Stock traders' bonuses are calculated on the basis of profits made up to... NOW. And perhaps not entirely by coincidence, the Dow has clambered back up to 13,300 and the FTSE above 6,400.

So the books close, the champagne flows and the rest of us can start doing our own accounts. Where are the customers' yachts?, as the naive investor asked.

Karl Denninger looks at E*Trade's difficulties and reckons the 70% mark-down of their home equity lending portfolio implies a loss of $1.5 trillion on HELOCs (home equity line of credit) alone. The bad news hasn't all come out yet.

Perhaps we entering the period of "dawning realisation".

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Friday, November 30, 2007

Thursday, November 29, 2007

"Give me Liberty or give me debt"

Bernard von Nothaus, issuer of the "Liberty Dollar" is sounding feisty. Such people are most inconvenient for the smooth running of public affairs; it's awkward cusses like him who were the grassroots of the American Revolution (though of course, the Founding Fathers faced a far more grisly legal retribution if they failed).

There is a serious point: is America prepared to refresh its commitment to the principles of the Constitution, which Ron Paul champions; or is it "the old order changeth, yielding place to new"? In which case, when was that decided, and by whom, and with what right?

It's a burning issue for us in the UK, too: here, a thousand years of organic (and often bloody) constitutional development is to be hurriedly reshaped by lawyers and bureaucrats working for the Executive, in the name of vaguely-phrased hurray-words ("justice, rights and democracy" - the last is particularly ironic, since I don't remember voting for this ramshackle assault). Has it become the people's representatives v. the people? Perhaps our "new" Labour government has ignore its Methodist roots and relaxed the laws on drinking, gambling and sexual activity so that we will be distracted from taking an interest in more serious matters.

On a lighter note, it's fun to see that, legal currency or not, such Liberty Dollars as are still out of FBI custody are currently a good investment. Maybe better than the Fed's IOUs, if you believe the bullion-hoarders.

Jacob Shallus might have thought so. The $30 he earned for engrossing the Constitution was the equivalent of 5 weeks' worth of a Philadelphia printer's wages in 1786. What does $30 get you today?

There is a serious point: is America prepared to refresh its commitment to the principles of the Constitution, which Ron Paul champions; or is it "the old order changeth, yielding place to new"? In which case, when was that decided, and by whom, and with what right?

It's a burning issue for us in the UK, too: here, a thousand years of organic (and often bloody) constitutional development is to be hurriedly reshaped by lawyers and bureaucrats working for the Executive, in the name of vaguely-phrased hurray-words ("justice, rights and democracy" - the last is particularly ironic, since I don't remember voting for this ramshackle assault). Has it become the people's representatives v. the people? Perhaps our "new" Labour government has ignore its Methodist roots and relaxed the laws on drinking, gambling and sexual activity so that we will be distracted from taking an interest in more serious matters.

On a lighter note, it's fun to see that, legal currency or not, such Liberty Dollars as are still out of FBI custody are currently a good investment. Maybe better than the Fed's IOUs, if you believe the bullion-hoarders.

Jacob Shallus might have thought so. The $30 he earned for engrossing the Constitution was the equivalent of 5 weeks' worth of a Philadelphia printer's wages in 1786. What does $30 get you today?

Wednesday, November 28, 2007

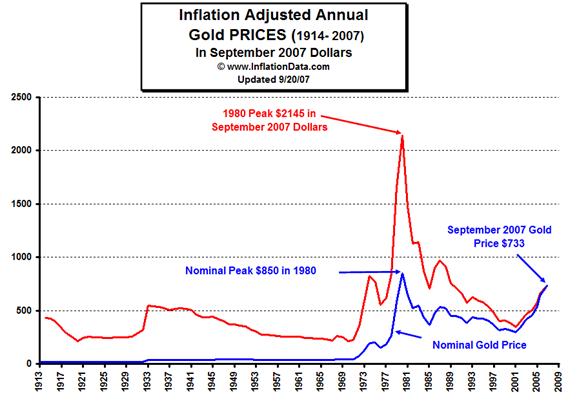

The long-term price of gold

I referred yesterday to an article by Tony Allison, which reproduced a graph of the long-term inflation-adjusted price of gold. Here is the original article from InflationData.com.

