I have received another charity mailing, this time from the World Children's Fund. There's so many that I feel guilt at not being able to give to all. And aren't they well-presented these days?

But there's something about the name of this one - similar to other charities somehow. So I google it. Page after page on Google, each leading you directly to their site.

But now for blogpower! I look to see what my fellow bloggers say. Here's one, and it's most interesting. I say no more, since I have no money to fight in court.

I shall now add Elmer to my links, and the US charity evaluation site, Charity Navigator.

Another case where bloggers have proved to be useful, I would say.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, September 30, 2007

Saturday, September 29, 2007

How much money do we need?

The mortgage conundrum

Much of the nation's wealth seems to be tied up in our houses, which don't appear to be very productive from an economic standpoint. There is a kind of circular logic:

1. Houses cost a lot, so you have to borrow a great deal of money to buy a house.

2. Houses cost a lot, because you can borrow a great deal of money to buy a house.

Having regard for the wider consequences of your proposals, what is the optimum solution?

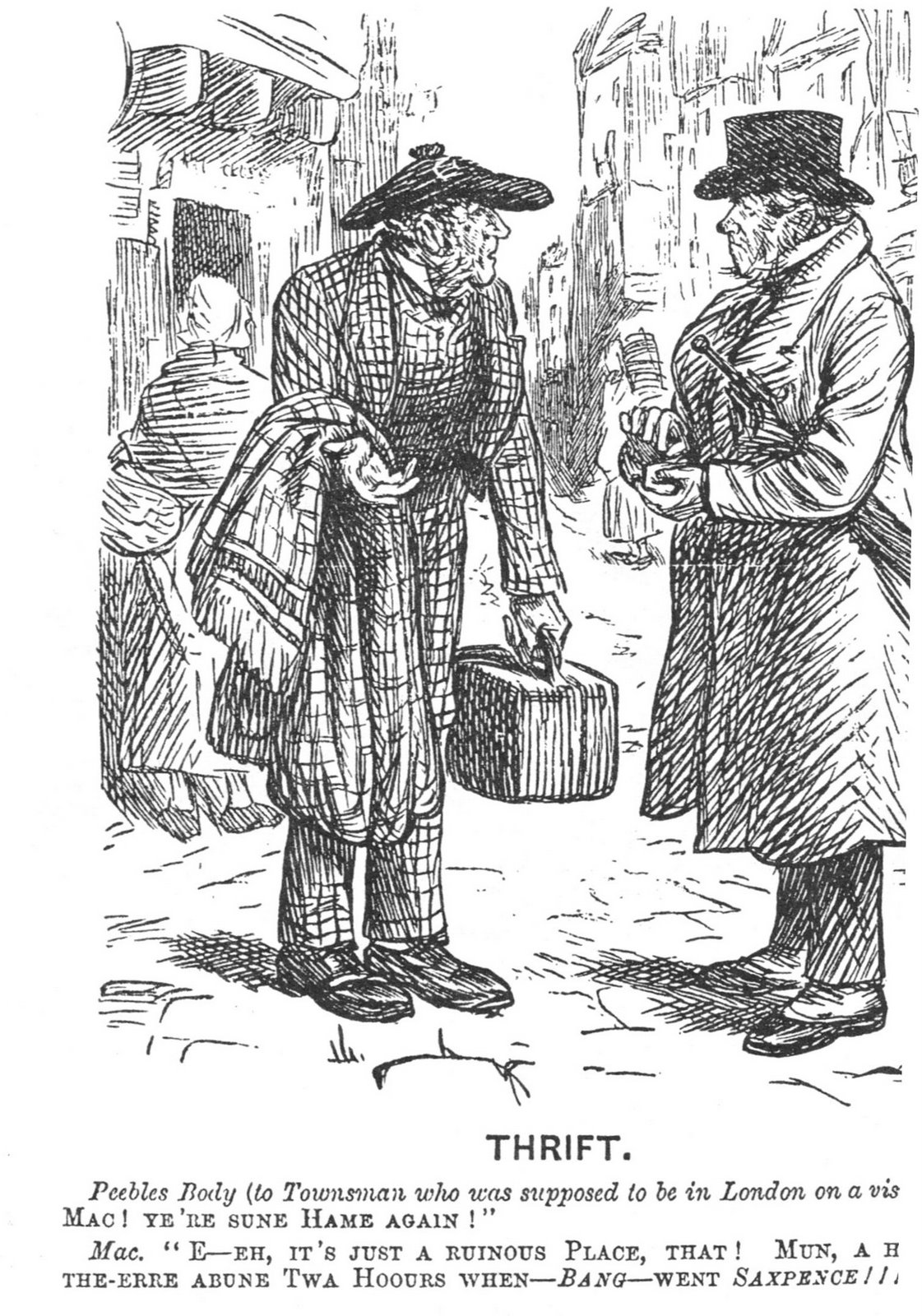

Thrift and Prudence: essay competition

Cartoon by Charles Keene (1823-1891) in "Punch" magazine

Cartoon by Charles Keene (1823-1891) in "Punch" magazineContrary to Mr Gordon Brown's claim to be prudent, many believe that the British Government (as well as that of the USA) wastes public money. One such critic is "Wat Tyler" in the British blog, Burning Our Money.

What if the people we criticise said, put up or shut up?

So, if you want better value for money in public finance, how would you get it? How would you achieve the same results for less money, or how would you improve quality without increasing expenditure?

If you wish to submit a longer piece, please submit your email in the comments - I shall then add you as an author to this blog pro tem (but will keep your email address off the blog unless you wish it to be published).

Dow 9,000 update

July 6 to present: Dow up from 13,611.69 to 13,895.63; gold up from $647.75/oz. to $743.10. So the "gold-priced Dow" is down 11.01% in 84 days.

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Annualised equivalent: gold increasing by c. 82% p.a., "gold-priced Dow" falling 40% over a year. Will these trends continue?

