that we won't get inflation (in some sectors, not housing), since falling interest rates tend to depreciate the currencies of debtor countries relative to their cash-rich trading partners. On the other hand, the latter will continue trying to hold down their currencies, in an attempt to keep the show on the road - the show being the osmosis of wealth from the lazy, spendthrift West to the hard-working, hard-saving developing world.

We're going to be buying less, but I don't know how fast the Eastern co-prosperity sphere will take up the slack. In his book "The Dollar Crisis", Richard Duncan argues for a worldwide minimum wage to stimulate demand; but maybe events have overtaken him. Certainly, China aims to expand its middle class, rapidly.

But there's another way for China to stave off depression while waiting for the sun to rise in the East. According to James Kynge, manufacturing and transportation costs account for only about 15% of the end-price of Chinese exports to the US. Some of the expanding Chinese middle class will surely go into advertising, marketing, sales, distribution and finance. As China develops its own version of Wal-Mart, Omnicom and banking, credit card and financing operations, it'll own more of the total profit in the supply chain - some of which it can sacrifice to retain market share. And they're motivated to do so by the fact that domestic consumption yields very little profit for their companies: the money's in exports. The longer this game goes on, the more the decline of capital and skilled labour at our end.

So let's worry about the effects at home first. Yes, for investors inflation may be a worry, but perhaps they should extend their concern to include the stability of the society in which they live, as unemployment and insolvency stalk through the West. The issues are no longer financial, but political and social.

And we'd better hope that we don't go for the wrong solutions. Daughty quotes Ambrose Evans-Pritchard's 12 December article in The Daily Telegraph, which concludes (amazingly), "... it may now take a strong draught of socialism to save the Western democracies." I do not think Mr Evans-Pritchard is very old. Or maybe he's just saying that to bug the squares, an expression I'll wager he's too young to remember.

Anatomy of a CDO

If I follow correctly, the trickery seems to come in step 4, where a CDO largely composed of middling-rated mortgage risk sells bits of itself with unreasonably optimistic ratings attached. "Skimmed milk masquerades as cream".

Thursday, December 27, 2007

Some interesting correlations

1. Since 2003, if the dollar falls, all other asset classes rise; and conversely, if the dollar rises, the rest drops.

2. The "real" (adjusted for the price of gold) interest rate on 3-month Treasury bills predicts movements in the exchange rate of the dollar a year later.

Since the "real" interest rate has fallen sharply, he therefore expects a strengthening in other assets next year.

Modestly, Silberman adds, "Correlations are never perfect and tend to fail just when you need them most."

I think he's right there. To me, there seems to be a lot of jiggery-pokery in the gold market (speculators vs. central banks), and the predominance of "fiduciary money" (credit) in the economy means that we're measuring sizes with elastic bands.

In times of stress, the normal predictors don't hold, so currently I view all investments as speculative. My first priority is to reduce my vulnerability with respect to creditors, and my second is building cash to take advantage of emerging opportunities.

Defensive investing

I've never understood why the stockmarket seems serenely unrelated to the dire state of the economy. Supposedly the market "looks ahead" around a year, but it can't be seeing what I'm looking at.

Anyhow, Panzner reproduces Dan Dorfman's article in the New York Sun, which reviews what's happened to the market in past recessions and gives tips on strong defensive areas - booze, cigs and "household products". I can understand that, too - or the first two, at least.

Jim Willie goes bowling

Jim Willie stands up nine reassuring statements about the US economy and smashes the lot down. He goes to the back of his mule for material to throw at Greenspan, Wall Street, CNBC etc and concludes that nothing is going to stop the financial melt. So he recommends gold.

He may be right, since on both sides of the Atlantic the authorities have decided to bail out lenders, instead of following Marc Faber's advice to let some of the players be taken out of the game.

However, as Faber has also pointed out recently, gold is an item everyone thinks everyone else supports, without committing themselves (elections have been lost that way). Is it not possible that we could see a continuing uptrend in the (relatively small) gold market, simply because of increased demand from existing fans? In which case, don't come late to the party - you'll have brought fresh beer but missed the fun.

Wednesday, December 26, 2007

Uncertainty

A couple of things seem pretty clear to me: first, that I haven't lived long enough to have enough experience to know whether the bulls or bears are right about just how far the ripples will spread from the credit market problem; second, that there's never been an economic cycle just like this one, so even the people who have lived long enough to know who's right are speculating at best. (highlight mine.)

So it's not just me that's confused. And we're in distinguished company: Marc Faber also says we are in a new situation, with the possibility of a first-time-ever worldwide bust.

