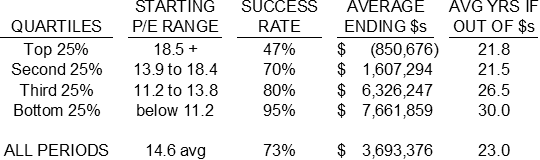

The forecast price-earnings ratios of the S&P 500 for 2008 range from 18.69 to 22.20. This does not bode well for long-term retirement investments made now. If the p/e ratio from the current c. 20 to 16, this would imply a share price decline of 20%, and even then you'd outlive your income in 30% of cases. A p/e of 12 requires shares to drop now by 40%, and that still means a one-in-five chance of running out of cash.

It looks as though, rather than fear a major crash, we should hope for one - as long as we're in cash or something else that's relatively safe and liquid.

4 comments:

That's what annuities are for - for insuring against excessive years of life. Perhaps we should call annuities "Life Insurance" and Life Insurance "Death Insurance". Anyway, our pension funds are all going to be in trouble, aren't they?

Hi DM: To your last point: alas, I think so. As for annuities, an RPI annuity with continuation for the surviving spouse is now running at around 2.5% of capital - by George, you need a lot of money to guarantee a respectable income. And it's all gone if a truck hits your car with both of you in it - tough luck on the next generation..

Hi Sackerson,

I just want to say that this link was of particular interest to the group to whom I email some of your posts. They, like my husband, are all retired university professors (about 10 years), managing their own retirement nest eggs of this size. They meet every two weeks to exchange financial information and love to discuss the macro economic situation and mostly being physical chemists just love the numbers.

Anyway, thanks for putting in the email link, I often use it although I don't usually make comments here. I manage my own portfolio also but am more of a stock watcher and since my money is not tax sheltered as my husband's is I make entirely different decisions based often on tax consequences.

Going into cash is the advice everyone throws around but nowadays where does one park one's cash that is safe, let alone bring a minimal return? Even the solid as houses banks here in Canada have been slaughtered as they reveal more and more their exposure to subprime debt.

I've been an investor a long time but this is a really scary market.

Thanks again.

jmb

I suppose your government has a depositor protection scheme as in the USA and UK, so I guess you'd distribute the deposits in a way that maximises the protection. Plus some in shoeboxes (or mice-proof tins).

And maybe you have some index-linked government bonds, like American TIPS and UK National Savings Index-Linked Certificates. Though that also usually means tying up money for fixed terms, whereas you may well wish to dive back into the market when the all-clear sounds.

Best wishes - "Sackerson"

Post a Comment