Thursday, September 27, 2007

Faber: bubble in commodities, but buy gold

Marc Faber in ABC News, Tuesday:

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Very simply, it will end in a catastrophe. We never had, in the history of capitalism, a global, synchronised, boom. If you travel around the world, everywhere you go, there are booming conditions.

Now if you look at the last 200 years of financial history, you had investment booms and mania in relatively small sectors in the economy: in the US in canals and railroad in the 19th century, some regional real estate markets. And then in the 1920s you had the stockmarket boom, and in the late 80s you have a silver, gold and energy share boom, and in the year 2000 we had a boom in tech stocks and in Japan in the 80s in Japanese shares. And each time these bubbles burst, they had an impact but the impact was largely sectorial or regional and not affecting the whole world.

Now, we have a bubble everywhere. We have a bubble in real estate prices, we have a bubble in stock, we have a bubble in art prices, we have a bubble in commodities.bigger the bubble, the bigger the bang will be. If someone argues we're in a global synchronised boom, I agree entirely. The consequence will be that the next boss will be a global synchronised boss.

By the way, I like that mistranscription, it conveys his Europeanness.

The southern Germans are comfortable with the themes of pain and loss, as you'll know if you've looked at the Meglinger painting on Dr Faber's GloomBoomDoom site. D.H. Lawrence wrote of the sensual agony in the little roadside shrines in interwar Bavaria. This is not simple morbidity - unlike modern crime/action films - but a sign that you can rise above suffering, instead of avoiding it.

A Viennese taxi driver explained to us the difference between Austrians and northern Germans: "They say, it's bad, but it's not hopeless; we say, it's hopeless, but it's not so bad."

Back to our muttons. Here he is again, quoted from various sources via Resourcexinvestor:

"Investors have to look for assets which cannot multiply as fast as the pace at which the Fed prints money."

... He advised buying gold to defend against monetary inflation... he recommends holding physical gold bullion investments in gold-friendly countries such as Hong Kong, India and Switzerland. He counsels against holding gold in the US for fear that it might be nationalized by the government.

Subscribe to:

Posts (Atom)