A couple of useful items from

Financial Sense:

Gary Dorsch (October 18) explains that a falling dollar helps the S&P 500, "which earn roughly 44% of their revenue from overseas, mostly in Euros", and supports house prices in the US; but it also raises the price of oil, gold and agricultural commodities. While the US seems set to cut rates further, the Eurozone may raise theirs to control inflation. In five years, the Brazilian real has doubled against the dollar! Oh, to have been a currency trader.

Meanwhile,

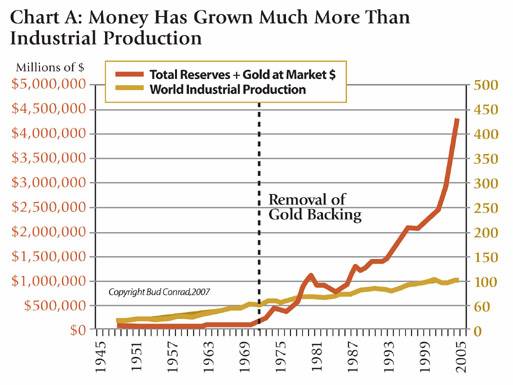

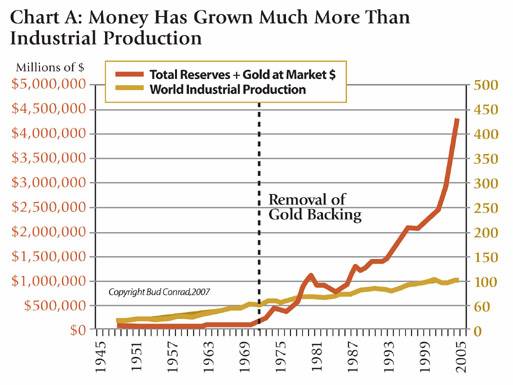

Doug Galland at Casey Research explains that gold was dipping together with shares, because institutional investors were scrambling for cash in the unfolding credit crisis. His view is that in the longer term, these sectors will diverge and gold will soar. He supplies an eloquently simple graph:

Speaking of eloquence, financial writers know their business but many need to hone their writing, so I propose a new prize: Sackerson's Prose Trophy. The first winner is Doug Galland, with the following simile:

Though admittedly impatient to see the gold show get on the road, we were largely unconcerned by gold’s behavior. That’s because our eyes remained firmly fixed on the perfect trap set over the years for Bernanke’s Fed.

Like hunters of antiquity watching large prey grazing toward a large covered pit, the bottom of which is decorated with sharpened sticks, we watched the handsomely attired and well-groomed Bernanke and friends shuffle ever closer to the edge, their attention no doubt occupied by pondering the flavor of champagne to be served with the evening’s second course.

One minute pondering bubbly, the very next standing, wide-eyed and hyperventilating, on thin cover with decades of fiscal abuse cracking precariously under their collective Italian leather loafers. We can’t entirely blame Bernanke for the dilemma he now finds himself in; it was more about showing up to work at the wrong place at the wrong time.

The second paragraph is splendid in its anticipation, and the phrasing conveys both the anguished expectation of the hunters and the relaxed, expansive mood of the prey. The denouement is a little disappointing: "pondering" is a repetition and the syntax is too florid; a short sentence would be better, contrasting the suddenness of the fall with the slowness of the approach.

Further nominations for Sackerson's Prose Trophy are welcomed.

As concern grows for the future of the dollar, we should reinterpret stock movements to take account of currency exchange fluctuations. The above chart shows the Dow since the start of the year (red line) and adjusted for relative value of the US dollar against the Euro (green line).

As concern grows for the future of the dollar, we should reinterpret stock movements to take account of currency exchange fluctuations. The above chart shows the Dow since the start of the year (red line) and adjusted for relative value of the US dollar against the Euro (green line).

I said

I said  Doctor Strange and the all-seeing Eye of Agamotto

Doctor Strange and the all-seeing Eye of Agamotto