I'm stung into a rant by an article I've just read. A classic example of mainstream journalist wisdom here - and only one of very many similar now available, I'm sure.

I'm don't know what the economics editor of one of the UK's most successful papers earns, but I'd be happy for him to earn double if he could tell us all this "it was so obvious" stuff BEFORE the crisis.

Not that it couldn't have been foreseen. In the late 90s, I was so concerned at US debts and the massive zoom in tech stocks driving the FTSE and Dow into the stratosphere, and so apprehensive of what I thought would be the inevitable aftermath, that I warned clients not to get into the frenzy, reminded them they had an option to switch into cash, moved my wife's pension savings into cash, and (despite the awfulness of modern British schools) resumed teaching as well as holding onto the financial advice business.

Am I wise? No, I listened to what many others were saying, and wasn't blinded by greed. But I wouldn't have learned it from the papers.

And the smugness! "Above all, the current crisis will force us to relearn one of the oldest lessons of all, one from neither the Seventies nor the Thirties but the wisdom of the centuries: that what you owe, you must one day repay." The credit bubble was created by banks, permitted by regulators and governments, and exploited by financial engineers and intermediaries - yet it is the private debtor and the taxpayer that will pay. Don't hold your breath waiting to see unemployed bankers selling the Big Issue.

*** FUTURE POSTS WILL ALSO APPEAR AT 'NOW AND NEXT' : https://rolfnorfolk.substack.com

Sunday, March 16, 2008

Back to 2003

Karl Denninger thinks we're on course to lose all the gains of the last 5 years:

I am updating expectations for this Bear Market; I no longer believe 1070 on the SPX will hold, and have now moved to the camp that sees the potential for the S&P to retrace all of the 2003-2007 Bull Market's gains, taking us back to around 800 on the SPX.

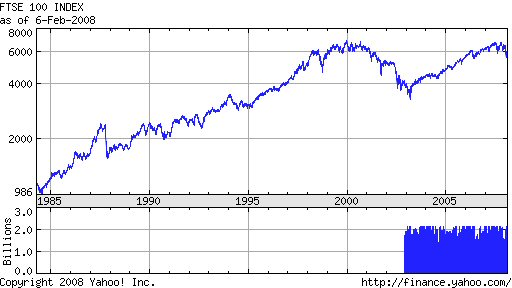

In the UK, the FTSE closed at 3,287.00 on 12 March 2003.

I am updating expectations for this Bear Market; I no longer believe 1070 on the SPX will hold, and have now moved to the camp that sees the potential for the S&P to retrace all of the 2003-2007 Bull Market's gains, taking us back to around 800 on the SPX.

In the UK, the FTSE closed at 3,287.00 on 12 March 2003.

Forgive us our debts, Part 2

A very stimulating response from "Caronte" to the earlier post on debt reduction, so I've taken the liberty to bring the argument out front here.

Caronte, you say:

Suppose it is believed with absolute certainty that every 50 years, say every year divisible by 50, all debts are forgiven. There would follow a bunching of loan demand as the forgiveness date nears, while willing lenders would simultaneously vanish. The market would no longer match credit demand and supply, total welfare would suffer. Debt forgiveness would only avoid this problem if it was done by stealth, unpredictably, once and for all and never again. Like forgiveness of tax evasion or illegal buildings. Difficult to persuade debtors, (or builders, or taxpayers), that forgiveness would not occur again. Lots of people would be encouraged to borrow beyond what they can afford (or evade tax) – the moral hazard implication. Unsustainable indebtedness would multiply rather than disappear. Moreover, a defaulting borrower does not need forgiveness if she genuinely cannot pay: can’t pay, won’t pay, period. If the defaulting borrower has some residual wealth, though less than the outstanding loan, who is to deprive the creditor of that? What legal or moral right would support state action without creditor compensation?

Caronte, you say:

Suppose it is believed with absolute certainty that every 50 years, say every year divisible by 50, all debts are forgiven. There would follow a bunching of loan demand as the forgiveness date nears, while willing lenders would simultaneously vanish. The market would no longer match credit demand and supply, total welfare would suffer. Debt forgiveness would only avoid this problem if it was done by stealth, unpredictably, once and for all and never again. Like forgiveness of tax evasion or illegal buildings. Difficult to persuade debtors, (or builders, or taxpayers), that forgiveness would not occur again. Lots of people would be encouraged to borrow beyond what they can afford (or evade tax) – the moral hazard implication. Unsustainable indebtedness would multiply rather than disappear. Moreover, a defaulting borrower does not need forgiveness if she genuinely cannot pay: can’t pay, won’t pay, period. If the defaulting borrower has some residual wealth, though less than the outstanding loan, who is to deprive the creditor of that? What legal or moral right would support state action without creditor compensation?

Would “debt cancellation (or rather, reduction) … be a suitable punishment for the principal offender”? True: “the relationship between mortgage lender and borrower is unequal. You have to live somewhere, and if you don't buy, you have to rent - and rents will tend to reflect the purchase price of houses.” No more than the relationship between employer and worker. There are various way to reduce this inequality, workers can form Trades Unions and cooperatives, and borrowers can found building societies – until New Labour wickedly de-mutualised i.e. privatised this form of social property which was not theirs to privatise. But the main reduction of the inequality comes from competition among lenders (and among employers).

“By adjusting the ratio of deposits to loans as it suits them, lenders can multiply the money supply”. True, there is a credit multiplier at work when banks re-lend their deposits and get some new deposits as a result. If they were prevented from re-lending – by law or by contract – they would act solely as custodians (as in the early days of gold-money) and would charge depositors for the service instead of paying interest. And any act of individual saving would instantly reduce total demand by the same amount and cause unemployment. Besides, the ratio of deposits to loans is regulated by law and is variable at will only when it is higher than a prudential limit. And banks face the consequences of their bad loans, they can go bankrupt and their shareholders can lose all their capital. That’s punishment enough. As long as they are competitive, there is not much of a reason to “punish” them by forcing them to remit those bad loans that still have a residual market value.

“Rather than prop up the worst of the lenders, let them go down. Why should the taxpayer assume the burden?” Absolutely right. “Pay off the depositors” – if the bank can, or if there is a state guarantee. But why “shrink the lending book” by debt remission? If mistakes are always to be automatically corrected ex-post when they are revealed as such, the market disappears and with it all the conceivable advantages that it brings.

An Australian economist whose name now escapes me once wrote an article mocking the theory of general economic equilibrium – with its complete system of futures markets – by imagining a system of “past” markets in which economic agents could undo their past transactions that with the benefit of hindsight turned out to be a mistake. Just imagine. Debt remission would have some of the same effects.

I say:

Caronte, welcome, and many thanks for the length and thoughtfulness of your response. I don't pretend to have your economic expertise, but I still think there's a debate to be had. I'll try to tackle some of your points, not necessarily in strict order.

I suppose that in ancient Israel, the economy was not so monetised as today, so the advent of the year of Jubilee may not have been so disruptive as it would today. I don't really advocate a periodic debt cancellation - though I'm beginning to wonder about the necessity of charging interest. (Isn't it the case that some Swiss banks do in fact charge you for looking after your money securely, instead of making investments with it or lending it out to others?)

Competition between lenders may help keep down interest rates, but it's the ballooning of asset prices - and the consequent increase in the size of mortgage required - that causes the damage. So many are now locked into monster mortgages that a significant rise in interest rates - which otherwise might be appropriate for tackling inflation - is politically very unfeasible.

I argue that the price of houses is pretty much beyond the buyer's control, except that there's a point where a purchase is either not affordable (we seem to have reached that stage) or, as with subprime, fudged at the outset with disastrous consequences later. So I suggest the expansion of credit (for which, as you say, regulators also share responsibility), and the terms set by fee-hungry lenders and intermediaries, are more to blame than the family that wants a roof over its head it can call its own. Finance for cars and consumer goods is something else; a house is a necessity, and surely, owning one is not an unreasonable aspiration.

Banks should be, but are not being made to face the consequences - look how governments are propping-up Northern Rock and Bear Stearns.

Debt reduction does not seem unreasonable to me. If a life insurance company fails, the book of life business can be passed on to another provider, who is only required to underwrite 90% of the outstanding life cover. So why not for lenders who (through greed and stupidity) have gotten their sums wrong? A 10% reduction in the capital only represents a couple of years' interest. Better a borrower who repays a reasonable proportion of the loan, plus interest, than simply mail back the keys and leave the bank with illiquid stock it doesn't know how to manage.

I say:

Caronte, welcome, and many thanks for the length and thoughtfulness of your response. I don't pretend to have your economic expertise, but I still think there's a debate to be had. I'll try to tackle some of your points, not necessarily in strict order.

I suppose that in ancient Israel, the economy was not so monetised as today, so the advent of the year of Jubilee may not have been so disruptive as it would today. I don't really advocate a periodic debt cancellation - though I'm beginning to wonder about the necessity of charging interest. (Isn't it the case that some Swiss banks do in fact charge you for looking after your money securely, instead of making investments with it or lending it out to others?)