If we're into guesswork, then mine is that for a while, the monetary inflation will offset the credit (or "fiduciary money", as I'm learning to call it) deflation.

And then? Here's what worries me, in my amateurish, hunchy fashion: balance can be achieved in different ways (an empty seesaw is not the same as one with an elephant at each end). There's been a massive buildup of energy within the system, and the question is, can the Xbox take it?

Can democracy resist the hyperinflation route?

I'm not so pessimistic; and if I were, investing in gold would be of less concern than physical survival.

Marc Faber: profile and views

And here's an interview he gave to Resource Investor 5 days ago. Some snippets:

it’s clear that in the U.S. we are already at some kind of a stage of stagflation where say retail sales are strong because grocery prices are rising very strongly. So that boosts essentially grocery sales whereas sales of discretionary items are sluggish...

the whole credit bubble that we’ve built over the last 25 years, I have to point it out, has now basically come to an end. We will have lower credit growth... that leads to poor economic conditions... the Fed will eventually win because they can print an unlimited amount of money, and they can essentially expand their balance sheet by not only acquiring treasury securities, but also lower quality paper... at that point I suppose that inflation will become a problem. And so in real terms you will have no economic growth, and you have a real kind of stagflationary environment...

whenever ... you have relative tightening of international liquidity ... you have a period of dollar strength... I think that we may have for the next three months at least a rebound in the U.S. dollar... I think long-term the dollar is a doomed currency because you have a money printer at the Fed and you have basically Hank Paulson at the Treasury who comes straight out of Wall Street and who has more interest in stabilizing the price of Goldman-Sachs stock than of having a strong dollar...

the global economy will slow down very considerably over the next six to 12 months...

I’m not very bullish about commodities right now. I think the price of gold will also come under some pressure... But long-term I think that having Mr. Bernanke at the Fed, you have essentially a friend of gold at the Federal Reserve because he will print money...

I would like to add to your comments that so many people are bullish about gold... people have actually very little gold in their portfolio... the gold bugs are bullish about gold, but the other 95% of the world, they have no gold exposure at all.

If he's right, my guesses (23 December) aren't too far off the mark.

Tuesday, December 25, 2007

Liberty Dollar Update

Sunday, December 23, 2007

Visions of 2008

USA

a marked deflation in property prices

a reduced demand for luxury goods and services

reduced imports of the above

consequent recession abroad

further interest rate cuts

higher unemployment

higher taxes

higher State and Federal budget deficits

a sell-off in equities

increased demand for bonds

a weakening currency

higher prices for food, fuel and clothing

increase in the price of good-quality agricultural land

consumer price inflation indices will not be able to continue to mask the real increases in costs of living, and this will have further consequences for public finances

public enquiries, leading eventually to a thorough reform of the financial system

UK

much the same as above, except I don't think our house prices will fall so far - the US subprime mess will hit investments, but we will drop our interest rates to devalue the pound to maintain stability against the dollar

Gold

will continue to fluctuate interestingly, but although some smart money is after it, there will be less spare money around generally, and other commodities will offer interesting opportunities for inflation-beaters. It's already above its inflation-adjusted long-term trend, and lenders will make sure that the real value of their loans is not destroyed by hyperinflation

... in short, slumpflation.

UPDATE

*and, by way of comparison, here is Karl Denninger's outlook in his Dec 24 post.

... plus a more sanguine assessment by Nadeem Walayat.

A Merry Christmas to all, and thanks for your visits and comments.

Saturday, December 22, 2007

IN, not DE

Righteous wrath

I've been looking for one of those famous photographs from China's "Great Leap Forward", showing children standing on a field of wheat, such is the success of the Party's new agricultural techniques. Can anyone help me find it on the Net?

For it's certainly a bit like the official-fudged miracle economy we've got now. Except even the peasants have stopped believing in it, to judge by what's happening in the retail outlets.

Green screens

Thursday, December 20, 2007

Hark what discord follows

What is inflation, anyway? Ronald Cooke looks at the damned lies and self-serving statistics that underpin the official Consumer Price Index.

Jim Patterson reads the stockmarket runes and concludes:

Sub-Prime issues have been discounted. With overall market returns compressed the downside is limited. We expect a better market in the weeks and months ahead.

In his slightly starchy prose, The Contrarian Investor agrees with Patterson, up to a point, but also gives a serious warning:

1. In today’s market, the probability of the market going up is higher than the probability of it coming down. Hence, it is rightly called a bull market.

