Echoing recent comments by Vitaliy Katsenelson (also on Barron's), Jeremy Grantham thinks profit margins will decline towards normal and the Standard & Poor's 500 will head from its current c. 1334 to 1100 in the year 2010 - a drop of about 18%.

Grantham is emphatic that borrowed money is not a stimulant to the economy:

I have an exhibit that shows the 30 years prior to 1982 when the debt-to-gross domestic product ratio was completely flat at 1.2 times. Total debt is defined as government debt, personal debt, corporate debt and financial debt. Then in the 25 years after 1982, the flat line goes up at a 45 degrees angle from 1.2 times to 3.1 times GDP. Massive. In the first 30 years, when debt is flat, annual GDP growth is its usual battleship, growing at 3.5% and hardly twitching. After the massive increase in debt, GDP, far from accelerating, grew at 3%. So debt in the aggregate does not drive the economy. The economy is driven by education, man-hours worked, capital investment and technology.

That last sentence is really pregnant. I'm not sure about the man-hours (the closer we approach peasanthood, the harder we'll work), but I think that on both sides of the Atlantic, we've been falling down on the other three.

In Britain, our government has failed to distinguish between investing in education, and managing it - and where it has tried to do the latter, has pursued a Romantic-heritage political agenda. Capital investment? Going abroad. Technology? Ditto - and eagerly taken up (if not positively filched) by our Eastern trading partners.

I live in what used to be Car City; now, the vast Longbridge site is being redeveloped for housing and shops - in other words, open prison for the new ex-industrial underclass.

But Rome, too, kept control of its plebs with bread and circuses for a couple more centuries, before it fell.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, February 10, 2008

Saturday, February 09, 2008

Will monetary inflation be absorbed by the bond market?

In the previous post, I looked at the expectation that interest rates will rise. But it seems that freaky things can happen if the government tries to stimulate the economy by progressively cutting interest rates and pumping more money into the system.

Professor Antal E Fekete thinks that in a deflationary environment, governmental attempts to reflate by introducing more money will be thwarted by the ability of the bond market to soak up the excess liquidity. Higher bond yields result in lower bond valuations, so reducing interest rates inflates the price of bonds. Fekete says that halving the rate doubles the bond price, and since mathematically you can halve a number indefinitely, the bond market can absorb all the fiat money you can create. Therefore, you can have hyperinflation and economic depression at the same time.

This trap is possible because the abandonment of the gold-and-silver standard means that the dollar has no limit to its expansion. And bond speculators have their risk covered by the need of the government to return to the market for renewed borrowing. If the Professor is right, it would be a nasty trap indeed.

But maybe our conclusion should be that this explains why interest rates must rise.

A quibble on style: especially in England, money is regarded as dull. So financial commentators try hard to add flavour, and in the Professor's case, too hard - it has been difficult for me to detect the meat of the argument under its many-spiced similes. Byron's Don Juan comes to mind:

And Coleridge, too, has lately taken wing,

But like a hawk encumber'd with his hood,

Explaining Metaphysics to the nation--

I wish he would explain his Explanation.

Professor Antal E Fekete thinks that in a deflationary environment, governmental attempts to reflate by introducing more money will be thwarted by the ability of the bond market to soak up the excess liquidity. Higher bond yields result in lower bond valuations, so reducing interest rates inflates the price of bonds. Fekete says that halving the rate doubles the bond price, and since mathematically you can halve a number indefinitely, the bond market can absorb all the fiat money you can create. Therefore, you can have hyperinflation and economic depression at the same time.

This trap is possible because the abandonment of the gold-and-silver standard means that the dollar has no limit to its expansion. And bond speculators have their risk covered by the need of the government to return to the market for renewed borrowing. If the Professor is right, it would be a nasty trap indeed.

But maybe our conclusion should be that this explains why interest rates must rise.

A quibble on style: especially in England, money is regarded as dull. So financial commentators try hard to add flavour, and in the Professor's case, too hard - it has been difficult for me to detect the meat of the argument under its many-spiced similes. Byron's Don Juan comes to mind:

And Coleridge, too, has lately taken wing,

But like a hawk encumber'd with his hood,

Explaining Metaphysics to the nation--

I wish he would explain his Explanation.

Warren Buffett's misleading optimism

Jonathan Chevreau reports Warren Buffett's bullishness on the US economy, long-term; but the real gem in this piece is the extensive, but cogent and crunchy comment by Andrew Teasdale of The TAMRIS Consultancy, who analyses Buffett's real approach to equity valuations.

Teasdale points out that although interest rates hit 21% in 1982, there was less debt, higher disposable income and lower valuations: relative to disposable income, debt is a bigger burden today than it was 25 years ago. He summarises his position pithily:

It is also worthwhile remembering that not everyone holds a Buffet portfolio and not everyone has the luxury of a 220 year investment horizon. If I was a long term investor with no financial liabilities arising over the next 15 years equities would be my preferred asset class relative to cash and bonds, but I would be mindful of valuations in determining where I put my money.