Competition between lenders may help keep down interest rates, but it's the ballooning of asset prices - and the consequent increase in the size of mortgage required - that causes the damage. So many are now locked into monster mortgages that a significant rise in interest rates - which otherwise might be appropriate for tackling inflation - is politically very unfeasible.

I argue that the price of houses is pretty much beyond the buyer's control, except that there's a point where a purchase is either not affordable (we seem to have reached that stage) or, as with subprime, fudged at the outset with disastrous consequences later. So I suggest the expansion of credit (for which, as you say, regulators also share responsibility), and the terms set by fee-hungry lenders and intermediaries, are more to blame than the family that wants a roof over its head it can call its own. Finance for cars and consumer goods is something else; a house is a necessity, and surely, owning one is not an unreasonable aspiration.

Banks should be, but are not being made to face the consequences - look how governments are propping-up Northern Rock and Bear Stearns.

Debt reduction does not seem unreasonable to me. If a life insurance company fails, the book of life business can be passed on to another provider, who is only required to underwrite 90% of the outstanding life cover. So why not for lenders who (through greed and stupidity) have gotten their sums wrong? A 10% reduction in the capital only represents a couple of years' interest. Better a borrower who repays a reasonable proportion of the loan, plus interest, than simply mail back the keys and leave the bank with illiquid stock it doesn't know how to manage.

This is not a problem limited to a single bank -and anyway, there are far fewer these days, and they are much larger, so one failure could really rock the boat. At worst, we could now be facing the prospect of mass bankruptcy, the crash of the credit system and general economic carnage. It's worth coming up with some fudge to keep borrowers and lenders going.

Here in the UK, you can enter an agreement with creditors and as long as you keep up the scheduled payments, interest charging stops altogether. Maybe that would be another way forward - the monthly repayment would be lower and the borrower would see his equity in the house increase over time.

We've been watching enslavement by money-owners who have been licensed to print almost unlimited amounts of their own money, but the poor man only feels it going past and can save none, so remains in debt-bondage. Better any reasonable rearrangement, than "I owe my soul to the company store".

Here in the UK, you can enter an agreement with creditors and as long as you keep up the scheduled payments, interest charging stops altogether. Maybe that would be another way forward - the monthly repayment would be lower and the borrower would see his equity in the house increase over time.

We've been watching enslavement by money-owners who have been licensed to print almost unlimited amounts of their own money, but the poor man only feels it going past and can save none, so remains in debt-bondage. Better any reasonable rearrangement, than "I owe my soul to the company store".

Saturday, March 15, 2008

Market timing

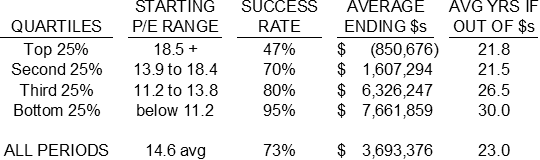

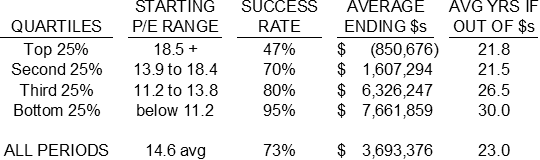

A very useful piece by John Mauldin considers long-term returns. He quotes findings by Ed Easterling at Crestmont Research, about what would have happened had you retired and invested $1 million to take $50,000 a year, rising annually with inflation. He looks at 78 different 30-year periods since 1900 and works out whether your money would last as long as you:

The forecast price-earnings ratios of the S&P 500 for 2008 range from 18.69 to 22.20. This does not bode well for long-term retirement investments made now. If the p/e ratio from the current c. 20 to 16, this would imply a share price decline of 20%, and even then you'd outlive your income in 30% of cases. A p/e of 12 requires shares to drop now by 40%, and that still means a one-in-five chance of running out of cash.

It looks as though, rather than fear a major crash, we should hope for one - as long as we're in cash or something else that's relatively safe and liquid.

The forecast price-earnings ratios of the S&P 500 for 2008 range from 18.69 to 22.20. This does not bode well for long-term retirement investments made now. If the p/e ratio from the current c. 20 to 16, this would imply a share price decline of 20%, and even then you'd outlive your income in 30% of cases. A p/e of 12 requires shares to drop now by 40%, and that still means a one-in-five chance of running out of cash.

It looks as though, rather than fear a major crash, we should hope for one - as long as we're in cash or something else that's relatively safe and liquid.

Forgive us our debts

In one version of the Lord's Prayer, the word "debts" replaces "trespasses", and this is in keeping with the etymology of "redemption". The ancient Jewish law forbade perpetual debt-slavery for fellow-believers, and even provided for ceremonial debt forgiveness every 50 years (which, I imagine, had a feedback effect on the terms and length of loan agreements).

"Hatfield Girl" gives a very vivid picture of our slow slide into dingy, shabby poverty, and it has to be every sane person's earnest wish that we (or our fellow citizens) don't return to the conditions so many suffered before the Second World War. Yet what is causing all this but the heavy chains of debt?

A disclaimer: I often feel that I not only know nothing, but never shall know anything, despite much effort. Then I see how the world is going, and wonder who knows better.

Having said that, I'm trying to work out why, as Karl Denninger says, we don't make the banks eat some of the debt they laid on us. In the comments to the Hatfield Girl piece linked above, "Caronte" refers to "moral hazard", a point I entirely accept. But I say that debt cancellation (or rather, reduction) would be a suitable punishment for the principal offender.

In our society, the relationship between mortgage lender and borrower is unequal. You have to live somewhere, and if you don't buy, you have to rent - and rents will tend to reflect the purchase price of houses.

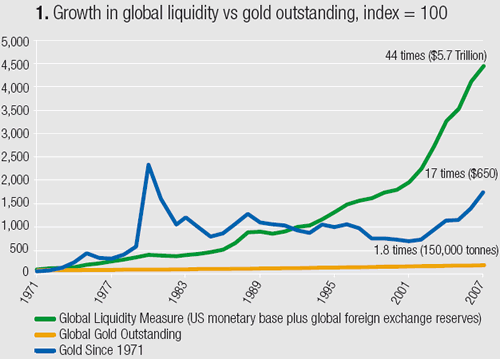

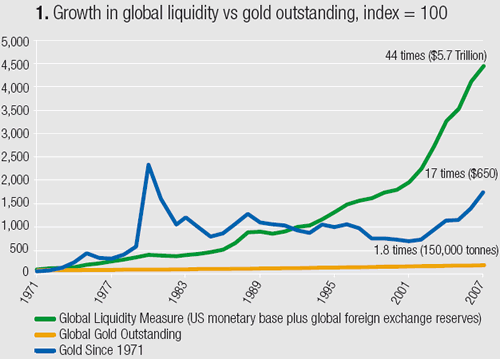

So what determines the price of houses? Supply and demand. And a major element of demand is how much money is available. By adjusting the ratio of deposits to loans as it suits them, lenders can multiply the money supply, as everyone knows (I say everyone, but actually I don't think the public is fully aware of the simplicity and enormity of this scam). Since 2000 or so, the money in the economy doubled, and so, un-oddly I think, did the price of houses.

The lender can decide how much to lend into the market generally, and consequently influence it; the buyer cannot decide, on an individual basis, to halve the value of the type of house he wants in the area where he needs to live.

So by what right should lenders inflate asset prices, fix on them loans of money they created virtually ex nihilo, then deflate asset prices by reducing lending in difficult times, and expect the borrower to bear the full weight of the consequences?

The borrower may have colluded with the lender to take on an unsustainable debt (or one that exposed the borrower to excessive deflation risk), but for reasons already given I suggest it was a shotgun marriage (or a mass marriage, like those Moonie wedding rallies) with the lender handling the Purdey. For subprime borrowers, I think it's fair to argue that the class of people involved means that the lenders had far better knowledge of the implications, and so are far more culpable.

Rather than prop up the worst of the lenders, let them go down. Why should the taxpayer assume the burden? Pay off the depositors, but shrink the lending book - which is mostly funny money, less substantial in its origins than candy floss - a drop of ink on 80-gram paper.

To quote the inscription on the statue of Justice above the Central Criminal Court, "Defend the children of the poor and punish the wrongdoer." The trespasses of the mighty are less to be forgiven.

"Hatfield Girl" gives a very vivid picture of our slow slide into dingy, shabby poverty, and it has to be every sane person's earnest wish that we (or our fellow citizens) don't return to the conditions so many suffered before the Second World War. Yet what is causing all this but the heavy chains of debt?

A disclaimer: I often feel that I not only know nothing, but never shall know anything, despite much effort. Then I see how the world is going, and wonder who knows better.

Having said that, I'm trying to work out why, as Karl Denninger says, we don't make the banks eat some of the debt they laid on us. In the comments to the Hatfield Girl piece linked above, "Caronte" refers to "moral hazard", a point I entirely accept. But I say that debt cancellation (or rather, reduction) would be a suitable punishment for the principal offender.

