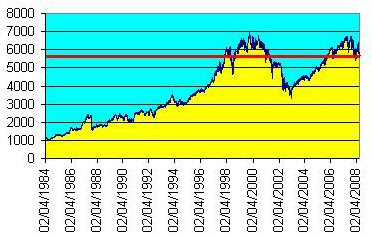

The FTSE is closing somewhere around 5,666.10 today. It closed at 5,709.50 on 17 February 1998, which was the first time the market had breached today's level.

The FTSE is closing somewhere around 5,666.10 today. It closed at 5,709.50 on 17 February 1998, which was the first time the market had breached today's level. So we've spent a little over 10 years to get nowhere in nominal terms, and meanwhile the value of money has dropped by approximately 25%.

Yes, shares pay dividends, but most people buy them as part of some collective arrangement that involves initial and recurring charges and/or fees. After charges (and taxes, remember), it would have taken a net dividend yield of about 3% per year simple, or 2.65% compound, merely to replace the value lost to inflation.

So quite possibly the putative investor in the FTSE has actually fallen behind where he was in 1998.

Are the pessimists lagging behind the news? Has the worst happened already?

The worst has not remotely happened. Utter hell is on its way for many people.

ReplyDeleteHi, DM. It does seem that in the past, market corrections overshoot. At the moment our problems are not market-based, but centred on the banks and lending, and I agree that there are more difficulties to come, which is why I put financial services on the back burner and resumed teaching at the end of 1999. The attempts by the government to paper over the cracks have allowed the situation to deteriorate since then. But the stockmarket bubble has deflated quite a bit, hasn't it?

ReplyDeleteInteresting insight. Thanks.

ReplyDelete