Not all the bad debt has yet surfaced, and as Karl Denninger comments, even at this stage Citibank has recently been forced to borrow foreign money at 14%, and other banks at over 7%, in preference to the 3% Federal Funds rate, presumably to keep the scale of their insolvency in the dark.

Inflation is increasing, therefore money-lenders are going to want more income to compensate for risk and the erosion of the real value of their capital. For the yield to rise, the capital value of bonds has to fall.

So I read Teasdale's summary as implying that for now, it's cash rather than either bonds or equities.

Teasdale points out that although interest rates hit 21% in 1982, there was less debt, higher disposable income and lower valuations: relative to disposable income, debt is a bigger burden today than it was 25 years ago. He summarises his position pithily:

It is also worthwhile remembering that not everyone holds a Buffet portfolio and not everyone has the luxury of a 220 year investment horizon. If I was a long term investor with no financial liabilities arising over the next 15 years equities would be my preferred asset class relative to cash and bonds, but I would be mindful of valuations in determining where I put my money.

Not all the bad debt has yet surfaced, and as Karl Denninger comments, even at this stage Citibank has recently been forced to borrow foreign money at 14%, and other banks at over 7%, in preference to the 3% Federal Funds rate, presumably to keep the scale of their insolvency in the dark.

Inflation is increasing, therefore money-lenders are going to want more income to compensate for risk and the erosion of the real value of their capital. For the yield to rise, the capital value of bonds has to fall.

So I read Teasdale's summary as implying that for now, it's cash rather than either bonds or equities.

Thursday, February 07, 2008

The Golden Compass doesn't work

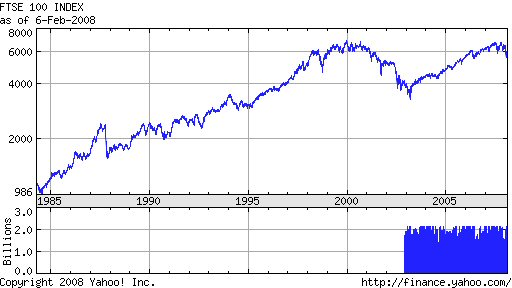

FTSE closed today down at 5,724.10, a point first reached (travelling the other way) in December 1998. The longer-term chart above suggests to me a glass ceiling. Or flogging a dead horse (I can't tell you how some ten-year-olds I know misheard that last saying recently, or how their conversation continued. That generation appears to be developing backwards from middle age.)

FTSE closed today down at 5,724.10, a point first reached (travelling the other way) in December 1998. The longer-term chart above suggests to me a glass ceiling. Or flogging a dead horse (I can't tell you how some ten-year-olds I know misheard that last saying recently, or how their conversation continued. That generation appears to be developing backwards from middle age.)Adjusted for inflation, the line would look worse, of course. I think my gut feeling was right ten years ago: essentially, we've been going down since the late nineties.