2. But should it come down (which is unlikely), it can collapse at extremely great speed and magnitude.

Hence, the stronger and longer this uptrend continues, the greater in magnitude and speed (as in volatility, not timing) the Great Crash III will be. Hence, the coming Great Crash III is a Black Swan event—an improbable but colossal impact event.

The importance of a particular event is the likelihood of it multiplied by its consequences. Black Swan events are events that are (1) highly unlikely and (2) colossal impact/consequences. One common mistake investors (and many professionals) make is to look at the former and forget about the latter i.e. ignore highly unlikely but impactful events.

Therefore, when contrarians are preparing for a crash, it does not necessary mean that they are predicting doom and gloom. Rather, they see the vulnerability of Black Swans and prepare for them.

Credit default swaps - a line of dominoes, one falls

If you're long stocks, bail now.

Wednesday, December 19, 2007

Stockmarket crash on the way?

All investors take heed, you are staring at a market that is NOT responding well to “Good News.” Markets that cannot rally on Good News tend to accelerate downward on any type of bad news, and that is the kind of market which appears to be taking shape.

Here we go

Now Governor Schwarzenegger is looking for a 10% cut in expenditures across the board, as the San Diego Union-Tribune reports.

Tuesday, December 18, 2007

What goes around, comes around

Interestingly for me, he relates this action in part to the UK's having taken on so much of US Treasury debt, a matter on which I commented repeatedly some time ago.

Monday, December 17, 2007

Snippets, straws in the wind

Nadeem Walayat predicts another brightening of the FTSE's candle flame, before it flutters again;

Jas Jain says "total household debt growth below $300B annual rate will lead to outright deflation within months" and this is why the Fed has to keep trying to stimulate lending, with ever-diminishing responses;

Ghassan Abdallah counsels against trying to short the market, what with many forces attempting to support it - best to sit out the dance;

AFP interprets the slide in world stocks as a disappointed response to the Fed's limited interest rate cut, and a sign of fear of inflation - something Alex Wallenwein predicted recently;

Finally, Captain Hook plays with ideas that have occupied me for some time (rubric mine):

... If what we are witnessing is at a minimum a Grand Super-Cycle Degree event, then a total collapse of stock, bond, and currency markets world-wide could be in store as the globe reverts back to more regionalized economies, and localized currencies...

... the swings in the markets are enough to curl one's spine these days, so speculator exhaustion could play a role in curbing interest in speculation. This is a natural considering the aging western populations at this point and will play a big role in curbing the demand for financial assets moving forward as retirees attempt to spend their savings.

Sunday, December 16, 2007

What is long-term investment?

Well, I'm not a respected Fleet Street money journalist, merely a no-account bearish personal financial adviser, but I'd suggest that in the exciting investment world of today, maybe a five-year period is not a good basis for comparing long-term results, or conditioning expectations for the future.

I had a client ask my opinion about investments a couple of years ago, because his bank had been showing him their fund's marvellous growth over a three-year period. I took time to explain to my client that over the five years to date (then), the graph (as for the FTSE 100) described a kind of bowl shape, and the period chosen by his bank just happened to draw a line from the bottom of the bowl to the lip.

I then showed him the five-year line in all its loveliness:

I then showed him the five-year line in all its loveliness: I think it's fair to say that these are not ordinary times. There has been a steady build-up of electrical charge, so to speak, over something like a decade (some would say, much longer), and there may well be some powerful bolts unleashed as a result. Where will the lightning will strike next: a steeple, an oak tree, a cap badge - who can tell?

I think it's fair to say that these are not ordinary times. There has been a steady build-up of electrical charge, so to speak, over something like a decade (some would say, much longer), and there may well be some powerful bolts unleashed as a result. Where will the lightning will strike next: a steeple, an oak tree, a cap badge - who can tell?

Massive debt; changes in the balance of international trade; demographic weakening of future public finances; sneaky currency devaluation; wild financial speculation; wars and the rumours of wars; imprecisely known ecological limits to growth; declining energy resources; the desperation of the world's poor to join our fantastic lifestyle; our fear that we may lose the comfortable living we used to imagine was our birthright; the corruption, abuse and neglect of the young; the selfishness of their parents and the middle-aged; the increasing burden and growing neglect and abuse of the old.

In all this turmoil, making five-year investment performance comparisons has an air of unreality, like planning tomorrow's menu on a mortally-wounded ocean liner.Friday, December 14, 2007

Lead, kindly light

Perhaps, after the next election, a new US President, with the strength of a fresh mandate, will be also able to act so decisively.