In our society, the relationship between mortgage lender and borrower is unequal. You have to live somewhere, and if you don't buy, you have to rent - and rents will tend to reflect the purchase price of houses.

So what determines the price of houses? Supply and demand. And a major element of demand is how much money is available. By adjusting the ratio of deposits to loans as it suits them, lenders can multiply the money supply, as everyone knows (I say everyone, but actually I don't think the public is fully aware of the simplicity and enormity of this scam). Since 2000 or so, the money in the economy doubled, and so, un-oddly I think, did the price of houses.

The lender can decide how much to lend into the market generally, and consequently influence it; the buyer cannot decide, on an individual basis, to halve the value of the type of house he wants in the area where he needs to live.

So by what right should lenders inflate asset prices, fix on them loans of money they created virtually ex nihilo, then deflate asset prices by reducing lending in difficult times, and expect the borrower to bear the full weight of the consequences?

The borrower may have colluded with the lender to take on an unsustainable debt (or one that exposed the borrower to excessive deflation risk), but for reasons already given I suggest it was a shotgun marriage (or a mass marriage, like those Moonie wedding rallies) with the lender handling the Purdey. For subprime borrowers, I think it's fair to argue that the class of people involved means that the lenders had far better knowledge of the implications, and so are far more culpable.

Rather than prop up the worst of the lenders, let them go down. Why should the taxpayer assume the burden? Pay off the depositors, but shrink the lending book - which is mostly funny money, less substantial in its origins than candy floss - a drop of ink on 80-gram paper.

To quote the inscription on the statue of Justice above the Central Criminal Court, "Defend the children of the poor and punish the wrongdoer." The trespasses of the mighty are less to be forgiven.

The silent watchdog

Yet another important post from that heroic toiler (an oxymoron for classical Greeks), "Tyler". He looks at the economic implications of our ageing population and demonstrates that public expenditure cannot continue as projected.

The long-serving Comptroller Generals, both in the USA and here the UK, have recently retired. The difference between them is that the American, David Walker, has spent two years on an increasingly well-publicised Cassandra mission to warn the public of future dire financial dislocation, because of unfunded liabilities such as medical care and pensions. I may be doing a disservice to Sir John Bourn, but I can't remember any media fuss about him going on such a tour here.

Looking at the website for the National Audit Office, I see that in the FAQs, the spelling of "comptroller" comes second, after a dry summary of the NAO's role. However, the "find" option on my Windows toolbar can find no occurrence of the following words in that web page:

disaster

bankruptcy

poverty

IMF

inflation

Some barking from its kennel would now be most welcome.

The long-serving Comptroller Generals, both in the USA and here the UK, have recently retired. The difference between them is that the American, David Walker, has spent two years on an increasingly well-publicised Cassandra mission to warn the public of future dire financial dislocation, because of unfunded liabilities such as medical care and pensions. I may be doing a disservice to Sir John Bourn, but I can't remember any media fuss about him going on such a tour here.

Looking at the website for the National Audit Office, I see that in the FAQs, the spelling of "comptroller" comes second, after a dry summary of the NAO's role. However, the "find" option on my Windows toolbar can find no occurrence of the following words in that web page:

disaster

bankruptcy

poverty

IMF

inflation

Some barking from its kennel would now be most welcome.

Thursday, March 13, 2008

In the know

Marty Chenard states something I've suspected, which is that a bear market is when the experts sell to the amateurs. This article seems to confirm that we are indeed in a bear market; on the other hand, Clif Droke thinks "an interim bottoming process is well under way". I like that "interim" - there's a hedge, if you like.

Housing stall, after all?

Looking at the economy now, we have to go well beyond subprime, and consider the general value of housing. Karl Denninger repeats that, in the long term, average house prices are three times income, but at the same time observes that they are "sticky". No-one wants to crystallise a loss, and you have to live somewhere, so why sell now?

If the financial victim next door has to sell his house at a 50% discount, that's all the more reason for you not to sell yours. If no-one sells voluntarily, how do you determine a real, as opposed to forced-sale value? So one effect of the housing drop could be a general slump in sales - with maybe a rise in home swaps for those who need to go to a different geographical area, perhaps for job reasons.

But what about people caught in negative equity? Here in the UK, ditching the house for less than the outstanding loan could leave you being chased for the balance, for years, unless you opt for bankruptcy. However, in the USA, many mortgages are on the roof but not on the borrower, leaving the lender short if the homeowner mails the keys back. Denninger has said more than once that borrowers need to consider this option solely on its financial/legal merits, as he thinks many lenders lost the moral argument when they knowingly advanced far too much to people who they knew couldn't maintain the loans. Now this could really upset the applecart.

Michael Panzner features a piece by FT columnist Martin Wolf. Wolf wonders what may happen if a high proportion of negative-equity homeowners default. The economic impact may be closer to Nouriel Roubini's $3 trillion, than to Goldman Sachs' more sanguine $1 trillion (the latter itself is a massive increase on the sort of figures bandied about before Christmas). Wolf sees two options:

There are two ways of adjusting the prices of housing to incomes: allow nominal prices to fall or raise nominal incomes. The former means mass bankruptcy and a huge fiscal bail out; the latter imposes the inflation tax.

But either option is so unattractive that (despite Denninger's image of paddling furiously as we head for the waterfall) there is a very strong incentive for fudge and delay. We've seen central banks pump many billions into the system in the last few days; and the ratings agencies seem to be trying their best to help maintain the status quo by not downgrading lenders as quickly and severely as some think they deserve. But again, housing is intrinsically illiquid, and houses aren't turned over rapidly like shares, which is why we have "mark to model" instead of "mark to market". What's the rush to crystallise a terrible loss now? Better a Micawberish hope that "something will turn up" than a grim Protestant insistence on an immediate collapse which would benefit very few people.

The real threat is this "jingle mail", and the potential consequences seem so dire that something creative may be done. Bankruptcy rules might be modified to protect lenders; maybe portions of recent loans may be written-off. How about part-ownership, part-rent, as with UK housing associations - having escaped the trailer park, many first-time homeowners may want to keep their foot on that first rung of the ladder. Not everyone will want to pour engine oil into the carpet and trash the light fittings.

So I think we will have fudge, delay and attempts at more creative solutions, and a long stall in the housing market. Unless there's another hammer blow that the system simply can't take, such as an explosion in the financial derivatives market, as arch-doomster Marc Faber expects and (in his inherited Swiss Protestant way) hopes. In that case, every sign we've seen so far is that our governments will run the money-presses white-hot rather than face major deflation. We all have an incentive to paddle away from the brink.

If the financial victim next door has to sell his house at a 50% discount, that's all the more reason for you not to sell yours. If no-one sells voluntarily, how do you determine a real, as opposed to forced-sale value? So one effect of the housing drop could be a general slump in sales - with maybe a rise in home swaps for those who need to go to a different geographical area, perhaps for job reasons.

But what about people caught in negative equity? Here in the UK, ditching the house for less than the outstanding loan could leave you being chased for the balance, for years, unless you opt for bankruptcy. However, in the USA, many mortgages are on the roof but not on the borrower, leaving the lender short if the homeowner mails the keys back. Denninger has said more than once that borrowers need to consider this option solely on its financial/legal merits, as he thinks many lenders lost the moral argument when they knowingly advanced far too much to people who they knew couldn't maintain the loans. Now this could really upset the applecart.

Michael Panzner features a piece by FT columnist Martin Wolf. Wolf wonders what may happen if a high proportion of negative-equity homeowners default. The economic impact may be closer to Nouriel Roubini's $3 trillion, than to Goldman Sachs' more sanguine $1 trillion (the latter itself is a massive increase on the sort of figures bandied about before Christmas). Wolf sees two options:

There are two ways of adjusting the prices of housing to incomes: allow nominal prices to fall or raise nominal incomes. The former means mass bankruptcy and a huge fiscal bail out; the latter imposes the inflation tax.

But either option is so unattractive that (despite Denninger's image of paddling furiously as we head for the waterfall) there is a very strong incentive for fudge and delay. We've seen central banks pump many billions into the system in the last few days; and the ratings agencies seem to be trying their best to help maintain the status quo by not downgrading lenders as quickly and severely as some think they deserve. But again, housing is intrinsically illiquid, and houses aren't turned over rapidly like shares, which is why we have "mark to model" instead of "mark to market". What's the rush to crystallise a terrible loss now? Better a Micawberish hope that "something will turn up" than a grim Protestant insistence on an immediate collapse which would benefit very few people.

Assuming wages continue to rise over time, the gap between prices and incomes will lessen. If the homeowners can somehow be reassured that the government is determined to support house prices, then the sell-to-rent speculators could be caught out in their attempt to "short" the housing market. Can they be sure that, having sold their nice house, they can buy another such in the right area for much less, later? What will they do meanwhile?

The real threat is this "jingle mail", and the potential consequences seem so dire that something creative may be done. Bankruptcy rules might be modified to protect lenders; maybe portions of recent loans may be written-off. How about part-ownership, part-rent, as with UK housing associations - having escaped the trailer park, many first-time homeowners may want to keep their foot on that first rung of the ladder. Not everyone will want to pour engine oil into the carpet and trash the light fittings.