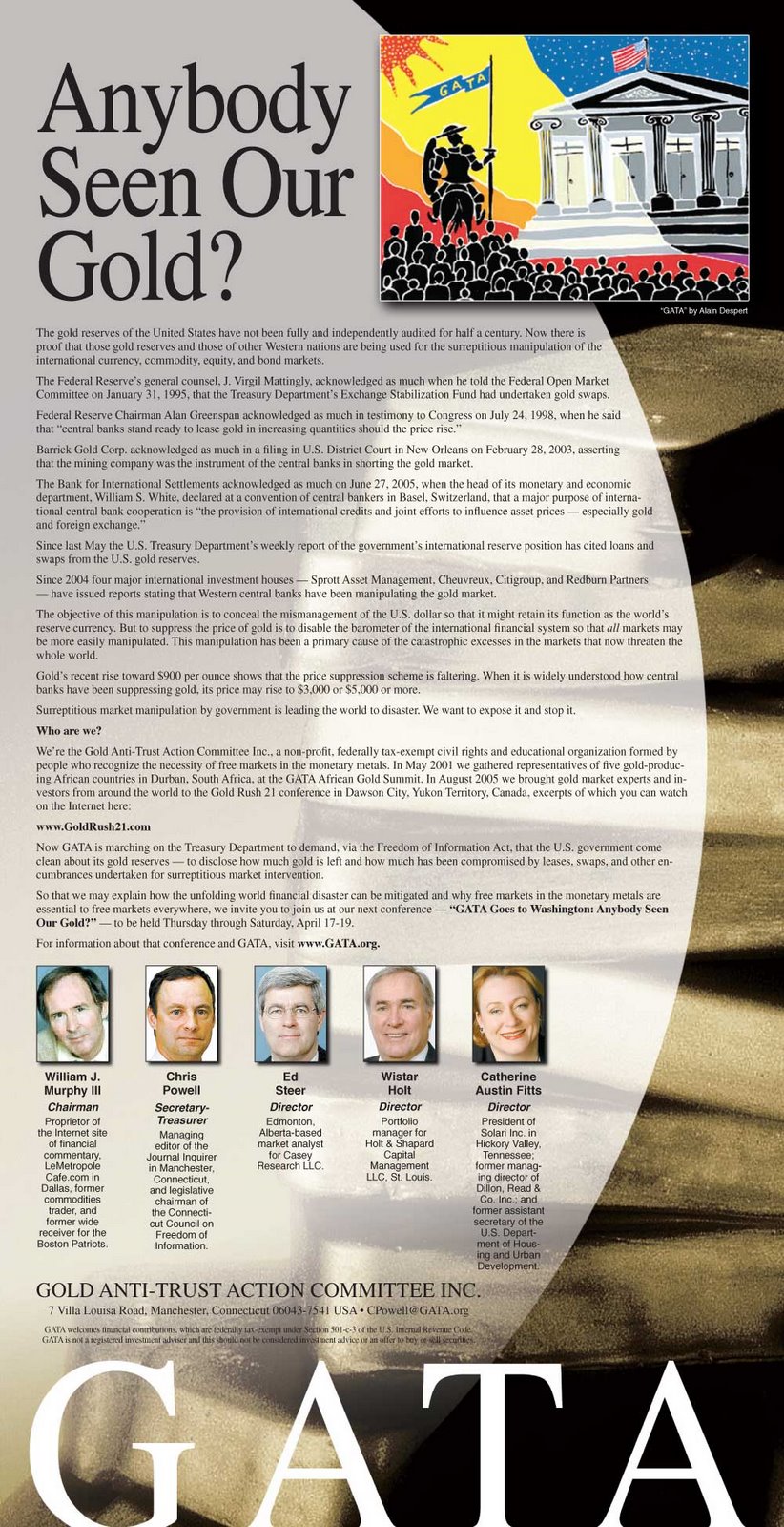

But what inflation measure to use? Gold seems to go down together with equity sell-offs, rather than seesawing against them. And unlike with the Dow, there doesn't seem to be an easily accessible index of the FTSE priced in gold terms; but GATA last week went very public with their theory that gold is being held down by surreptitious selling - and has been quietly disappearing from central bank vaults. This is something I've touched on a number of times before, and MoneyWeek gives its take on it here. Meanwhile, here's the ad:

Tuesday, February 05, 2008

The New World Order: a philosophical objection

A deep essay by Christopher Quigley here, but one I intend to re-read. Marxist philosophy always made my eyes water, practically instantly, as I have little tolerance for prolonged abstract multisyllabic holy-rolling, but I'll steel myself because we have to have some understanding of the madness that seems to have seized our modern conspiratorial ruling class. "Affairs are now soul-size".