It looks to me as if the median price of gold (in 2007 dollars) runs at around $450/oz., but I'd be glad to hear from anyone who can give a better estimate.

And the Contrarian Investor's Journal argues why, even in deflationary times, gold may still be a good choice.

It looks to me as if the median price of gold (in 2007 dollars) runs at around $450/oz., but I'd be glad to hear from anyone who can give a better estimate.

And the Contrarian Investor's Journal argues why, even in deflationary times, gold may still be a good choice.

Tuesday, November 27, 2007

I beg to differ

I seem to recall it was some Supreme Court decision, where one judge said he dissented from the view of his colleagues "for the reasons which they have given". Elegant.

Tony Allison, in Financial Sense yesterday, gives the above graph and reads it as an indication that we could be heading for a gold price spike like that in 1980; whereas I look at the inflation-adjusted trend since 1914 and think that, unless my timing in and out of that market is superbly prescient, I'm better off doing what I do now, which is trying to pay down debts and save cash.

Yes, when I've done the latter, I might well make precious metals and commodities part of my portfolio.

"Legal tender for all debts, public and private"

Karl Denninger is emphatic that there's going to be a deflation, not inflation, and investing in metals won't save us.

Karl Denninger is emphatic that there's going to be a deflation, not inflation, and investing in metals won't save us.Part of his argument is that the money supply is determined not just by how much there is in the economy, but also by how fast it changes hands (its "velocity"). If the heartbeat of economic activity slows, the monetary pressure will reduce.

Denninger shares the growing concern that subprime losses could be of the order of $1 trillion, and believes

... we are literally weeks or a handful of months away from an utter implosion in the equity markets.

I believe we are very, very close to the precipice - and that nothing Bernanke or Paulson can do now will change the outcome. The opportunity to address this and stop it expired a few years ago, with the cumulative damage growing the longer regulators fail to act.

In which case, it's time to hold cash, which on American notes says is good "for all debts".

This reminds me of another quotation I can't source: "Would that I could be so certain of anything as he is of everything." I suspect he may be right on this one; then again, I would, since I've been feeling it in my bones for about a decade, before the official policy became to inflate our way out of all troubles.

Drinking in Last Chance Saloon

Michael Panzner alerts us to an article by Martin Hutchinson in Prudent Bear, which explains how the rotten apples in the banking barrel can affect the others. Here's a grim tidbit or two:

... If as now appears likely the eventual losses in the home mortgage market do not total only $100 billion, but a figure much closer to $1 trillion, then the subprime debacle becomes something much more than a localized meltdown...

Hutchinson suggests that in a bear market, "Level 3" assets may actually be worth as little as 10% of the banks' own declared estimates, and:

This immediately demonstrates the problem. Goldman Sachs, generally regarded as insulated from the subprime mortgage problem, has $72 billion of Level 3 assets; its capital is only $36 billion. If anything like 90% of the Level 3 assets’ value has to be written off, Goldman Sachs is insolvent. [...] Only the bonuses will survive, paid in cash and draining liquidity from the struggling company.

I observed a couple of weeks ago that "the Dow and the FTSE rise towards the end of the year, when traders' annual bonuses are calculated" and guessed that "the Dow will rise until bonus time". Watch for a rally of sorts and a final, determined suckout of bonuses, ahead of a forced, sober reassessment.

Monday, November 26, 2007

The top card's getting a mite dusty

Dimitri Speck (in Financial Sense) looks at the behaviour of gold when the stockmarket falls, and tends to the conclusion to which we've referred before: the gold price is rigged in order to allay fears when equities weaken. In short, it's a crooked card game.

That in itself is grounds for worry (nothing to hide, nothing to fear); and the desired result must be achieved by dumping bullion, which can't continue indefinitely. On this thesis, the crisis signal will be when gold stops dancing with the Dow.

That in itself is grounds for worry (nothing to hide, nothing to fear); and the desired result must be achieved by dumping bullion, which can't continue indefinitely. On this thesis, the crisis signal will be when gold stops dancing with the Dow.

Subscribe to:

Posts (Atom)