So I think we will have fudge, delay and attempts at more creative solutions, and a long stall in the housing market. Unless there's another hammer blow that the system simply can't take, such as an explosion in the financial derivatives market, as arch-doomster Marc Faber expects and (in his inherited Swiss Protestant way) hopes. In that case, every sign we've seen so far is that our governments will run the money-presses white-hot rather than face major deflation. We all have an incentive to paddle away from the brink.

Wednesday, March 12, 2008

Put your hand in a parting wave

Frank Barbera discusses the implications of Elliott Wave Theory for the current stock market and concludes, like Karl Denninger, that there's at least as much bad news ahead as we've had already.

Unbelievable, unimaginable

The problem with looming economic disaster is that you look out the window and since what you see is normal, you wonder what that mad Cassandra is wailing about.

Michael Panzner reproduces an article by Paul Farrell in MarketWatch about the absolutely enormous international derivative market, currently estimated at $516 trillion. Those numbers are beyond imagining, but if 2% goes bad, that's equivalent to 20% of the world's annual GDP up the chimney.

Michael Panzner reproduces an article by Paul Farrell in MarketWatch about the absolutely enormous international derivative market, currently estimated at $516 trillion. Those numbers are beyond imagining, but if 2% goes bad, that's equivalent to 20% of the world's annual GDP up the chimney.

Tuesday, March 11, 2008

Lessons from Japan

Krassimir Petrov looks at the Japanese experience of deflation - 17 years and counting. A monetarist view would require the following steps to end it:

• Condition 1. Bad loans made during the boom years must be written off as losses during the bust. This cleanses the banking system from the toxins of the boom.

• Condition 2. Weak businesses should be liquidated during the bust, rather than propped up by the government or the banks. These bankruptcies and liquidations shift scarce resources to more productive uses

• Condition 3. Finally, Interest rates must rise sufficiently to restore proper valuations in the capital markets, and therefore allow stocks and bonds to fall in value relative to consumer goods. This realigns properly the price ratio of capital goods to consumer goods.

Now, I suppose, it's our turn.

Money has poured out of Japan over the years, looking for better yields elsewhere, but Petrov is not at all sure that when the "carry trade" reverses, the Japanese market will rise. He thinks a more interesting bet is on the rise of the Yen in the foreign exchange market. And that's a poker game I don't have the confidence to join.

• Condition 1. Bad loans made during the boom years must be written off as losses during the bust. This cleanses the banking system from the toxins of the boom.

• Condition 2. Weak businesses should be liquidated during the bust, rather than propped up by the government or the banks. These bankruptcies and liquidations shift scarce resources to more productive uses

• Condition 3. Finally, Interest rates must rise sufficiently to restore proper valuations in the capital markets, and therefore allow stocks and bonds to fall in value relative to consumer goods. This realigns properly the price ratio of capital goods to consumer goods.

Now, I suppose, it's our turn.

Money has poured out of Japan over the years, looking for better yields elsewhere, but Petrov is not at all sure that when the "carry trade" reverses, the Japanese market will rise. He thinks a more interesting bet is on the rise of the Yen in the foreign exchange market. And that's a poker game I don't have the confidence to join.

Pure gold

Karl Denninger offers a couple of very valuable insights today:

1. He thinks that we're only part way through the stock market decline:

Have you ever noticed that the "crooners" on Television never tell you to get out at or near the top, and call it a "buying opportunity" all the way down? Well gee, the last time they did this it only took 7 years before you were back to "even", and of course that's before price inflation ate up all your money.

I think he's right - mostly, the financial sections in the papers seem to me hardly better than celeb gossip.

2. Following on from this, he offers a technical tip on spotting turning points between bull and bear markets

... you buy the SPY (or a S&P 500 mutual fund such as VFINX) when the 20 week moving average crosses the 50 week moving average by more than 1%, and you go to cash (or treasuries) when the 20 week moving average crosses the 50 week moving average in the downward direct by more than 1%.

Being in the right asset class at the right time, as judged by this measure, beats those who stay in the market all the time. Denninger does warn that although it's been true for the last 20 years, it may not hold true forever.

1. He thinks that we're only part way through the stock market decline:

Have you ever noticed that the "crooners" on Television never tell you to get out at or near the top, and call it a "buying opportunity" all the way down? Well gee, the last time they did this it only took 7 years before you were back to "even", and of course that's before price inflation ate up all your money.

I think he's right - mostly, the financial sections in the papers seem to me hardly better than celeb gossip.

2. Following on from this, he offers a technical tip on spotting turning points between bull and bear markets

... you buy the SPY (or a S&P 500 mutual fund such as VFINX) when the 20 week moving average crosses the 50 week moving average by more than 1%, and you go to cash (or treasuries) when the 20 week moving average crosses the 50 week moving average in the downward direct by more than 1%.

Being in the right asset class at the right time, as judged by this measure, beats those who stay in the market all the time. Denninger does warn that although it's been true for the last 20 years, it may not hold true forever.

Why safe investments aren't

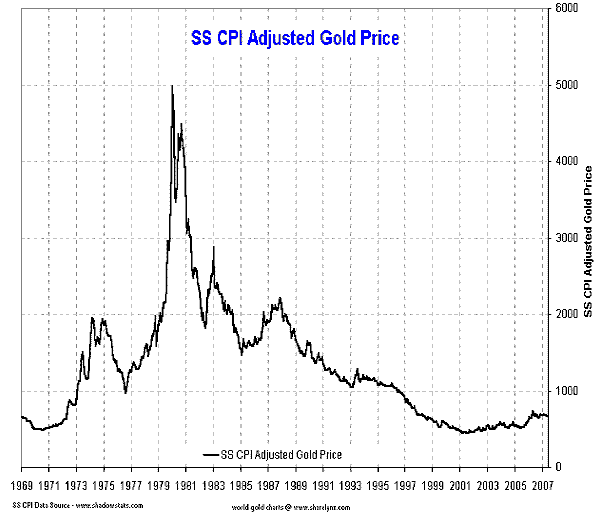

Michael Panzner's latest explains a point I've learned and repeated here before: "refuge" investments like gold are not as safe and predictable as you might assume. Borrowing money to invest boosts prices, and then when credit becomes tight, forced sales can deflate prices just as rapidly. We're all in a bouncy castle, like it or not.

Monday, March 10, 2008

Property slump or stall?

Karl Denninger says house prices over the last 100 years have averaged three times income. What's the implication for us?

This BBC survey says the average semi (a standard unit of housing, one would think) is "worth" slightly over £200,000; official statistics put household income at £33,492. So houses cost around six times earnings.

That suggests a 50% drop is due. But as Keynes observed with wages, house prices tend to be "sticky downward": no-one is in a hurry to realize a big loss on their home equity. Death, divorce and redundancy may force some sales; others may choose to wait, or go for house swaps.

Or wages could double. Up till recently, it was a standard assumption that "inflation" would run at 2.5% p.a. and wage increases 2% above that. Using the "Rule of 72", it would take 16 years of 4.5% wage increases to double nominal incomes.

Whether wages will always rise in real terms, is another matter. One of the effects of globalization is to hold down wages in the developed countries; and food and energy costs look as though they will continue to rise as the rest of the world gets richer and more populous.

This BBC survey says the average semi (a standard unit of housing, one would think) is "worth" slightly over £200,000; official statistics put household income at £33,492. So houses cost around six times earnings.

That suggests a 50% drop is due. But as Keynes observed with wages, house prices tend to be "sticky downward": no-one is in a hurry to realize a big loss on their home equity. Death, divorce and redundancy may force some sales; others may choose to wait, or go for house swaps.

Or wages could double. Up till recently, it was a standard assumption that "inflation" would run at 2.5% p.a. and wage increases 2% above that. Using the "Rule of 72", it would take 16 years of 4.5% wage increases to double nominal incomes.

Whether wages will always rise in real terms, is another matter. One of the effects of globalization is to hold down wages in the developed countries; and food and energy costs look as though they will continue to rise as the rest of the world gets richer and more populous.