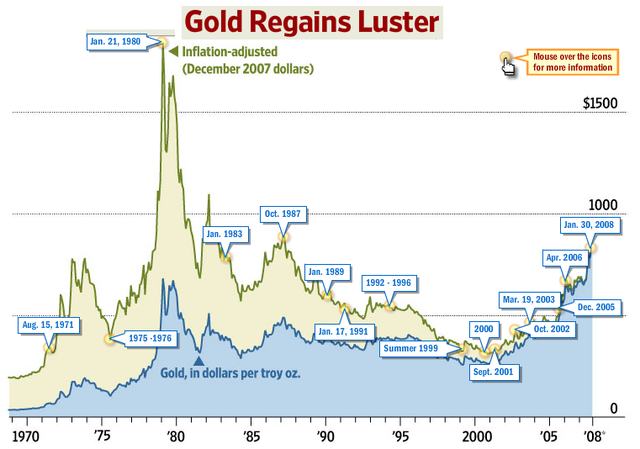

Gold chart confusion

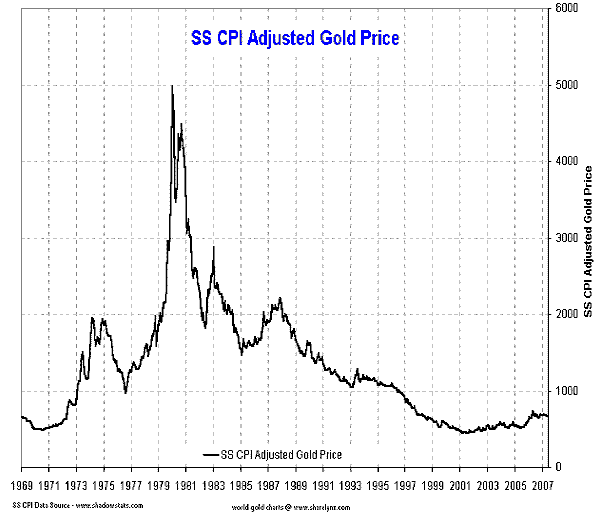

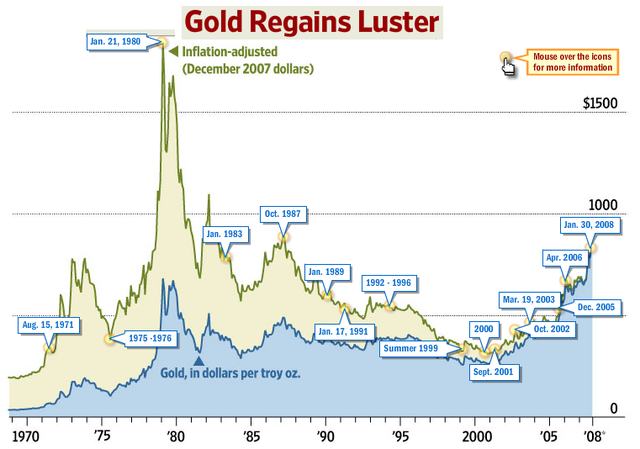

Here's a chart of gold against inflation as measured by CPI, from Captain Hook, and it suggests that high as it is now, the price of gold is still below its 1973 - 1997 average:

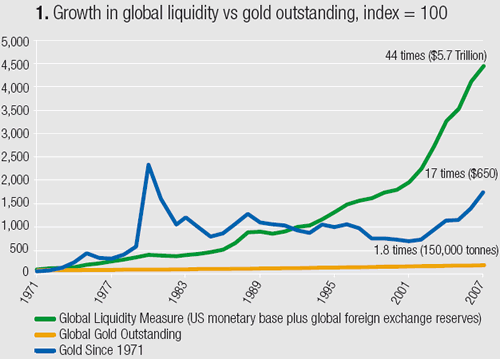

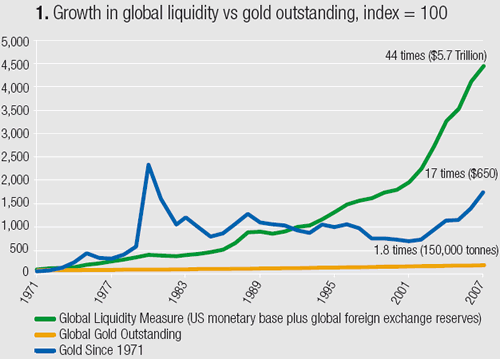

... and here's another from Ty Andros's TedBits, comparing gold to gobal financial liquidity:

... and here's another from Ty Andros's TedBits, comparing gold to gobal financial liquidity:

Which line of reasoning would you support at this time?

... and here's another reproduced on the Contrarian Investor's Journal (possibly from TedBits, which I'll come to in a moment), which seems to show the opposite:

... and here's another from Ty Andros's TedBits, comparing gold to gobal financial liquidity:

... and here's another from Ty Andros's TedBits, comparing gold to gobal financial liquidity:

Which line of reasoning would you support at this time?

Sunday, February 03, 2008

Why equities should go down

I'm breaking radio silence because of a brilliantly lucid article (from the subscription-only Barron's site) found for us by Michael Panzner.

Vitaliy Katsenelson explains that the current average price-earnings ratio may seem cheap, but that's because recent profit margins have been well above the 8.5% trend. Even allowing for a shift since 1980 away from industry towards the higher-margin service sector, the present 11.9% profit margin should be seen against a longer-term background figure of around 8.9 - 9.2%, which if current p/e ratios continue would imply a downward stock price correction of 22 -25%.

This chimes with Robert McHugh's "Dow 9,000" prediction from last July. And in many fields it's usual for overshoot to occur in the process of regression to a mean, so if it holds true in this case we could see even deeper temporary lows.

Day traders, be warned: this piste is a Black Run.

Vitaliy Katsenelson explains that the current average price-earnings ratio may seem cheap, but that's because recent profit margins have been well above the 8.5% trend. Even allowing for a shift since 1980 away from industry towards the higher-margin service sector, the present 11.9% profit margin should be seen against a longer-term background figure of around 8.9 - 9.2%, which if current p/e ratios continue would imply a downward stock price correction of 22 -25%.

This chimes with Robert McHugh's "Dow 9,000" prediction from last July. And in many fields it's usual for overshoot to occur in the process of regression to a mean, so if it holds true in this case we could see even deeper temporary lows.

Day traders, be warned: this piste is a Black Run.

Subscribe to:

Posts (Atom)