Thursday, December 13, 2007

Denninger: depression, but when?

The other is to keep the door closed until the smell is too bad, and then we have far worse problems - but it could take years. End result: deflationary depression.

Tuesday, December 11, 2007

Collectivized security leads to riskier behaviour

Research into piles of sand grains showed that the timing of sudden collapses is quite unpredictable, but there is an inverse correlation between their magnitude and likelihood. As the sand piles up, "threads" of instability form, that can be triggered by the fall of a single grain in the wrong place. This is akin to the "Butterfly Effect" in catastrophe theory, I suppose.

Mauldin connects this up with a paper published last year, about uncertainty created by humans in the development of their economic structures:...the greater the number of connections within any given economic network, the greater the system is at risk.

This underscore the concerns I hinted at in an earlier post. The potential for catastrophic change is building up, and we can't predict what will be the trigger. Therefore, all the connections we are forming with each other need to be balanced by provisions for disconnecting, or for insulating one region from changes occurring in another.

To use an analogy, the supertankers that take oil around the world's oceans are internally divided into compartments. It would be cheaper, and so more profitable, not to install the internal compartments. But without them, a large wave hitting the ship could cause a movement in the liquid cargo that would shift the balance and quite possibly sink the vessel altogether.

So there is a trade-off between efficiency and survival.

Another aspect is how human behaviour changes in relation to risk perception. For example, research shows that when road junctions are widened and vision-obscuring vegetation cleared, drivers compensate for the extra security by going faster and less carefully. I understand that each of us has his/her our own preset level of risk tolerance, and when circumstances change, will seek to bring things back to that level .

But what if you don't fully understand the new circumstances? A miscalculation as to the level of security inherent in the situation could lead to your behaving more dangerously than you realise. The complexity and obscurity of CDOs, derivatives and credit default swaps are examples in the world of finance and economics, but surely this applies to other fields, too.

Perhaps conservative instincts are not just laziness, stupidity and timidity, but survival instincts. Have you noticed how those maddeningly slow drivers don't have dents in their old, lovingly-polished cars?

Maybe I'll get a hat, for driving.

The Fed may trigger off a run on Treasury bonds, says Wallenwein

Wallenwein suspects that the Fed has been buying longer-term US Treasury bonds to sustain demand and so keep interest rates low, but he thinks that once others scent the Fed's fear, there will be a massive dump that will throw more on the market than the Fed can mop up. This, he thinks, will send longer-term interest rates soaring.

His conclusion is that gold will perform its usual function of a safe haven in times of uncertainty.

As I pointed out this summer, the UK has (fairly recently) become the third-largest holder of US Treasury bonds.

Monday, December 10, 2007

A run on non-banks

Jim in San Marcos explains that it's probably not the banks we need to worry about, but the financial entitities that are NOT covered by Federal deposit insurance.

And Karl Denninger also details other areas threatened by financial contraction.

Sunday, December 09, 2007

Little boxes

It would have made no difference had it been a tin of cloned credit cards. You don't need to know what's in the box, or how it works; you need to know what it does, and who it's for.

Once you start thinking along these lines, things get so much clearer. For example, you don't have to be a "quant" like Richard Bookstaber, to know that derivatives are about risk. More precisely, they're for increasing risk.

Supposedly, a derivative reduces risk; but if you look at its use, it's a box that tells lenders and gamblers how far they can go. Seeing the fortunes that can be made in high finance, there is the strongest temptation to push the boundary.

My old primary school had a lovely little garden behind it, where we played at morning break. One game was "What's the time, Mister Wolf?". You went up to the "wolf" and asked him the time; he'd say nine o' clock; to the next child he'd say ten o'clock and so on, until he'd suddenly shout "Dinner time!" and chase you. Obviously, the game was not about telling the time.

So it is with financial risk models that service the need to maximise profits: always another trembling step forward. There's only one way to find out when you've gone too far.

But what if you could ask the time, and know that someone else would end up being chased? I think that explains the subprime packages currently causing so much trouble.

The bit I don't understand is why banks started buying garbage like this from each other. Maybe it's a case of the left hand not knowing what the right hand is doing, since these organisations are so big. Or maybe it's that everyone has their own personal box.

Then there's credit default swaps, and other attempts to herd together for collective security. They don't work if the reduction in fear leads to an increase in risk-taking. United we fall: no point in tying your dinghy to the Titanic's anchor-chain.

In fact, I think this opens up a much wider field of discussion, about efficiency versus survivability. In business, economics and politics we might eventually find ourselves talking about dispersion, diversity and disconnection.