Marc Faber speaks on the crisis

Video here on Bloomberg. Summary and comment on Contrarian Investor. Some points he makes:

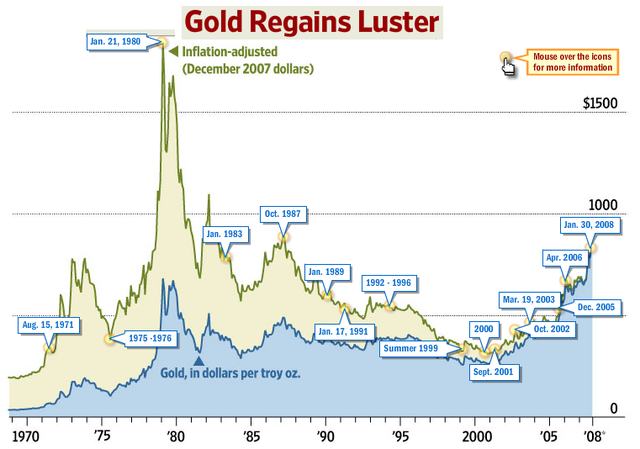

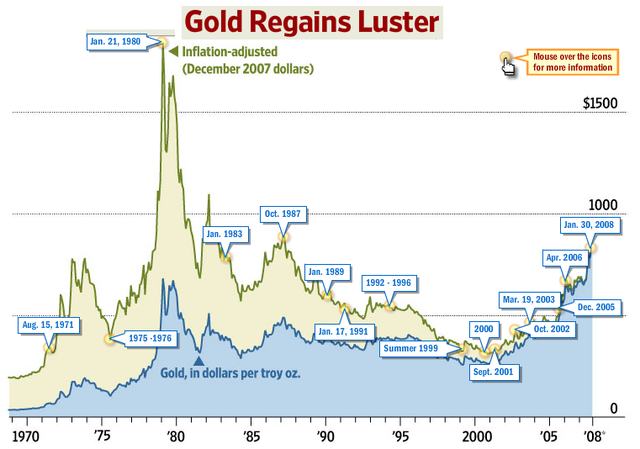

Bernanke's policies will destroy the dollar; he should have gone to Zimbabwe. Property assets in a bubble, but bonds (except maybe for some carefully-researched junk bonds!) also likely to be a victim of inflation. Emerging markets worse than the Dow. Deflation may hit the dollar through devaluation, rather than the nominal value of US equities. Commodities (e.g. gold) were at an inflation-adjusted 200-year low in the late 90s, so even after the recent rises they're not overvalued. Derivatives (NOT the packaged ones) will blow up in the next 3 - 6 months. He hope a major bank will fail and reintroduce discipline into the system.

Have you noticed how cheerful gloomy types get when disaster hits?

Bernanke's policies will destroy the dollar; he should have gone to Zimbabwe. Property assets in a bubble, but bonds (except maybe for some carefully-researched junk bonds!) also likely to be a victim of inflation. Emerging markets worse than the Dow. Deflation may hit the dollar through devaluation, rather than the nominal value of US equities. Commodities (e.g. gold) were at an inflation-adjusted 200-year low in the late 90s, so even after the recent rises they're not overvalued. Derivatives (NOT the packaged ones) will blow up in the next 3 - 6 months. He hope a major bank will fail and reintroduce discipline into the system.

Have you noticed how cheerful gloomy types get when disaster hits?

Sunday, March 09, 2008

Another toiler in the vineyard

Safe Haven features an article by "Randy", who predicts that the American economy will go haywire. The good news is that, within a generation, poverty will make the US economically competitive again.

That's not an ironic comment. It seems to me that America's most precious heritage is not her wealth, but her love of liberty and her distrust of power. She has been seduced by Mammon and Empire, and the undoubted difficulties we face may turn out to be the last-minute rescue, the ram caught in the thicket.

That's not an ironic comment. It seems to me that America's most precious heritage is not her wealth, but her love of liberty and her distrust of power. She has been seduced by Mammon and Empire, and the undoubted difficulties we face may turn out to be the last-minute rescue, the ram caught in the thicket.

Deus ex machina

You know you're in trouble when you have to appeal to the Great Leader to do something. Karl Denninger publishes an open letter to the President, the Presidential candidates and others.

- He complains that 23A exemption letters and the recent TAF facility are being used to hide the scale of banking problems from the public.

- He points out that over the last 100 years, local house prices trend to 3 times median local income (work that out for your own house).

- He lists action points to make the system transparent and honest - even though some lenders will be immediately destroyed, like the little slips of flash-burn paper used by spies in Sixties movies.

- Imagine the conversation between interns on receipt of Denninger's fax;

- List the not-to-be-published reasons why nobody who could solve the problem, will;

- Compose the official reply.

Saturday, March 08, 2008

Another Ranter

Alex Wallenwein goes schlock Gothick:

Employment figures, the Thornburg collapse, Carlysle Group troubles, sky-high oil prices, rampant inflation, the dollar-crash, and neverending Fed bailouts of fast failing super banks are pounding the stake deeper and deeper into the global debt-vampire's heart. He will find his much-deserved rest before long. Unfortunately, the portfolios of careless and gullible retail investors, consisting largely of Dracula's debt-spawn, will die along with their master.

I'd give him a "Highly Commended" in the Sackerson's Prose Prize competition for that first, rolling sentence. But he gets pretty apocalyptic, too:

The next Dow-bottom will plumb depths not seen since the early 1990's, maybe even the 1980's!

The early 90s saw the Dow around the 3,000 - 5,000 range. Eat that, Robert McHugh.

Then he shoots for the moon:

... gold can easily go past $3,000 per ounce this year

- and makes a reckless recommendation:

If anyone still has money in any stocks or mutual funds, it's time to exit.

Overstated, I think - but completely wrong? Maybe not.

Employment figures, the Thornburg collapse, Carlysle Group troubles, sky-high oil prices, rampant inflation, the dollar-crash, and neverending Fed bailouts of fast failing super banks are pounding the stake deeper and deeper into the global debt-vampire's heart. He will find his much-deserved rest before long. Unfortunately, the portfolios of careless and gullible retail investors, consisting largely of Dracula's debt-spawn, will die along with their master.

I'd give him a "Highly Commended" in the Sackerson's Prose Prize competition for that first, rolling sentence. But he gets pretty apocalyptic, too:

The next Dow-bottom will plumb depths not seen since the early 1990's, maybe even the 1980's!

The early 90s saw the Dow around the 3,000 - 5,000 range. Eat that, Robert McHugh.

Then he shoots for the moon:

... gold can easily go past $3,000 per ounce this year

- and makes a reckless recommendation:

If anyone still has money in any stocks or mutual funds, it's time to exit.

Overstated, I think - but completely wrong? Maybe not.

Another 42 stars?

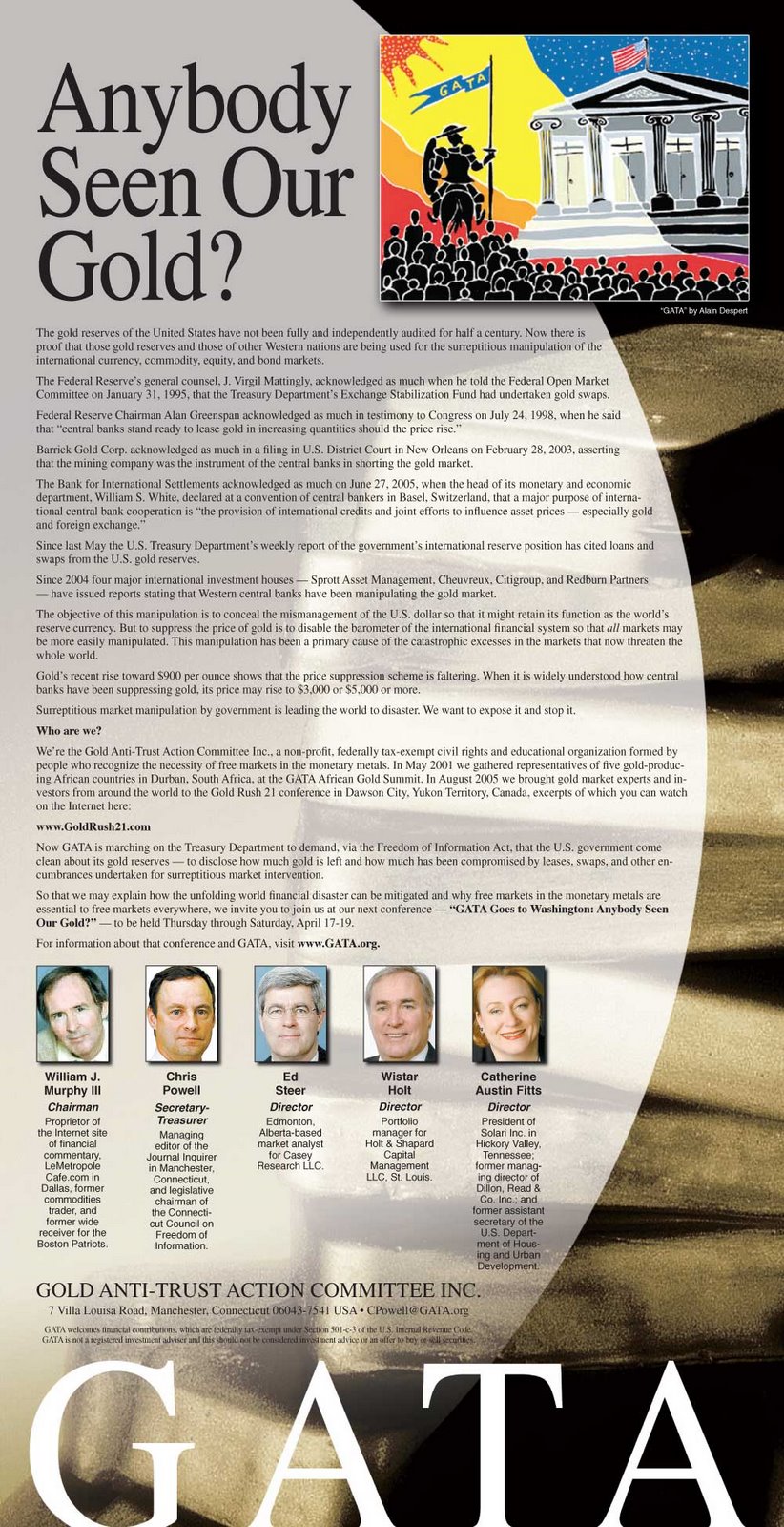

"Deepcaster" continues to hint at the operations of "The Cartel". His theory is outlined in this post of August 11, 2006. In a nutshell, there's a plot (a) to dissolve the US and make a new entity by combining it with Canada and Mexico, and (b) ruin the dollar in order to replace it with the "Amero", presumably to recommence the thieving by inflation. So it's like what some think the EU project is about.

Except I don't think the EU or its North American equivalent are driven by sinister motives; just venal ones. Concentrating wealth and power makes very juicy opportunities, provided you can simplify the command structure. All that consulting the common people and getting their agreement is so tedious.

Democracy is inconvenient, by design. I think the thirteen stripes on "Old Glory" remain there, not just as a historical quirk, but to remind the Federal Government that it's very important to say "please" and "thank you". Even in the first go at making the nation, Maryland, Delaware and New Jersey chose to delay the ratification of the Articles of Confederation, until certain issues had been resolved to their satisfaction.

Here's to the awkward squad.

Except I don't think the EU or its North American equivalent are driven by sinister motives; just venal ones. Concentrating wealth and power makes very juicy opportunities, provided you can simplify the command structure. All that consulting the common people and getting their agreement is so tedious.

America grows. She acquired 29 states in the nineteenth century and five in the twentieth. Where next? Canada has 10 provinces and 3 territories; Mexico has 31 states and one federal district; Greenland is owned by Denmark but has been granted home rule. But Canadians, Mexicans and Greenlanders may have their own views about assimilation.

Democracy is inconvenient, by design. I think the thirteen stripes on "Old Glory" remain there, not just as a historical quirk, but to remind the Federal Government that it's very important to say "please" and "thank you". Even in the first go at making the nation, Maryland, Delaware and New Jersey chose to delay the ratification of the Articles of Confederation, until certain issues had been resolved to their satisfaction.

Here's to the awkward squad.

Survivalism

Michael Panzner finds another useful article, this time by Laura Coffey on making contingency plans for losing your job.

I sent a circular to my clients in the late 90s, urging them to take out redundancy insurance, because I thought the coming stockmarket crash would be followed by recession; but of course I didn't anticipate that the government would use monetary inflation to defer the reckoning (and, I now fear, make it worse). Articles like Coffey's are straws in the wind, I think.

I sent a circular to my clients in the late 90s, urging them to take out redundancy insurance, because I thought the coming stockmarket crash would be followed by recession; but of course I didn't anticipate that the government would use monetary inflation to defer the reckoning (and, I now fear, make it worse). Articles like Coffey's are straws in the wind, I think.

Diversity, dispersion and disconnection

Karl Denninger continues his heroic (it's always lonely out in front) campaign to call the banks and the regulators to their reckoning. As he points out, we're all tied together, and instead of making it better, that makes it worse, as non-Americans will find out:

The dollar will bounce around before starting to take off. So far, we've not seen people figure out the "rest of world will be f***ed", but if you think the exchange rate problems won't lead to that, you're sadly mistaken. Beware.

The dollar will bounce around before starting to take off. So far, we've not seen people figure out the "rest of world will be f***ed", but if you think the exchange rate problems won't lead to that, you're sadly mistaken. Beware.

The bigger they are, the harder they fall

Michael Panzner refers us to a Financial Times article on the (overdue) dwindling confidence among our youngster trading community. The piece includes this paragraph:

Unlike past housing crises, the banking sector is far less well equipped to cope with the fallout because of the wave of banking consolidation in the last decade. [...] This means the pain has become concentrated among a small handful of institutions, all of whom play a crucial role in keeping all markets liquid.

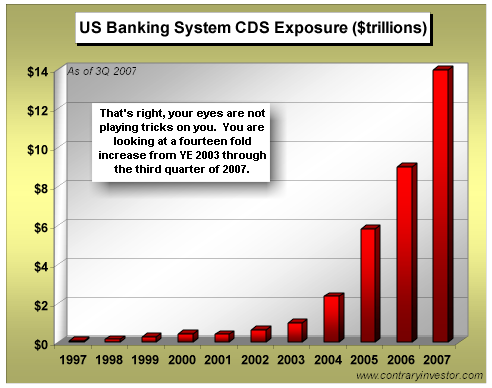

I recently quoted this Contrary Investor article, which includes a graph of the ballooning exposure of American banks to credit default swaps (CDS), under which arrangement everybody insures everybody else. The risk is 99%+ concentrated into only SIX banks.

Who benefits from such concentrations? I commented on Panzner's site:

Concentration of finance into an ever-smaller number of giant banks is inherently dangerous. You reduce the risks of small hazards, but you increase the potential damage from a Black Swan / fat tail event. Systemic safety is in diversity, dispersion and disconnection.

There is increasingly a conflict of interest between those who benefit from concentrations of power and wealth (think of the bonuses and cushy jobs), and the general populace. Wasn't the US Constitution itself specifically designed to prevent such concentrations?

In my view, the sub-prime contagion is not only spreading to other sectors of the economy, but beginning to call into question how big government, high finance and monstrous companies impact on the fundamental values of our (systematic and real in the USA, ramshackle and sham here in the UK) democracies.

It seems to me that small-scale democracy-cum-economy is not only an historical reaction to the centralist authoritarianism of George III (who meant well, I am sure), but a kind of imitation of Nature, which has endured the most massive disruptions (a planet encased in ice, or burning from a massive meteor strike) because of my alliterative trio of survival traits: diversity, dispersion and disconnection.

Unlike past housing crises, the banking sector is far less well equipped to cope with the fallout because of the wave of banking consolidation in the last decade. [...] This means the pain has become concentrated among a small handful of institutions, all of whom play a crucial role in keeping all markets liquid.

I recently quoted this Contrary Investor article, which includes a graph of the ballooning exposure of American banks to credit default swaps (CDS), under which arrangement everybody insures everybody else. The risk is 99%+ concentrated into only SIX banks.

Who benefits from such concentrations? I commented on Panzner's site:

Concentration of finance into an ever-smaller number of giant banks is inherently dangerous. You reduce the risks of small hazards, but you increase the potential damage from a Black Swan / fat tail event. Systemic safety is in diversity, dispersion and disconnection.

There is increasingly a conflict of interest between those who benefit from concentrations of power and wealth (think of the bonuses and cushy jobs), and the general populace. Wasn't the US Constitution itself specifically designed to prevent such concentrations?

In my view, the sub-prime contagion is not only spreading to other sectors of the economy, but beginning to call into question how big government, high finance and monstrous companies impact on the fundamental values of our (systematic and real in the USA, ramshackle and sham here in the UK) democracies.

It seems to me that small-scale democracy-cum-economy is not only an historical reaction to the centralist authoritarianism of George III (who meant well, I am sure), but a kind of imitation of Nature, which has endured the most massive disruptions (a planet encased in ice, or burning from a massive meteor strike) because of my alliterative trio of survival traits: diversity, dispersion and disconnection.

Friday, March 07, 2008

Ten years after the stock market bounce

The FTSE is currently at 5,664.60. It stood at 5,782.90 at the end of trading on 6 March 1998. Has your wealth kept pace with inflation?

There's lots of ways to figure inflation. Monetary inflation is like pumping up an air bed (or a Space Hopper): if you squmph one end down, another part will swell, and that makes it hard to estimate the effect in any particular sector. So let's go back to the major source of inflation, and assume M4 (bank lending) has increased by an average 10% p.a. - I don't think that's far off.

According to this article (which also predicts even lower returns in future years) the total return on equities over the last 100 years has averaged 10.1%. That'd be nice. Now let's assume dividends averaged 3% - and let's assume you kept it all, instead of what really happens, which is you pay much of it to intermediaries, stockbrokers, fund managers and the taxman. To get the rest of this monetary-inflation-matching total return, we'd have to see 7% p.a. capital growth.

7% compounded for ten years makes 96.7%. So if you had bought the FTSE ten years ago, it would need to be worth around 11,375 today. After taxes, fees and charges. And then it would have to be worth even more, to make up for the fact that you don't keep all of your dividends, either.

Oh.

Thursday, March 06, 2008

From soup to nuts

Steve Moyer gives a pretty clear (occasionally a bit aerated) potted history of the woeful train of events, over the ten years from the start of the technology stock boom to the popping (and it's only just started) of the real estate bubble.