Saturday, December 08, 2007

Liberty update

As Chumbawumba sang:

I get knocked down

But I get up again

You're never going to keep me down

We'll be singing

When we're winning

We'll be singing

... good luck.

Thursday, December 06, 2007

Better to be rich and mis?

So I'd ask whether economic progress is more important than being happy and optimistic. Read "Insurance - The White Man's Burden" and decide.

UPDATE

...and a nice little thread in Market Ticker's forums section, on rat-race dropouts who've taken to the beaches in Hawaii

The Dow is a shape-changer

An argument for betting on the index, if you're not an attentive stock-watcher.

This, I suggest, is one to bookmark, or print and put in in your wallet.

A moment of sanity

My grandfather used to say, things are never as good as you hope or as bad as you fear. As I reported some while ago, members of the Chicago Stock Exchange in 1934 papered their club room with what they thought were now worthless stock certificates, but within five years were steaming them off the walls again.

The Thirties crash hit debtors, unwary investors (especially those trading with borrowed money) and insolvent banks. The lessons from this are easy to learn.

Wednesday, December 05, 2007

Unreal

Two problems: one is, I can't visualise anything with many zeroes, so it's not real for me. More importantly, if there's a major meteor-strike financial bust (i.e. deflation), I'd have thought cash in hand is what everyone will want.

Unless a crazed government opts for hyperinflation. In which case, I'd rather have pallets of canned baked beans, boxes of ammunition and many brave, loyal friends. You can't eat gold.

But as with all truly terrible imaginings, the mind bounces off this like a tennis ball from a granite boulder, and we turn back to normal life with determined optimism.

The Fed and King Canute

... the problem with the U.S. financial system ... is not liquidity, but the solvency of mortgage loans and securitized debt. The Fed's actions are not likely to have material impact on this.

This, plus Larry Lindsey's comments noted in my previous post, adds weight to Karl Denninger's continuing theme of inevitable deflation.

Larry Lindsey: extraordinary rendition

Ed Steer (Financial Sense) relates his October experience of an unusually frank speech, and answers to questions, by President Bush's former economic adviser. According to Steer (I paraphrase), Lindsey's views include:

- The Fed knew home loans were getting dumb, but didn't want to spoil the party

- Banks are going to have to revalue their property holdings realistically

- Hedge funds will have to take what comes, and probably will

- America has offloaded zillions in toxic-waste loan packages to other countries, and ha, ha !

- House prices will plummet

- Don't trust the government CPI figures

- Gold dumping is coming from European central banks, not the US

- America could handle a 20-30% dollar devaluation

... loads of beef in that burger, where's the fluffy bun?

Tuesday, December 04, 2007

The end of usury

He points out - as do others, including proponents of Islamic sharia banking - that however much money is created through credit, more must be created to cover the interest charged. Usury endlessly blows up the balloon, which must eventually pop, before the cycle begins again.

Lenders do want their money back, and so generally take security for the loans they grant. At some point - and Denninger believes it's now very close - lenders will become unwilling to lend further, and/or borrowers will retrench or become unable to service their debts. In short, borrowers will have to pay up or be ruined, together with the more reckless lenders.

Can the government print extra money to solve this? Not according to Denninger, who says that the effect of bad money will be to drive out private lenders (who would demand very high interest rates for lending in an inflationary environment). Since the government itself runs partly on borrowed money, it's not an option.

Conclusion: cash will be king; get out of debt now.

Sunday, December 02, 2007

Ted Spread

Michael Panzner shows a couple of ominous graphs:

One is the "TED spread" - the difference between interest rates charged by banks to each other, and short-term (and safe) Treasury bonds. A wider margin indicates that the market is charging more because it considers lending to be more risky, and the current TED spread is approaching 1987 levels.

The other shows the ratio of amount loaned out, to amounts of cash on deposit. Lenders are now very stretched.

Saturday, December 01, 2007

The Angriest Guy In Economics

Karl Denninger, on the other hand, is very emphatic that our economic woes are no laughing matter. Here he calls for all the "off-book" items to be included in lenders' accounts, and if that bankrupts them, so be it: a cleansing of the financial system, condign punishment for the perpetrators and a warning to others. This is similar to Marc Faber's position: he says the crisis should be allowed to "burn through and take out some of the players". Gritty.

And concrete. Denninger supplies a photo of a customer-empty store at 6 p.m. on a Sunday evening, to underscore his point.

Now that's something we can put to the test - look at the shops in your area and work out how crowded you'd normally expect them to be at the beginning of December.