Nobody had to invest in tech stocks, but we all have to live somewhere. A bubble in housing is really pernicious, because it has implications for almost everyone.

Low interest rates inflated property prices, which led to much larger mortgages. Deflating valuations by raising interest rates would trap many mortgage-holders who have taken on big loans and kept up a good credit history so far.

Therefore, unless the government is willing to deal with the political pain of accelerated mortage defaults, interest rates must now stay low-ish for a long time. So I guess that credit risk will be adjusted not by price, but by access: it will simply get harder to find a willing lender. If there is less lending, then that (it seems to me) is deflationary.

I don't believe that the burden of the monster mortgage will be reduced by rapid general inflation of both wages and prices as in the 70s and 80s. Increased world demand for food and energy will inflate prices, but globalisation means that for many - especially the poorer sort - wages won't keep up. The cost of housing will be a generation-long millstone around the neck.

Inflating the currency won't help. It will reduce the wealth of savers, but if we are importing not only luxuries but (increasingly) necessities, inflated wages will be gobbled up by inflated import prices.

Some may argue that currency debasement will make our exports more competitive. But for a long time now, manufacturing industry has been disappearing like snow in midsummer. Even if our export prices should become more competitive because of foreign exchange rates, domestic productive capacity has shrivelled: whole factories and shipyards have gone abroad, and the related human resources have withered, too. You can't reconstruct the proletariat and their workplaces overnight. Gone are the days when the Midlands engineering worker tinkered with metal in his garden shed, showing his son how to use the tools. Half a mile from where I live, one of the big engineering plants set up by the Birmingham-based Lucas family was taken over first by the Italian Magneti Marelli, then by the Japanese super-corp Denso, and now it's been stripped of its machines and will be demolished to make way for... housing. Goodness know how the mortgages on them will be paid.

I think Karl Denninger is right: the banks must be made to eat some of the debt they fed us. Either they will be ruined, or we shall be.

Nobody had to invest in tech stocks, but we all have to live somewhere. A bubble in housing is really pernicious, because it has implications for almost everyone.

Low interest rates inflated property prices, which led to much larger mortgages. Deflating valuations by raising interest rates would trap many mortgage-holders who have taken on big loans and kept up a good credit history so far.

Therefore, unless the government is willing to deal with the political pain of accelerated mortage defaults, interest rates must now stay low-ish for a long time. So I guess that credit risk will be adjusted not by price, but by access: it will simply get harder to find a willing lender. If there is less lending, then that (it seems to me) is deflationary.

I don't believe that the burden of the monster mortgage will be reduced by rapid general inflation of both wages and prices as in the 70s and 80s. Increased world demand for food and energy will inflate prices, but globalisation means that for many - especially the poorer sort - wages won't keep up. The cost of housing will be a generation-long millstone around the neck.

Inflating the currency won't help. It will reduce the wealth of savers, but if we are importing not only luxuries but (increasingly) necessities, inflated wages will be gobbled up by inflated import prices.

Some may argue that currency debasement will make our exports more competitive. But for a long time now, manufacturing industry has been disappearing like snow in midsummer. Even if our export prices should become more competitive because of foreign exchange rates, domestic productive capacity has shrivelled: whole factories and shipyards have gone abroad, and the related human resources have withered, too. You can't reconstruct the proletariat and their workplaces overnight. Gone are the days when the Midlands engineering worker tinkered with metal in his garden shed, showing his son how to use the tools. Half a mile from where I live, one of the big engineering plants set up by the Birmingham-based Lucas family was taken over first by the Italian Magneti Marelli, then by the Japanese super-corp Denso, and now it's been stripped of its machines and will be demolished to make way for... housing. Goodness know how the mortgages on them will be paid.

I think Karl Denninger is right: the banks must be made to eat some of the debt they fed us. Either they will be ruined, or we shall be.

They knew it was coming

Karl Denninger looks at the cash-rich balance sheets of non-financial companies, many of which could now pay off all their bank debts from the kitty. Whatever they may have been telling you, it looks as though they've been voting with their wallets.

Tuesday, March 04, 2008

Eat what you cooked

Karl Denninger comments on the proposals to make banks write down some outstanding capital on loans, to secure what's left of the banking system. Painful, but it might save the day.

I wouldn't say it's impossible. America has more resilience and capacity to renew than its envious enemies wish to believe.

Good luck.

I wouldn't say it's impossible. America has more resilience and capacity to renew than its envious enemies wish to believe.

Good luck.

Sunday, March 02, 2008

Subprime hitting GSEs

Karl Denninger comments trenchantly on a new scheme by "Fannie Mae", the government-sponsored mortgage lender: "Homesaver Advance" takes the borrower's missed mortgage payments and puts them into an unsecured loan, thus "healing" the credit history so that home lending can continue as if (as if!) everything were normal. Denninger sees this as a signal to "short" Fannie Mae.

But over a period, Denninger has moved on from trying to exploit such market weaknesses, to urging his fellow citizens to protest about the corruption of the financial system. His tone is now getting darker - like Jeffrey Nyquist, he's beginning to worry about international relations, for example the way that China's population pressure may threaten Russia's land. Lhasa 1950, Khabarovsk and Irkutsk when?

But over a period, Denninger has moved on from trying to exploit such market weaknesses, to urging his fellow citizens to protest about the corruption of the financial system. His tone is now getting darker - like Jeffrey Nyquist, he's beginning to worry about international relations, for example the way that China's population pressure may threaten Russia's land. Lhasa 1950, Khabarovsk and Irkutsk when?

Which crank are you?

In turbulent times, we get an increase in prophets, astrologers, clairvoyants, magicians and mountebanks. Perhaps we can place more reliance on the significance of their appearing, than on the things they have to say.

"Deepcaster", who I think of as the Nostradamus of finance, often refers to a shadowy clique he calls The Cartel; if only one could identify them - or him! But there is some basis for the paranoid - for example, who owns the Federal Reserve does indeed seem to be a secret; though I doubt the chairman strokes a white cat. Here are some of Deepcaster's tips for economic survivalism:

Keep a significant portion of your wealth in tangible assets including Precious Monetary Metals (in amounts subject to timing considerations) and Strategic (e.g. Crude Oil) and select agricultural commodities which the public needs and regularly uses...

Attempt to make, although it may be very difficult, an evaluation of counterparty strength. Regarding options, for example, are they clearing house guaranteed? And how strong is the clearing house?

“Go local” in banking, and commercial, and essential goods supply relationships. “Self reliance” and “local reliance” are key goals...

Develop an investing and trading regime for certain key tangible assets markets to minimize or avoid the impact of Cartel-initiated takedowns...

Stay informed...

Since we're going back to the Seventies, here's Al Stewart's 1973 cult Nostradamus lyric (from Past, Present and Future). There's always a little frisson in old mortality. Speaking of which, Jeffrey Nyquist returns to his Cassandran theme of America as ancient Athens on the brink of the Peloponnesian catastrophe.

I shouldn't laugh too much at all this. The vibrations of the First World War were, I think, felt in the art and music of the years before it; and the millennarian gloom of Eliot's Waste Land (1922) was also only a few years ahead of economic, social and military turmoil. The current flock of seers and chanters may be like the restless sheep before the earthquake.

"Deepcaster", who I think of as the Nostradamus of finance, often refers to a shadowy clique he calls The Cartel; if only one could identify them - or him! But there is some basis for the paranoid - for example, who owns the Federal Reserve does indeed seem to be a secret; though I doubt the chairman strokes a white cat. Here are some of Deepcaster's tips for economic survivalism:

Keep a significant portion of your wealth in tangible assets including Precious Monetary Metals (in amounts subject to timing considerations) and Strategic (e.g. Crude Oil) and select agricultural commodities which the public needs and regularly uses...

Attempt to make, although it may be very difficult, an evaluation of counterparty strength. Regarding options, for example, are they clearing house guaranteed? And how strong is the clearing house?

“Go local” in banking, and commercial, and essential goods supply relationships. “Self reliance” and “local reliance” are key goals...

Develop an investing and trading regime for certain key tangible assets markets to minimize or avoid the impact of Cartel-initiated takedowns...

Stay informed...

Since we're going back to the Seventies, here's Al Stewart's 1973 cult Nostradamus lyric (from Past, Present and Future). There's always a little frisson in old mortality. Speaking of which, Jeffrey Nyquist returns to his Cassandran theme of America as ancient Athens on the brink of the Peloponnesian catastrophe.

I shouldn't laugh too much at all this. The vibrations of the First World War were, I think, felt in the art and music of the years before it; and the millennarian gloom of Eliot's Waste Land (1922) was also only a few years ahead of economic, social and military turmoil. The current flock of seers and chanters may be like the restless sheep before the earthquake.

A pound to a penny

Adrian Ash points out that against gold, the British pound is now less than 1% of its value in 1931.

Why there are no customers' yachts

Hedge fund and investment trust managers sit on a big pile of money and a small percentage creamed off still means a handsome living. But Daniel Amerman maintains that's not the biggest advantage they have over you. As he shows with worked examples, shrewd use of the rules of the game can turn a real investment loss into a substantial gain.

By borrowing money at preferential interest rates, and writing-off the interest as a business expense, they can multiply the amount invested, reduce taxation and massively boost the return on the original capital. All is well as long as prices go up, and Amerman sees this a huge incentive to continue the inflation in financial assets: the system demands it.

His conclusion, in general terms, is to ignore the usual fairytales told to the small investor, work out how the con really operates, and exploit it. He thinks you should be in tangible assets, and understand the implications of taxation and inflation for your portfolio .

Michael Kilbach echoes that with respect to commodities, though like me, he thinks there'll be a step back before the next jump:

In the long term we believe prices are heading much higher and we are therefore looking for pessimism in the precious metals market before adding to our positions. We sell into extreme optimism. We understand that we could miss out on an opportunity to have more invested for a short term move higher, and we are willing to risk losing that opportunity. Rather than trying to catch up to the current markets move we try to anticipate the next markets move.

By borrowing money at preferential interest rates, and writing-off the interest as a business expense, they can multiply the amount invested, reduce taxation and massively boost the return on the original capital. All is well as long as prices go up, and Amerman sees this a huge incentive to continue the inflation in financial assets: the system demands it.

His conclusion, in general terms, is to ignore the usual fairytales told to the small investor, work out how the con really operates, and exploit it. He thinks you should be in tangible assets, and understand the implications of taxation and inflation for your portfolio .

Michael Kilbach echoes that with respect to commodities, though like me, he thinks there'll be a step back before the next jump:

In the long term we believe prices are heading much higher and we are therefore looking for pessimism in the precious metals market before adding to our positions. We sell into extreme optimism. We understand that we could miss out on an opportunity to have more invested for a short term move higher, and we are willing to risk losing that opportunity. Rather than trying to catch up to the current markets move we try to anticipate the next markets move.

Don't take on gunslingers

A client raised an important point some weeks ago: when he decides to sell or switch his holdings in a collective investment (e.g. an insurance bond or pension), the company wants to receive the authorisation in writing, by which time it could be too late. The traders can act straight away, on the price they see on their screens.

Paul Lamont echoes this in SafeHaven:

The Wall Street Firms will know if the Ambac deal fails long before investors. We commented last April: "As the editor of The Commercial and Financial Chronicle in November of 1929 reported on the Great Crash, 'the crowd didn't sell, they got sold out.' The trading desks of the Wall Street Firms will cash out as the panic develops, the lady in Omaha will be stuck on the phone with a busy signal... To avoid this, investors should be moving now to financially healthy institutions and buying U.S. Treasury Bills."

You can't outdraw the fast hand, but you can get out of town when you hear he's coming.

Paul Lamont echoes this in SafeHaven:

The Wall Street Firms will know if the Ambac deal fails long before investors. We commented last April: "As the editor of The Commercial and Financial Chronicle in November of 1929 reported on the Great Crash, 'the crowd didn't sell, they got sold out.' The trading desks of the Wall Street Firms will cash out as the panic develops, the lady in Omaha will be stuck on the phone with a busy signal... To avoid this, investors should be moving now to financially healthy institutions and buying U.S. Treasury Bills."

You can't outdraw the fast hand, but you can get out of town when you hear he's coming.

Creak... squeak... pop!

This and more is in the latest ContraryInvestor piece on SafeHaven. Almost all of the above is concentrated in a mere five banks.

This and more is in the latest ContraryInvestor piece on SafeHaven. Almost all of the above is concentrated in a mere five banks.The tone is not doomster:

The world is not about to come to an end. Through adversity is born opportunity for those prepared both emotionally and financially.

As with Northern Rock, I expect that when calamity strikes, the bank directors and financial regulators will still have good payoffs and pensions. What a tolerant society we live in.

Friday, February 29, 2008

What the rubber mat said

I sat in my clients' office yesterday afternoon, waiting for them to arrive. The office had lovely new desks; as it turned out, not new, but taken from another business that has recently closed.

The reason for the delay - at least for one of the directors - was a last-moment requirement for tico rubber, needed next morning for anti-vibration matting under a five-ton machine that was being re-sited. The usual supplier, a major international concern, has recently shut down the closest depot to Birmingham. Rationalisation. Outsourcing. Globalization.

So while waiting, I tried to help my client find the material somewhere else. Googling away, we found it in the far north of England, or Cornwall; too far. Maybe just possibly in Market Harborough or Leicester? On calling the nearer companies, specifications and stock levels were doubtful.

My clients' business is contrarian: they move machines, and although originally that meant from one UK site to another, more often now it involves sending them abroad. As the decline of British manufacturing industry has accelerated, they've been very busy recently. For obvious reasons, the bonanza will end sometime.

But back to the matting. Once, suppliers of components you needed would be close at hand. Now we could be looking at journeys to the ends of the country - meaning cost, delay and maybe, sometimes, a lost contract.

The Pearl River in China is now home to myriads of small manufacturers, and the synergy improves everyone's productive capacity. Like it used to in Birmingham, "city of a thousand trades". But now in the UK, we could be dropping below the threshold of economic viability for manufacturing industry.

That's what the mat said to me.

The reason for the delay - at least for one of the directors - was a last-moment requirement for tico rubber, needed next morning for anti-vibration matting under a five-ton machine that was being re-sited. The usual supplier, a major international concern, has recently shut down the closest depot to Birmingham. Rationalisation. Outsourcing. Globalization.

So while waiting, I tried to help my client find the material somewhere else. Googling away, we found it in the far north of England, or Cornwall; too far. Maybe just possibly in Market Harborough or Leicester? On calling the nearer companies, specifications and stock levels were doubtful.

My clients' business is contrarian: they move machines, and although originally that meant from one UK site to another, more often now it involves sending them abroad. As the decline of British manufacturing industry has accelerated, they've been very busy recently. For obvious reasons, the bonanza will end sometime.

But back to the matting. Once, suppliers of components you needed would be close at hand. Now we could be looking at journeys to the ends of the country - meaning cost, delay and maybe, sometimes, a lost contract.

The Pearl River in China is now home to myriads of small manufacturers, and the synergy improves everyone's productive capacity. Like it used to in Birmingham, "city of a thousand trades". But now in the UK, we could be dropping below the threshold of economic viability for manufacturing industry.

That's what the mat said to me.

What's your house worth?

Home prices WILL contract so that the median house is 2.5-3x the median income

says Karl Denninger. Now do your sums.

Some interesting comments and suggestions (including my usual twopenn'orth) on this post at the Capitalists@work blog - people seriously discussing inflation hedging and survivalism, here in the UK. We're getting beyond ivory-tower discussion.

says Karl Denninger. Now do your sums.

Some interesting comments and suggestions (including my usual twopenn'orth) on this post at the Capitalists@work blog - people seriously discussing inflation hedging and survivalism, here in the UK. We're getting beyond ivory-tower discussion.

Tuesday, February 26, 2008

Beyond gold

This blog by Thomas H. Greco looks interesting. The author, an American, has taken the trouble to address a convention in Malaysia on currency issues,and you'll recall that they're trialling the gold dinar in the province of Kelantan.

Greco thinks that modern technology may let us keep accounts of exchanges without having to resort to traditional forms of currency. I suppose this could be similar to Local Exchange Trading Systems. It's also interesting that he's featured and commented on Ron Paul's proposal that currency systems should be allowed to compete. Greco even looks at Air Miles as one candidate!

Greco thinks that modern technology may let us keep accounts of exchanges without having to resort to traditional forms of currency. I suppose this could be similar to Local Exchange Trading Systems. It's also interesting that he's featured and commented on Ron Paul's proposal that currency systems should be allowed to compete. Greco even looks at Air Miles as one candidate!

Going down

Another grizzly, this time Captain Hook:

You should know that when banks begin to fail in the States, and they will, things could spiral out of control to the extent controls will to need be placed on both digital and physical movement. Transfers between banks will cease up completely, debts will be called in (so pay them off now), systems from food distribution to medical care will break down, and Martial Law will be the result as the population retaliates. Life will change as you know it.

[...] Japan has never really escaped the credit crunch that gripped their economy back in the 90's after bubblizing the real estate market. That's the tell-tale-sign a bubble economy is on its last legs you know - when master planners need resort to bubblizing the real estate market. Generally it's all down hill after that on a secular (long-term) basis because this is a reflection of not just a turn in the larger credit cycle; but more, and the driver of credit growth in the end, this is the signal demographic constraints have turned negative. [...] It's a simple numbers game, where an aging population is less prone to take on debt.

He considers the possibility of a Japanese-style asset deflation, which gels with my earlier thoughts regarding a generation-long UK property slump.

You should know that when banks begin to fail in the States, and they will, things could spiral out of control to the extent controls will to need be placed on both digital and physical movement. Transfers between banks will cease up completely, debts will be called in (so pay them off now), systems from food distribution to medical care will break down, and Martial Law will be the result as the population retaliates. Life will change as you know it.